Pricing Inches up Slightly in January

According to the Ten-X Commercial Nowcast, pricing is running hottest in the office sector, up 4.5 percent year-over-year, despite that segment’s languishing fundamentals.

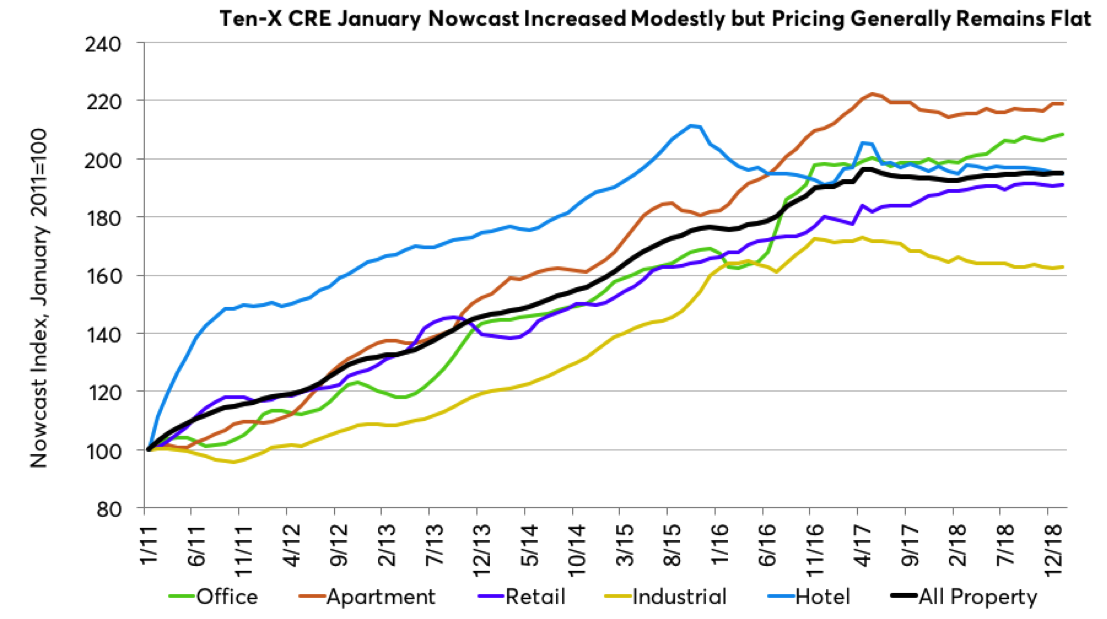

Property prices started the year up slightly according to the Ten-X Commercial Nowcast. The All Property Nowcast ticked up 0.1 percent in January from December, placing it 1.4 percent above the weak year-ago level.

According to the Ten-X Commercial Nowcast, pricing is running hottest in the office sector, despite that segment’s languishing fundamentals. The 0.4 percent office nowcast increase in January on the heels of December’s 0.6 percent gain placed office property prices up 4.5 percent year-over-year. The office nowcast was up across all regions in January, with the West posting the strongest monthly gain. The Southwest remains the strongest in terms of annual growth, up a whopping 14.9 percent.

On the other end of the spectrum, hotel pricing continues to weaken. Indeed, the Ten-X Commercial Hotel Nowcast continues its annual decline, off 0.4 percent from a year ago and posting its fourth consecutive monthly decline in January. With the negative impact of the government shutdown falling hard on the airline industry raising concerns of how it could hurt personal and business travel, investors may have been wary of the segment in January. This dovetails with widespread weakness in the hotel segment survey data. Weakness was centered in the Midwest and Southwest but no region demonstrated strength in the month.

Industrial pricing, another segment where investor sentiment has been battered by policy-induced fears related to potential trade disruption, finally posted a positive monthly gain in in January after back-to-back drops to end 2018. Perhaps the removal of trade fears from front and center helped, as survey results were generally better than we have seen. The Ten-X Commercial Industrial Nowcast increased 0.2 percent in January, though it is still down 0.8 percent from a year ago. While this was the slowest annual decline posted by the industrial index in some time, it also reflects a weak year-ago comparison. Regional results were mixed, with the Northeast and West up in January and the other regions down.

The Ten-X Commercial Retail Nowcast also increased 0.2 percent in January. Retail pricing is now up 1.3 percent year-over-year according to the nowcast, its lowest annual gain in this cycle. The regional retail nowcasts were mixed, with the Midwest and Southwest declining in January and the other three regions increasing.

Following December’s robust 1 percent increase, the Ten-X Commercial Apartment Nowcast consolidated the gain with a 0.1 percent gain in January. This pushed the apartment nowcast 2.2 percent above a year ago, the strongest annual increase since the end of 2017. Northeast apartment pricing was weak in January according to the nowcast, likely reflecting large markets like New York City and Boston with fairly severe supply issues. Southwest apartment pricing was also negative in January while the other three regions posted gains, which were strongest in the Midwest and Southeast at 0.8 percent in both.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.