North American REITs: A Shifting Landscape?

By Ana Lai, Senior Director, S&P Global Ratings: Choppy equity markets and increasing tenant risks are some of the factors impacting the generally healthy North American REITs market.

By Ana Lai, Senior Director, S&P Global Ratings

While the North American REIT landscape remains largely healthy, there are some trends emerging in the sector that merit attention. Here’s what’s on the horizon for North American REITs over the next 12 months:

While the North American REIT landscape remains largely healthy, there are some trends emerging in the sector that merit attention. Here’s what’s on the horizon for North American REITs over the next 12 months:

The landscape is smooth, but improvements will decelerate.

Fourth-quarter 2015 earnings for North American REITs largely met S&P Global Ratings‘ expectations, and fundamentals in most segments of REITs we rate remain fairly healthy. Demand has increased as a result of slow but steady economic growth, and companies have been exhibiting discipline in managing supply conditions. So far in 2016, rating activity for the sector has been positive, with two upgrades and no downgrades.

But there are some weak pockets, as certain subsectors are facing increasing tenant risk and choppy equity markets that could limit equity issuance. Combined with our expectation for REITs’ credit profiles to improve at a slower pace, we expect the ratio of upgrades versus downgrades to decline. In addition, we cannot ignore event risk, as evidenced by Brixmor’s removal of its senior management team following the announcement of improper non-GAAP accounting.

Increasing risks and uncertainties.

Same-store net operating income (NOI) growth for the REITs rated by S&P Global Ratings averaged 4.8 percent, in line with our expectations. The storage and multifamily sectors led the pack with same-store (NOI) growth of 8.7 percent and 6.3 percent, respectively. But the retail and office sectors lagged the average, with same-store NOI growth of 2.7 percent and 3.8 percent, respectively. Tenant weakness is more pronounced in retail and some geographic areas of office and healthcare, compared with other REIT subsectors. We expect overall same-store NOI growth to be in the 3 to 4 percent range in 2016, a modest deceleration compared with 2015.

More broadly, while the risks of higher interest rates is less of a concern in the next 12 months, given our expectation that rate increases will be slow, REITs’ access to equity capital markets remains challenging due to recent capital markets turbulence and discounted trading values.

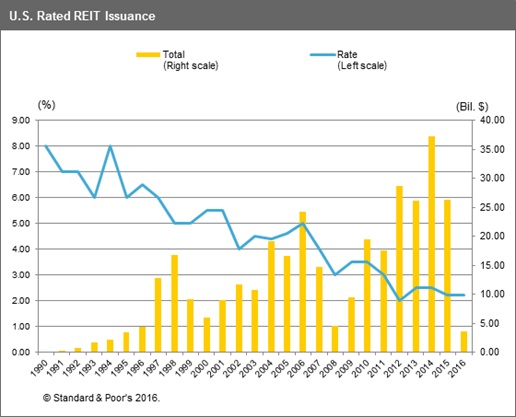

We believe companies will continue to capitalize on favorable asset values through dispositions and utilize still relatively low borrowing costs under existing revolving credit facilities in order to fund development or acquisitions. Over the next 12 months, we expect these sources of funds will support REITs’ liquidity needs to a greater extent than raising capital through equity or issuing debt. Indeed, coupled with widening credit spreads (for both investment-grade and speculative-grade), we expect the pace of debt issuance to remain significantly lower in 2016 than 2015 (see chart at left). But higher reliance on revolving credit facilities could adversely affect these companies’ near-term liquidity. We also expect REITs to increase their use of cash flow for share repurchases, which could become a greater part of REITs’ capital allocation, given equity price erosion and lack of compelling investment opportunities because of still-frothy asset prices and less attractive capitalization rates.

Retail REITs will remain pressured.

Retail REITs reported fourth-quarter results that were largely in line with our expectations. Strip-center REITs outperformed mall REITs as strip center same-store NOI grew by an average of 3.1 percent versus 2 percent NOI growth for malls.

Though the retail landscape has increasingly grown more volatile, we expect the majority of retail REITs rated by S&P Global Ratings to remain relatively unscathed, given the subsector’s continued focus on recycling weaker tenants with stronger ones. However, over the past year, the amount of debt retailers have issued that is trading at distressed levels has nearly doubled, and we believe this could increase, leading to a greater number of tenant bankruptcies or financial restructurings over the next two years. This, along with an evolving operating strategy because of rapidly growing e-commerce, could begin to shift REIT fundamentals in a less favorable direction.

McGraw Hill Financial, which owns Standard & Poor’s Ratings Services, recently changed its name to S&P Global Inc. Standard & Poor’s Ratings Services is now S&P Global Ratings.

You must be logged in to post a comment.