Office Conversions Surge

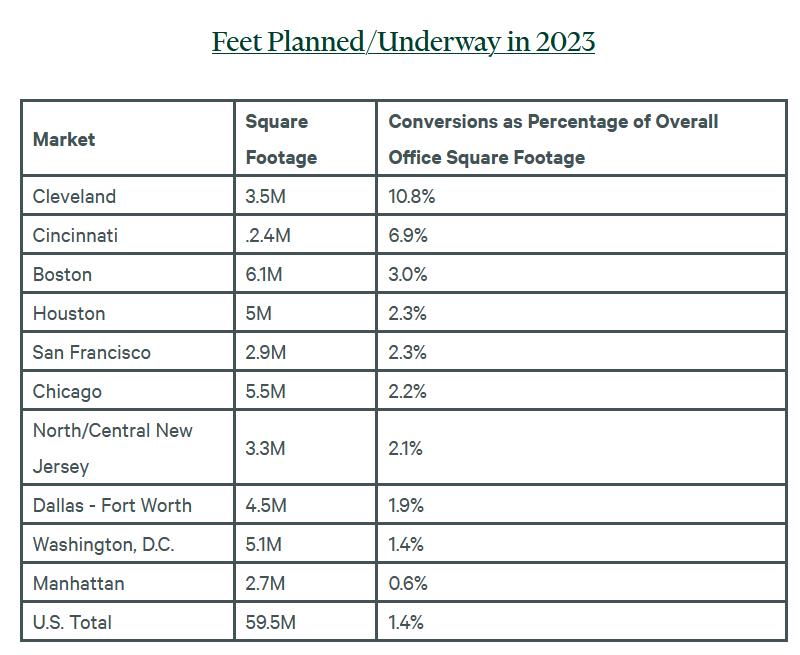

Cleveland has the highest percentage of its stock targeted for repurposing, while Boston has the largest footprint, the latest CBRE research finds.

Julie Whelan, Global Head of Occupier Research, CBRE, says a strategic approach on the part of cities is necessary to transform former office districts into mixed-use areas that attract people and businesses. Image courtesy of CBRE

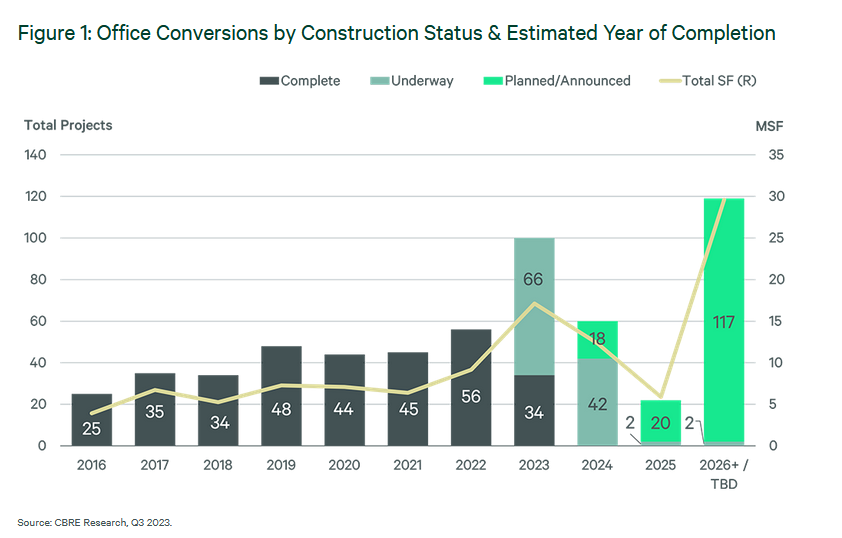

Office conversions this year are likely to more than double the recent annual average, with an estimated 100 such projects scheduled for delivery, according to a new report from CBRE.

This boom, from an average of 41 completions annually during 2016–22, according to the firm’s study, is largely driven by more incentives and other support from state and local governments.

Across 40 U.S. markets tracked by CBRE, 60 million square feet of office conversions are planned or in progress, which adds up to 1.4 percent of the nation’s total office inventory.

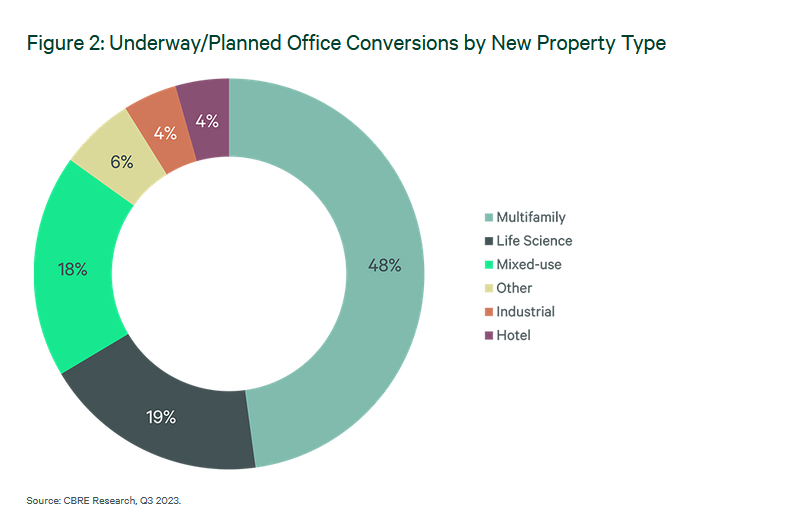

Nearly half (48 percent) of office conversions this year are into multifamily projects. Although conversions to life science space have dropped since last year, they nonetheless accounted for 19 percent of office conversions, closely followed by office-to-mixed-use conversions, which totaled 18 percent of the pipeline.

READ ALSO: Return-to-Office Push Meets Hybrid Work Era

Since 2016, the report states, 110 office-to-multifamily conversions have been completed, creating nearly 20,000 housing units. The 118 such projects currently planned or underway should create an estimated 21,000 additional units.

Unsurprisingly perhaps, metros seeing strong conversion numbers usually have more older office buildings with higher vacancies. CBRE cites Cleveland as an example; this city has a whopping 11 percent of its office stock slated for conversion.

Seven of the top 10 markets for conversion activity have average office vacancies above the second-quarter U.S. average of 18.2 percent.

Boston has the largest quantity of space undergoing conversion or in the planning stages: 6.1 million square feet, or 3 percent of its total office inventory.

Public-private power

A key and growing factor, CBRE says, is that major cities, such as New York and Chicago “have passed zoning code changes and established public-private partnerships to make conversions more financially feasible.” These incentives are often targeted at converting office buildings into much-needed affordable and/or zero-emissions housing.

Office Conversions by Construction Status & Estimated Year of Completion. Chart courtesy of CBRE Research

Converting offices to other use types is a complex process with many different moving parts, according to prepared remarks by Mike Watts, CBRE President of Investor Leasing. He also noted when state and local governments are supportive of these projects, it signals to developers that efforts are underway to make the process more financially feasible and predictable.

In a separate statement, Julie Whelan, CBRE global head of Occupier Research, said that while conversions are one solution, these projects alone will not resolve the market’s challenges, adding that a strategic approach on the part of cities will be necessary to transform former office districts into mixed-use areas that attract people and businesses.

In June, the U.S. Chamber of Commerce released a survey focusing on the obstacles to office conversions and concluding that local permitting and zoning regulations were the most problematic.

In August, Commercial Property Executive reported on New York City’s plans to expedite office-to-residential conversions.

You must be logged in to post a comment.