Regional Banks’ Quiet Comeback

Priority Capital Advisory's Zachary Streit on why they're returning and what it means for borrowers.

Over the past year, many headlines in commercial real estate finance have focused on the contraction of credit and the challenges of refinancing in a higher-rate environment. But beneath the surface, a quieter story is beginning to unfold—regional and local banks are re-engaging with the CRE lending market. For borrowers and capital markets professionals alike, this resurgence could mark a turning point.

Following the regional banking scare in early 2023, many institutions took time to stabilize their balance sheets, de-risk their loan portfolios and build back depositor confidence. Today, a number of those same banks are emerging with a renewed appetite to lend, especially on well-structured development and transitional assets.

Several factors are driving this shift.

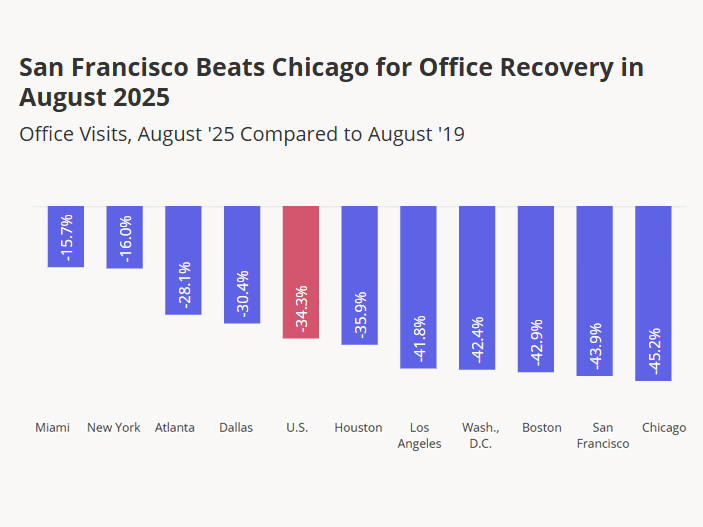

1. Cleaner balance sheets: Banks have begun to absorb losses tied to challenged office assets and other legacy exposures. The result is a recalibrated loan book with improved asset quality and more capacity for new originations.

2. Stabilizing deposits: Despite persistent volatility in the interest rate environment, deposits at many regional institutions have been steadily recovering. While rates above 5 percent still present a headwind, funding pressures have eased considerably relative to a year ago.

READ ALSO: The Impact of Tariffs on Sale-Leasebacks

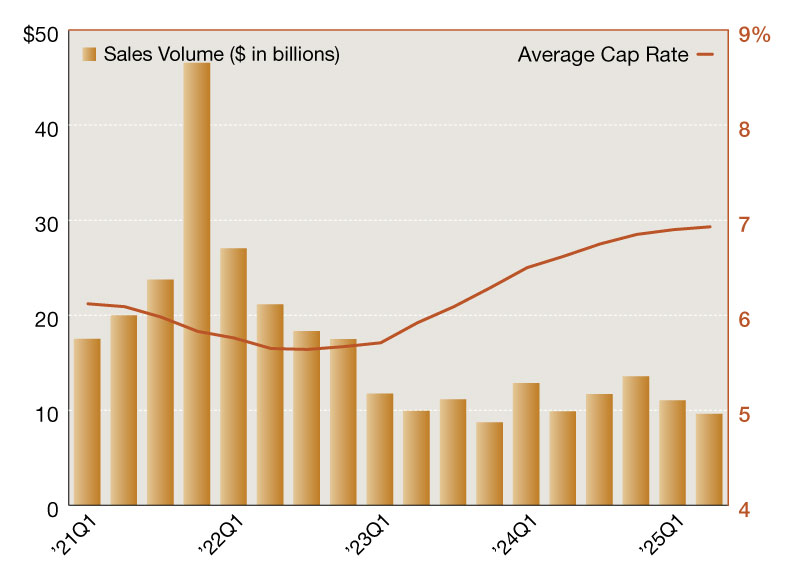

3. Loan payoffs & undeployed capital: Even in a high cap rate environment, certain loans are maturing and paying off. These inflows are creating liquidity that banks are under pressure to redeploy. With fewer internal investment options, many are turning back to CRE lending to generate yield.

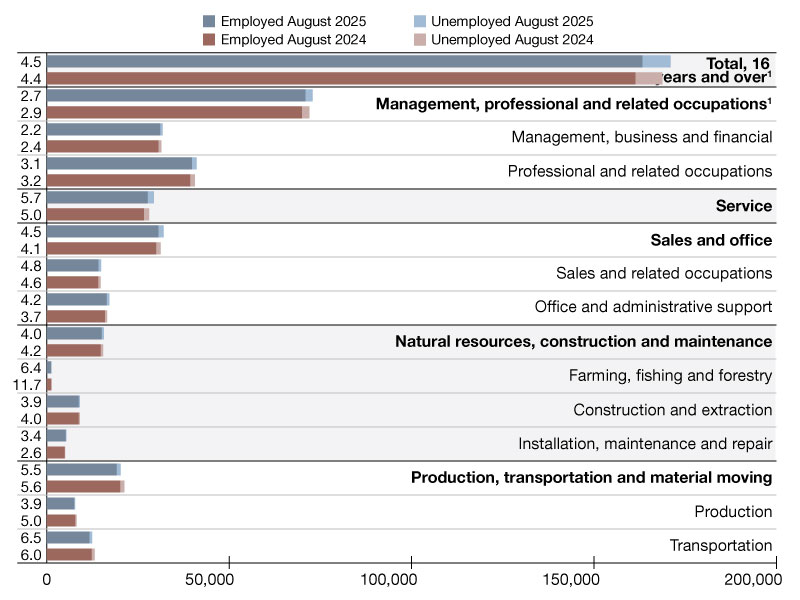

4. The need for interest income: Regional banks, especially those without large fee-based businesses, rely heavily on net interest margin. Lending—particularly to middle-market sponsors in non-core markets—offers a reliable path to revenue in an otherwise subdued capital markets landscape.

What’s notable about this wave of activity isn’t just that banks are lending again, but how competitive some of the terms have become. Spreads as tight as 200 basis points over Treasuries and 230 over 1-month term SOFR are achievable on permanent and transitional financing, respectively. We’re seeing higher leverage structures, partial or burn-off recourse options, and in some cases, the return of fixed-rate swaps that allow borrowers to lock in sub-6 percent all-in rates on permanent financings and sub-7 percent rates on transitional financing.

These offerings aren’t just isolated incidents. They suggest a broader trend of selective re-entry by banks that are confident in their underwriting and focused on relationship-driven lending. Geography, sponsorship and project type still matter—these lenders are not reaching indiscriminately—but they are present, active and willing to transact.

For market participants, this creates a timely opportunity. As institutional debt funds and life companies remain cautious, regional banks can offer a valuable counterbalance: more flexible structures, lower spreads and a pragmatic view of risk. The key, as always, is knowing where to look—and how to match a project’s nuances to a lender’s unique credit profile.

In a market where capital availability can vary dramatically from one week to the next, staying connected to these emerging sources is essential. The window may not be wide, but for now, it’s open.

Zachary Streit is founder & president of Priority Capital Advisory, a premier boutique debt and equity capital advisor for middle-market and upper middle-market commercial real estate sponsors and investors.

You must be logged in to post a comment.