New Construction, Pricing Pose Risks to REITs

Nareit Senior Vice President of Research & Economic Analysis Calvin Schnure assesses the extent to which overbuilding could undermine future valuations.

By Calvin Schnure

Calvin Schnure, Nareit Senior Vice President of Research & Economic Analysis

One of the hardest challenges in real estate investing is anticipating a future downturn. It’s also one of the most important aspects of risk management, as commercial real estate has experienced severe cycles in the past. With the current real estate expansion already having lasted longer than past upturns, most market participants are looking for warning signs.

Two of the most important potential risks in commercial real estate are if property prices get too inflated, and if new construction exceeds demand. These two phenomena are often linked, as price increases may spur speculative building, and the resulting glut may in turn precipitate a price collapse. Let’s take a look at the most recent trends in prices and construction.

Valuation trends

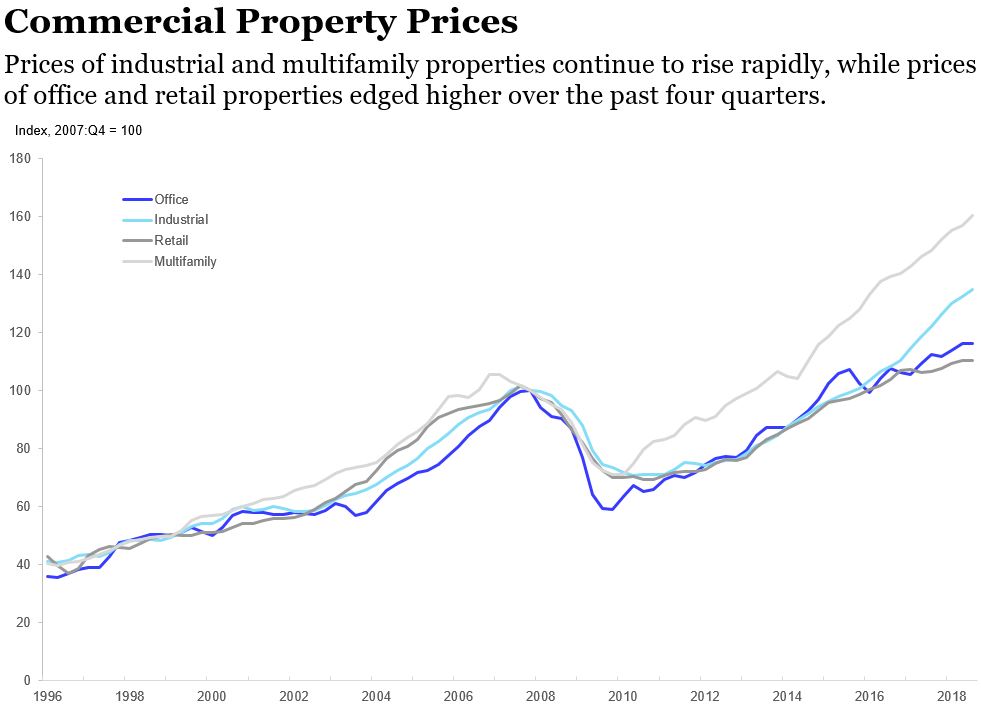

Property prices have risen steadily for the past eight years. According to the CoStar Commercial Repeat Sales Index, prices rose 5.0 percent over the 12 months through September 2018 and are 30 percent above their peak levels in 2007. Multifamily and industrial properties have experienced especially large gains (Chart 1). These sustained increases have led to some concerns about overvaluation.

Chart 1. Sources: CoStar, Nareit

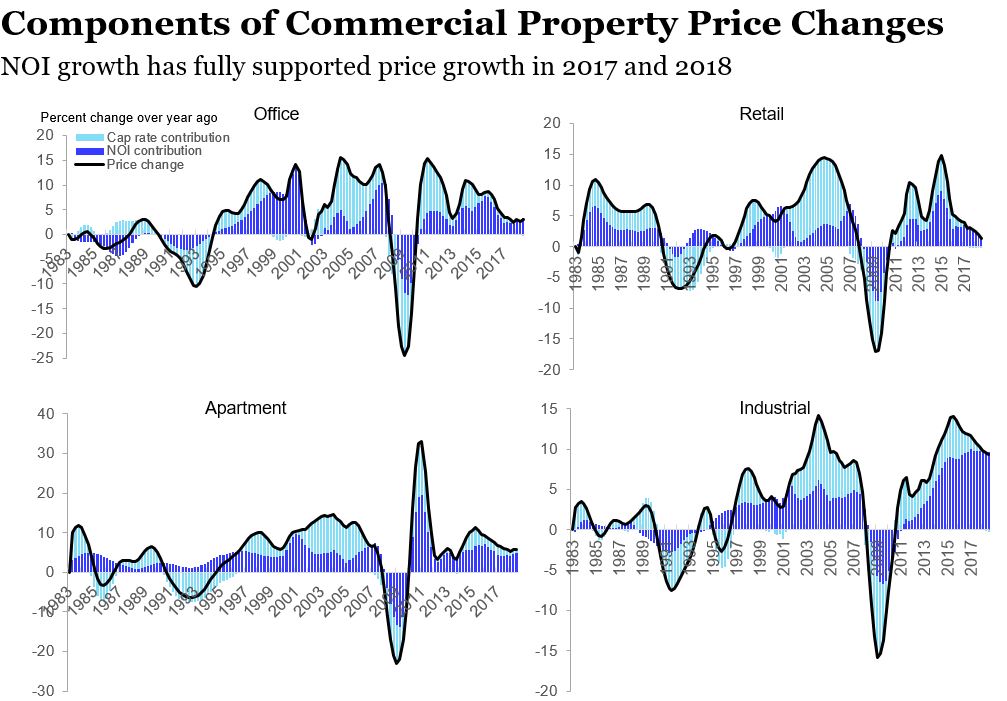

We can break out the increase in commercial property prices into two components: one driven by growth of net operating income (NOI), (Chart 2, shown in the dark blue bars) and another by cap rate compression (Chart 2, shown in the light blue bars). Past periods that had rapid price gains that were not supported by rising NOI, like office markets from 2003 through 2007, or retail properties over the same period, proved to be more vulnerable to subsequent price declines. This is not just due to the financial crisis that occurred in 2008, as the same pattern of price increases well in excess of NOI can be seen in office, retail, apartment and industrial markets in the late 1980s, and all four markets suffered sharp price declines in the early 1990s. In contrast, office price gains in the late 1990s were driven entirely by rising NOI, and prices proved resilient during the recession in the early 2000s.

Chart 2. Sources: CoStar, Nareit

Recent price increases have been fully supported by rising NOI. Industrial properties are particularly impressive, with NOI increases of nearly 10 percent for the past three years driving prices higher. At the other end of the spectrum, price increases have decelerated among retail properties, but the modest gains that have occurred have been matched by increase in NOI. The apartment and office markets have experienced moderate price increases, which have also been driven by rising NOI.

Construction risks

What about construction—are there risks that overbuilding will undermine prices, even if past NOI growth has been supportive? Let’s look first at the apartment market, which has experienced a surge in supply. New supply has averaged 300,000 units per year or more for the past four years, as compared to fewer than 100,000 completions in 2012 and earlier. Demand has largely kept pace, however, and despite lagging new construction in 2016 and 2017, net absorption has surged again to 350,000 units over the past four quarters. Vacancy rates have turned down again, and rent growth has picked up, rising 3.4 percent over the past four quarters. While construction is high, so is demand.

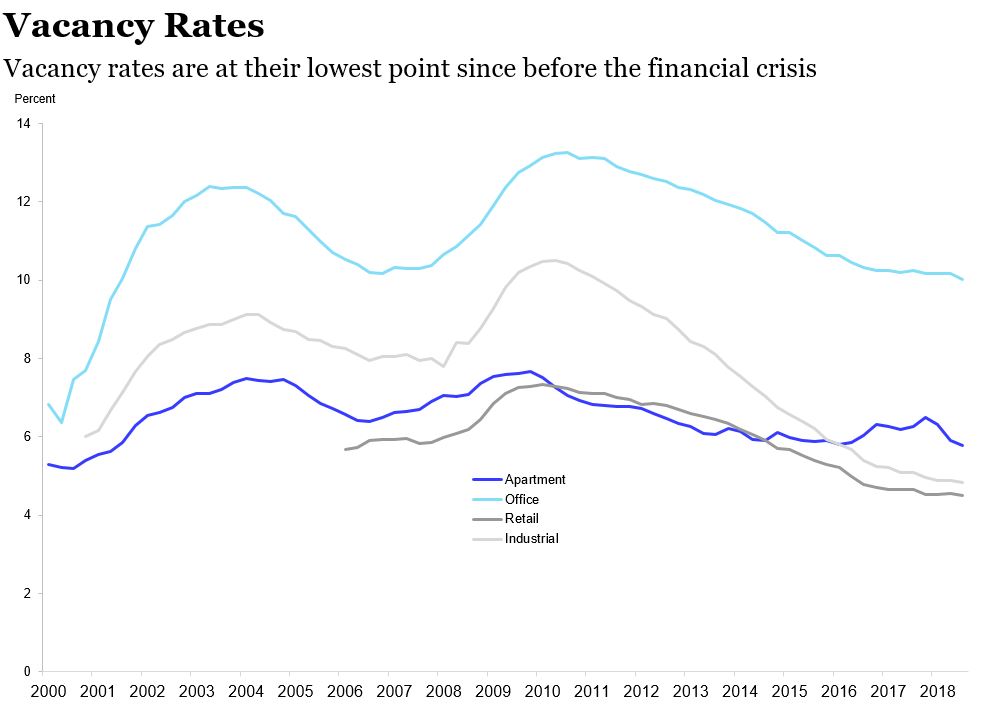

There’s a similar story about the balance of supply and demand across the other major property sectors, although each has a different twist. Industrial markets are expanding rapidly due to the growth of logistics facilities to transport goods purchased on the Internet, and the new supply is barely able to keep pace with demand. Net absorption in office markets had softened during 2017 and early 2018, perhaps as the spread of office sharing cut into the growth of demand. The market strengthened in the third quarter, however, with net absorption of 20.4 million square feet versus less than 10 million square feet of completions. Retail property markets have seen slow growth of demand, in part due to store closures and bankruptcies by retailers struggling with online competitors. There has been little new construction of retail space, however, helping the sector avoid any overhang. National vacancy rates of all these property types are at the lowest point since before the financial crisis in 2008 (Chart 3).

Chart 3. Sources: CoStar, Nareit

Investment outlook

This is good news for any investors in commercial real estate, including investors in REITs, as low vacancy rates boost income and support rising prices, generating future investment returns.

No crystal ball has perfect clarity for the path ahead, but the indicators analyzed here—price gains that are well-supported by NOI growth, and a reasonable balance between supply and demand among the major property types—bode well for the future.

You must be logged in to post a comment.