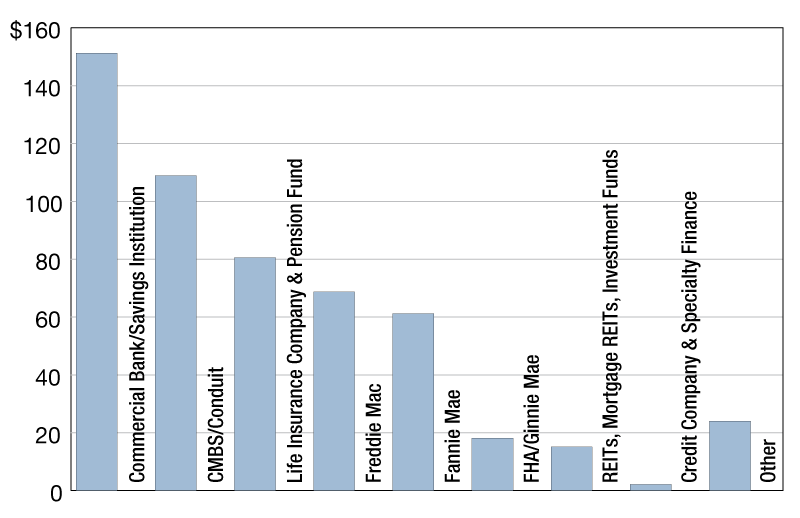

Originations by Lender

Commercial banks and savings institutions constituted the most active investor group in 2017, with $151.2 billion in activity (29 percent of total volume).

by Reggie Booker

by investor group; $ in billions

Commercial banks and savings institutions was the most active investor group in 2017 with $151.2 billion in activity (29 percent of the total). The second most active investor group was GSEs with a total of $130 billion (25%), followed by CMBS, CDO and ABS issuers with $108.9 billion in activity (21%), and life insurance companies and pension funds with $80.5 billion (15%). Lenders reported closing $18.2 billion (3%) for FHA/Ginnie Mae, $15.1 billion (3%) of loans for REITs, mortgage REITs, investment funds, and $2.2 billion (0.4%) of loans for credit companies and specialty finance companies. A total of $24 billion (5%) of commercial/multifamily loans closed as a lender is classified as for ‘other investor types’ by participants.

Loans closed for CMBS, CDO and ABS conduits were the largest loans, averaging $46.9 million in 2017. The average loan for REITs, mortgage REITs, investment funds came in at $37.7 million. Other average loan sizes were $30.1 million for credit company and specialty finance company, $21.7 million for life companies and pension funds, $17.6 million for Fannie Mae, $14.7 million for Freddie Mac, $12.8 million for FHA/Ginnie Mae, $10.3 million for commercial banks and savings institutions, and $29.4 million for other investor types.

Reggie Booker is the Mortgage Bankers Association’s associate director of commercial real estate research.

You must be logged in to post a comment.