RCG Ventures Wraps $1.8B Retail Portfolio Deal

The transaction includes 99 properties across 28 states.

RCG Ventures LLC has completed the acquisition of a $1.8 billion multi-tenant retail portfolio from Global Net Lease Inc. The three-phase transaction included 99 properties across 28 states, totaling more than 14 million square feet.

The acquisition was initiated with a first closing earlier this year, backed by equity investments from institutional partners including Ares Management, Koch Real Estate Investments and Goldman Sachs Alternatives. This phase provided the financial foundation for the overall acquisition.

The final phases of the sale involved 12 encumbered properties and generated approximately $313 million in gross proceeds, bringing the total to $1.8 billion. GNL plans to use the proceeds to reduce leverage by paying down its revolving credit facility. As it exits the multi-tenant retail market, the company will only focus on single-tenant net lease assets—a strategy expected to reduce annual G&A expenses by about $6.5 million and lower capital expenditures.

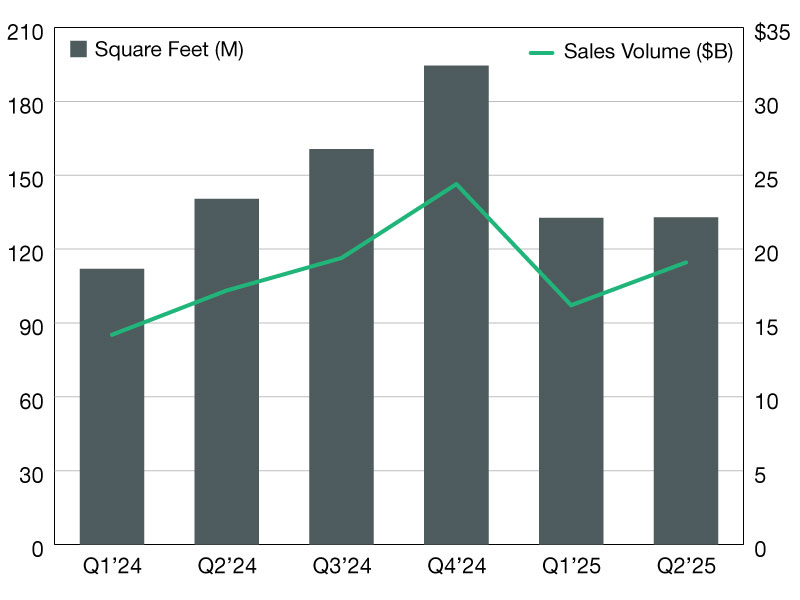

READ ALSO: Retail’s Resilience Draws Private Capital Back

Truist Securities Inc. served as RCG Ventures’ financial advisor, while KeyBank Institutional Real Estate provided committed financing. McGuireWoods LLP and King & Spalding LLP provided legal counsel to RCG, with Gibson Avenue Capital LLC also serving as an advisor. BofA Securities acted as GNL’s exclusive financial advisor on the sale, with BMO Capital also holding an advisory role. Paul, Weiss, Rifkind, Wharton & Garrison LLP was the legal counsel.

A closer look at a $1.8 billion portfolio

The portfolio includes a mix of power centers, grocery-anchored centers and other retail properties, with a tenant roster led by PetSmart, Dick’s Sporting Goods, Kohl’s, Best Buy and Michael’s. The assets are spread across the Northeast, Mid-Atlantic, Southeast, Midwest and Southwest, extending as far west as Nevada.

Notable properties include Fountain Square in Brookfield, Wis.—a 166,346-square-foot center home to Michael’s, PetSmart and Golf Galaxy—and Centrum Shopping Center in Pineville, N.C., which spans 122,256 square feet and includes tenants such as Home Depot, Best Buy and Super G Mart.

Just a few months ago, RCG also acquired The Streets of West Chester, a 237,000-square-foot shopping center near Cincinnati. AR Global sold the property for $21.3 million or $90.23 per square foot.

With the completion of its latest acquisition, RCG’s retail portfolio now totals more than 130 properties nationwide.

You must be logged in to post a comment.