Retail REIT Returns Down 19% Y-O-Y

December 4, 2019

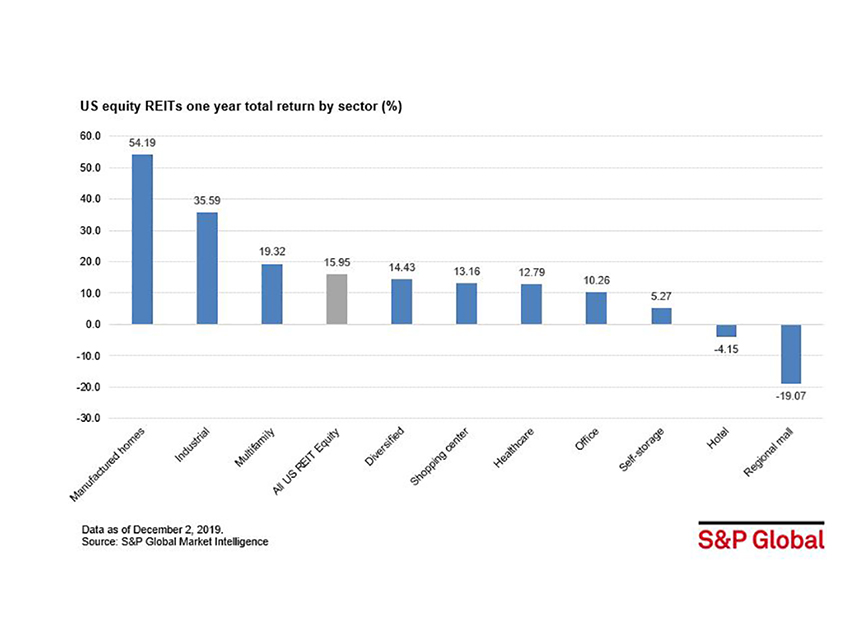

The manufactured homes REIT sector topped the chart with a 54.2 percent total return, according to S&P Global Market Intelligence.

As of Dec. 2, 2019, publicly traded U.S. equity REITs posted a 16 percent one-year total return.

The manufactured homes REIT sector topped the chart with a 54.2 percent total return, beating the broader U.S. equity REIT index by 38.2 percentage points. The industrial and multifamily REIT sectors followed with 35.6 percent and 19.3 percent one-year total returns, respectively.

On the other end of the spectrum, the regional mall sector had the lowest one-year total return of -19.1 percent. The hotel sector was second lowest among the sectors, with a -4.2 percent one-year total return.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.