Poll Results: Biggest Challenges of H2 2023

It's all about interest rates and capital availability, according to most CPE readers.

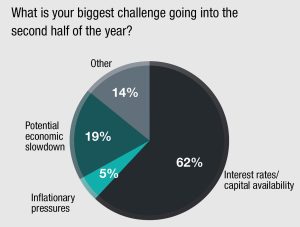

What is your biggest challenge going into the second half of the year?

In last month’s reader poll, respondents identified their biggest anticipated challenges through the second half of 2023, and how they may have changed since the start of the year. The listed challenges remained the same, with only slight changes on what respondents identified as their top obstacles. The breakdown suggests that the current business environment for commercial real estate remains roughly the same, with changes toward views of a potential or ongoing recession, as well as the identification of other, sector-specific challenges.

In identical fashion to December 2022’s survey, 62 percent of responders listed interest rates and the availability of capital as their biggest obstacle toward business, with many industry experts perceiving a meaningful resumption of lending and sales transactions as occurring only following months of market stability.

Despite the Federal Reserve pausing on rate increases last month, the overall sentiments appear to only be focused on long-term market fundamentals, which would make investors and lenders less reluctant. At present, the emergence of a more stable lending environment is months away at the earliest, and a possible resumption of interest rate hikes at the Federal Reserve’s meeting this month might further alter sentiments.

READ ALSO: CRE Midyear Outlook: Cautiously Optimistic

Similar to extant problems with interest rates, 5 percent of respondents listed inflationary pressures as their biggest concern, the primary motivator for the elevated interest rates and market volatility. Conversely, 19 percent of respondents listed a recession as their biggest obstacle to their businesses, a 5 percent decrease from December’s 24 percent. This likely owes to the fact that nearly a third of the industry believes that the nation is already in one, according to a recent survey from RCLCO.

Finally, supply chain issues were not identified as a significant struggle, in slight contrast with December’s 5 percent of respondents. That, alongside a potential economic slowdown, translated to 14 percent of responses listing other challenges, such as low office occupancy rates and net declines in property values as their top struggles, with the office sector being hit particularly hard.

Click here to see CPE’s latest poll, and the results of previous surveys.

You must be logged in to post a comment.