Retail Sales, Foot Traffic on the Mend. Upswing or Seasonality?

Do real estate pros have any reason to cheer? Colliers has the data.

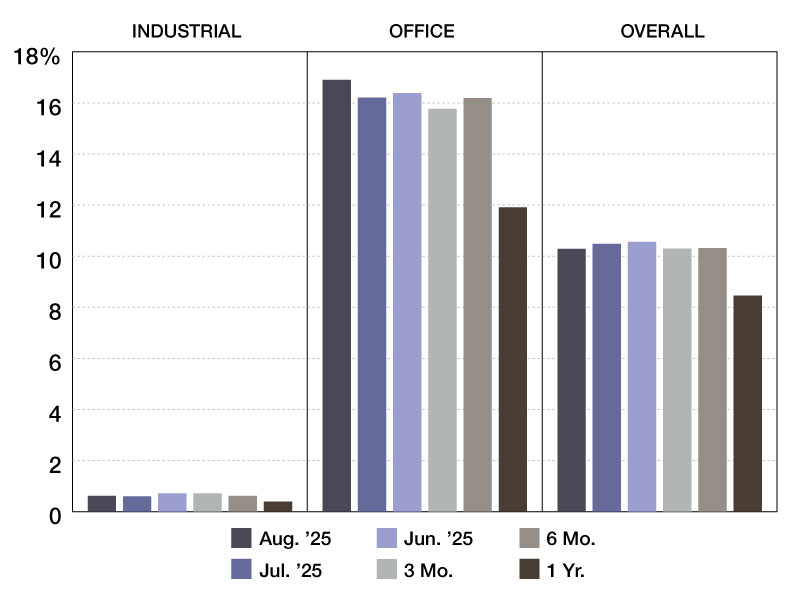

Retail traffic and sales ticked up in August as seasonal ebb countered economic woes such as tariffs and inflationary pressures.

August saw shop visits climb 1.1 percent year-over-year, while sales also rose, 3.5 percent, according to a monthly retail foot traffic and sales analysis by Colliers.

Inflation, the double agent

Sticky inflation nudged short-term gains, leading to an underlying retail sales volume growth of 0.4 percent. Consequently, prices showed little wiggle room with fewer promotions in August, causing consumers to rely more on online shopping, paving the way for a competitive in-store retail road ahead.

LISTEN: Investment Matters: Rocking Neighborhood Retail

Apparel emerged as a frontrunner, with in-shop sector sales jumping 7.6 percent compared to last year. Consumers remained loyal as foot traffic likewise grew, though by a more moderate 4.7 percent. This suggests higher average transactions and indulgent one-off buys drove the increase, rather than a steady acquisition inflow.

Conversely, sustained and stable growth propped up value retailers, which emphasize affordability at a time when consumers become more discerning and disciplined in their spending habits, Anjee Solanki, national director within Colliers’ U.S. retail services and practice groups, told Commercial Property Executive.

“Brands such as Family Dollar, Ollie’s Bargain Outlet, HomeGoods, Dollar Tree, Five Below, TJ Maxx, Goodwill, Citi Trends and Ross Dress for Less have consistently ranked among the top 10 performers by average visits per location since the beginning of 2025,” Solanki added.

Should economic uncertainty persist, such retailers are on track to continue leveraging their strengths as they refine stock, adopt private labels and lean into convenience to attract frugal customers, she reasoned.

Back-to-school impacts retail sales

As parents and students prepared to kick off the new school year, their shopping habits aligned with certain brands, which stood to gain from this seasonal variance, Solanki told CPE. The data supports this line of thinking.

“Retailers like Michaels, Staples and Citi Trends benefited from strong demand for school supplies, apparel and seasonal items. At the same time, value chains like Ollie’s Bargain Outlet, Goodwill and Ross Dress for Less captured budget-conscious shoppers seeking affordable back-to-school essentials,” Solanki added.

With back-to-school shopping in full swing, budgets got tighter and consumers had to make choices. Certain retail sectors felt the aftermath of their decisions, such as theatres and music venues, which saw foot traffic plunge 26.9 percent, the steepest drop across all categories.

Home improvement stores also recorded slight turbulence, as shoppers deprioritized core DIY projects, opting to conserve cash “amid elevated travel and back-to-school spending and limited personal time,” Solanki commented. Home improvement saw a 5.7 percent decline in sales year-over-year.

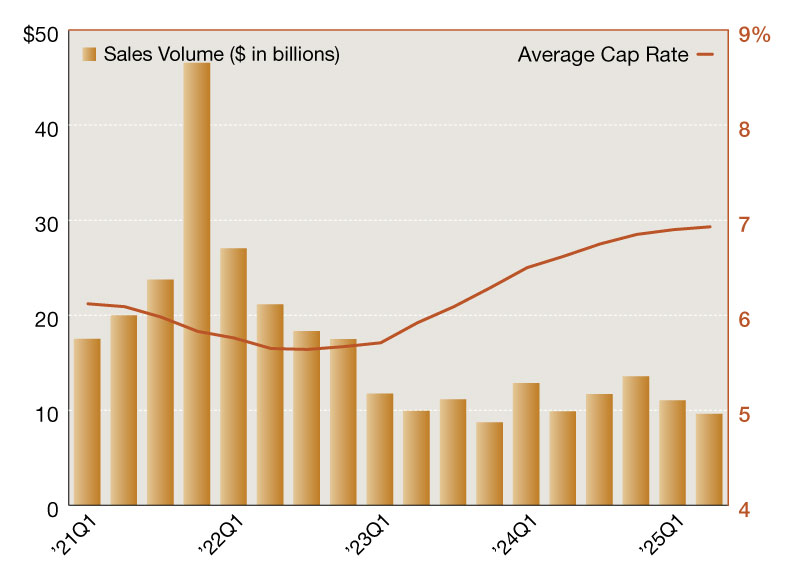

All this considered, the uptick in sales and traffic mirrors a broader retail trend visible in CRE, characterized by an increase in investor interest in select subsectors, as it relates, for example, to the single-tenant net-lease retail market.

You must be logged in to post a comment.