New Growth on the Horizon

Bright spots are emerging for several property types, according to PwC’s midyear outlook.

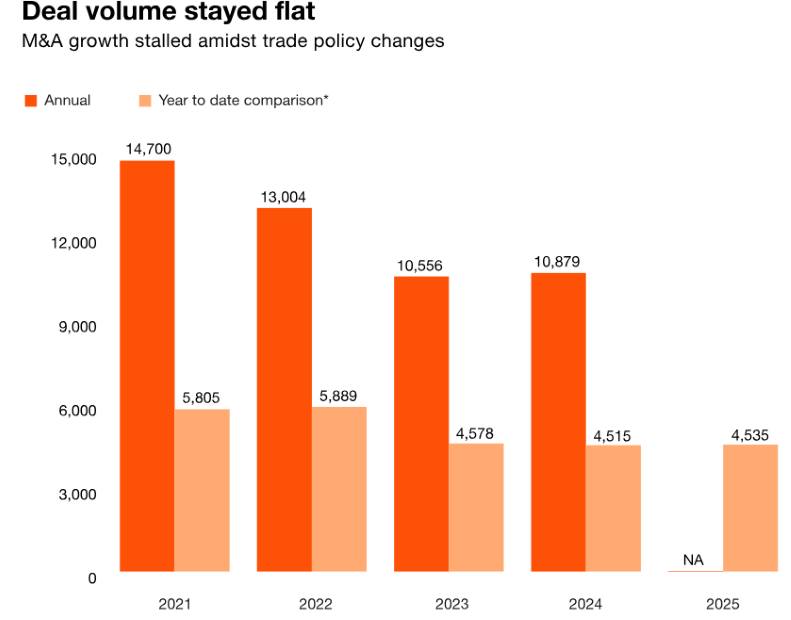

The U.S. business sector came into 2025 looking forward to a resurgence of merger-and-acquisition activity, based on their collective expectations about inflation, interest rates and the new presidential administration, according to highlights from a new report from PwC.

Contrary to those expectations, the administration has pursued aggressive policies with respect to trade and tariffs. So far, at least, this has not resulted in an M&A slowdown, as both deal volume and total dollar value are comparable, year-over-year.

Still, a May survey by PwC found that roughly one-third of respondents were pausing or revisiting deals, leading the Big Four accounting firm to conclude in its US Deals 2025 Midyear Outlook, “We believe an upswing is still possible, but it’s unlikely without more policy clarity and stability.”

Despite this, PwC perceives “green shoots” emerging in the commercial real estate sector, “signaling a cautiously optimistic outlook.”

This hopefulness is focused on several specific areas: office-to-residential conversions, data centers and some specific changes to U.S. tax policy affecting the real estate industry. Let’s look at these in turn.

In the face of various obstacles, office-to-residential conversions are nonetheless gaining momentum. PwC notes that as against 73 conversion projects completed in the U.S. in 2024, in itself an increase from 63 in 2023, 279 projects are scheduled for completion in 2025 and beyond.

“Office-to-residential conversion is emerging as one of the most compelling strategies in today’s commercial real estate landscape. As urban cores redefine their purpose, we see this trend unlocking significant value and serving as a key catalyst for deal activity moving forward,” Tim Bodner, PwC U.S. Real Estate Leader, told Commercial Property Executive.

Between this and continued movement in the return-to-office process, the report sees “hope for growth in the beleaguered office sector.”

On the data center side, PwC tags this sector as an “emerging … dominant alternative asset class,” part of a broader trend that’s expanding CRE’s traditional focus on office, retail and industrial into cold storage, life sciences and senior living.

READ ALSO: Data Center Industry’s Remarkable Momentum

Of note, acquisitions of existing data centers through single-property and portfolio deals rose by more than 60 percent in the U.S. in 2024.

Data centers, PwC says, “occupy a critical intersection of real estate, infrastructure and energy. Their viability ultimately depends on electricity costs, power availability and sustainability mandates, but ever-increasing data demands will continue to underpin rising institutional investment in them.”

Recent tax policy updates affecting the U.S. real estate sector include potential extension or reform of certain key provisions of the Tax Cuts and Jobs Act. These include restoration of 100 percent bonus depreciation for qualified property, increased Qualified Business Income to 23 percent for pass-through entities, preservation of tax-deferral treatment on Section 1031 exchanges and mortgage interest deductions, and enhanced tax incentives under the Opportunity Zones program and the Low-Income Housing Tax Credit.

M&A activity: A matter of confidence

Regarding M&A activity in the commercial real estate sector itself, PwC reports “renewed momentum” this year, despite some lingering caution.

READ ALSO: Is M&A Activity Back in Commercial Real Estate?

Mega-transactions like Blackstone’s $4 billion acquisition of Retail Opportunity Investments and Apollo’s $1.5 billion acquisition of Bridge Investment Group, the outlook says, “reflect unwavering sector confidence and the view that repriced assets offer long-term value. Private equity firms, sovereign wealth funds and insurance companies alike are ramping up their activity, particularly in sectors like hospitality and privately held office portfolios.”

While some entities might hold back on transactions, PwC contends that “increased consolidation presents an opportunity to create value through scale, portfolio diversification and operational efficiencies.”

While deal volume hasn’t fully bounced back, early signals point to a new phase of strategic consolidation rather than a typical cyclical rebound, the report noted. “In a ‘higher-for-longer’ rate environment, those who move decisively can capitalize on this inflection point and shape the next chapter of growth.”

You must be logged in to post a comment.