2025 Office Vacancy Update

Major markets show mixed vacancy trends, according to Yardi Research Data.

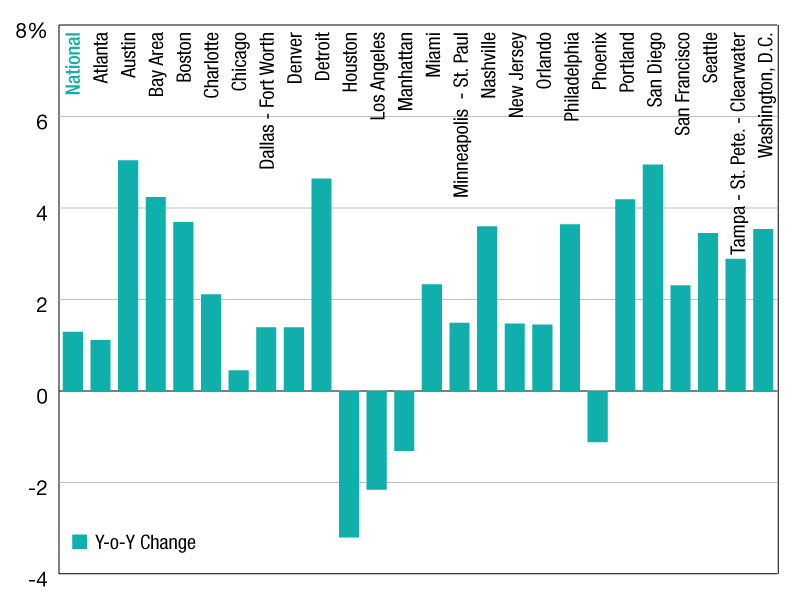

As of June, the national office vacancy rate continued to rise, posting a 1.3 percent year-over-year increase, according to Yardi Research Data. Although the pace of growth has moderated in some areas, vacancy expansions remained the norm across most tracked U.S. markets.

Austin once again topped the list with the sharpest increase—up 5.0 percent year-over-year—highlighting the ongoing challenges facing Sun Belt metros with elevated development pipelines. San Diego (4.9 percent) and the Bay Area (4.2 percent) also saw notable jumps, as demand in tech-heavy regions remains sluggish amid evolving workplace strategies.

West Coast markets continued to underperform, with Portland (4.2 percent) and San Francisco (2.3 percent) registering sizable gains. These figures reflect broader trends of lagging recovery in coastal urban hubs, where hybrid work adoption has been more persistent.

Signs of stability emerge in select markets

In contrast, some markets have started to show improvement or relative stabilization in office vacancy. Houston led the pack with a 3.3 percent decline in year-over-year vacancy, followed by Los Angeles (-2.2 percent) and Manhattan (-1.3 percent). These shifts may be attributed to limited new supply and steady tenant retention in some urban cores.

Florida’s office performance remained mixed. Tampa–St. Petersburg–Clearwater saw a significant 2.9 percent vacancy uptick, while Miami posted a milder increase of 2.3 percent.

The data underscores the continued fragmentation of the U.S. office sector, with geography, tenant demand and construction activity shaping widely divergent outcomes.

—Posted July 29, 2025

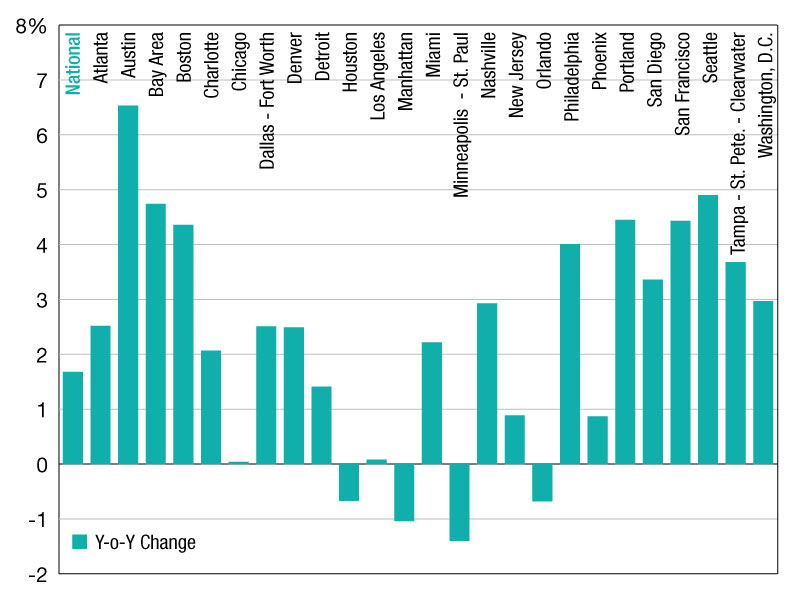

As of March, the national office vacancy rate posted a year-over-year increase of 1.7 percent, reflecting a persistent imbalance between supply and demand across U.S. markets, according to CommercialEdge data.

Although not as steep as previous periods, the upward trend remained widespread, with a majority of tracked metros seeing vacancy expansions.

Austin led the country with one of the largest year-over-year vacancy increases at 6.5 percent—continuing a pattern of oversupply that has weighed on Sun Belt cities. Seattle (4.9 percent), the Bay Area (4.7 percent) and Boston (4.3 percent) followed closely, underscoring ongoing hurdles in tech-heavy and coastal urban markets.

West Coast struggles, East Coast improves

Portland, Ore. (4.4 percent), San Francisco (4.4 percent) and San Diego (3.4 percent) also reported significant jumps, highlighting a slower recovery trajectory for West Coast cities, CommercialEdge shows.

Meanwhile, Los Angeles and Chicago stood out for their near-zero year-over-year changes in vacancy. In Los Angeles, the vacancy rate ticked up just 10 basis points, from 16.4 percent in March 2024 to 16.5 percent in March 2025. Chicago saw a similarly negligible rise.

On the other end of the spectrum, a handful of markets recorded year-over-year improvements. At -1.4 percent, Minneapolis–St. Paul saw one of the sharpest declines. Manhattan (-1.0 percent) and Orlando, Fla. (-0.7 percent) also posted vacancy contractions, reflecting limited new construction or recovering tenant demand.

The data also revealed divergence among Florida markets: Tampa–St. Petersburg–Clearwater recorded a notable increase (3.7 percent), while Miami remained relatively stable (2.2 percent).

—Posted on April 29, 2025

You must be logged in to post a comment.