Multistory Warehouses’ Future Is Looking Up

How this emerging niche is helping meet the rising demand for last-mile distribution.

Bronx Logistics Center, a 1.3 million-square-foot multistory facility, is the largest industrial development of its kind in New York City. Image courtesy of JLL

A new JLL Urban Logistics report highlights the opportunities and challenges facing developers targeting the growing last-mile logistics market and tracks the emerging industrial subset of multistory warehouses from its overseas roots to its first U.S. location in Seattle through today, when New York City now has five multistory warehouse properties and five under construction.

Mehtab Randhawa, global head of industrial research, JLL, notes there are a total of seven buildings completed in the U.S., with four under construction. There are approximately 12 additional buildings in the planning stages within major metropolitan markets, he said.

“Developers are exploring various sites nationwide to convert or construct last-mile logistics facilities. As e-commerce demand continues to rise in the future, occupiers are reassessing their networks to ensure closer proximity to densely populated urban areas for their logistics facilities. As a result, there will be ongoing high demand for infill land sites,” Randhawa told Commercial Property Executive.

Randhawa is one of the authors of the report, Multistory Warehouses and their Towering Future, along with JLL Vice Chairman Leslie Lanne and Senior Research Analyst Elizabeth Keiger.

READ ALSO: Industrial Sector Navigates Growth Challenges

Five years ago, Prologis developed the first multistory logistics property in the U.S., borrowing a concept that got its start in Asia at least two decades earlier to build warehouses in densely populated areas with a lack of land. European markets facing their own density issues picked up the trend years later and it eventually made its way to Seattle, where Prologis Georgetown Crossroads, a 590,000-square-foot, three-story warehouse, opened in 2018 on 13.6 acres.

“If we examine land-constrained markets in APAC or cities like London, where the concept of multistory warehouses has been embraced, it appears that trend will inevitably advance in the U.S. as well, albeit at a slower pace,” Randhawa told CPE. “While not every market necessarily requires a multistory building, many densely populated markets can benefit from the efficiency and economies of scale that these structures provide in the movement of goods.”

Randhawa said it’s important to note that users of these types of spaces typically employ smaller delivery vans to navigate the challenges of traffic and narrow roads within urban cores. He said newer multistory buildings are purposefully designed to accommodate fleet parking for vans, trucks and employees, in addition to catering to specific requirements for high-energy and electric charging facilities.

“This trend signifies toward more sustainable and technologically advanced logistics facilities that align with the evolving needs of urbanized areas. As cities continue to densify, the demand for modern, adaptable, and environmentally friendly multistory warehouses is expected to increase,” Randhawa said.

1237 W. Division in Chicago, the region’s first multistory logistics facility. Image courtesy of JLL

The report notes that sustainability measures, such as EV charging stations, rooftop solar panels, and greener delivery methods, offset the carbon footprint of urban logistics buildings.

Building challenges

Some of the biggest hurdles to development of multistory warehouses in urban locations are land availability and zoning ordinances. Lanne notes urban logistics buildings are not typical modern tilt-wall big-box construction. Nearly 60 percent of the urban logistics inventory in New York City, for example, was built between 1900 and 1959. Zoning laws around the country pertaining to industrial real estate are also often outdated too. Approval processes can be lengthy and complex and many municipalities are facing opposition from residents seeking moratoriums on new industrial developments.

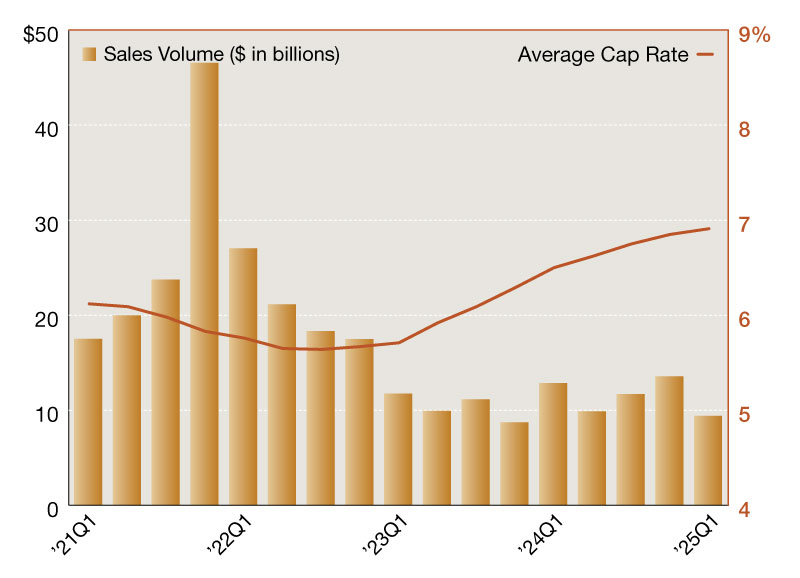

A lack of available land is also a problem as demand for space outpaces supply. Additionally, land costs skyrocketed after the pandemic and obtaining financing for a specialized product has become even trickier with an ongoing banking crisis and rising interest rates.

“Although financing hurdles may present themselves in the short term, the underlying demand and economic viability of these projects are expected to prevail. Market dynamics and the evolving needs of occupiers will eventually drive increased investments in last-mile logistics spaces across these markets,” Randhawa told CPE.

Opportunities exist

Despite the challenges, there are opportunities for those seeking last-mile logistics locations to reach more consumers in a short distance and satisfy the growing demand for same-day or even one- to two-hour e-commerce deliveries. JLL states markets to watch include San Francisco, Los Angeles, Boston and Philadelphia as well as New York City, Chicago and the Mid-Atlantic region. Emerging urban logistics markets cited include Atlanta, Miami, Dallas, Houston and Seattle.

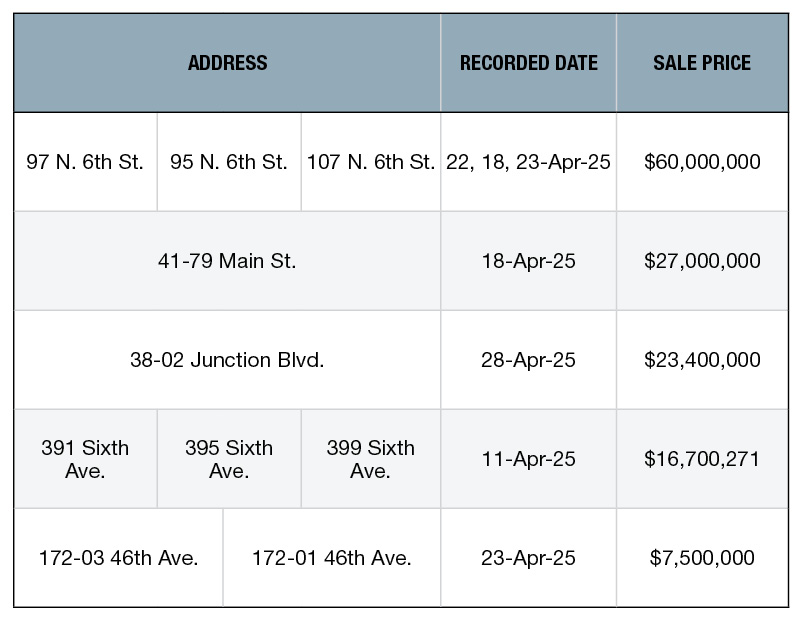

In areas where raw land is scarce, developers are turning to existing properties and converting them into multistory warehouses. One of the case studies cited is 2505 Bruckner in the Bronx. Developers Innova Property Group and Affinius Capital transformed a 20-acre site that had been an outdated movie theater property into a 1.1 million-square-foot warehouse with two levels that became the largest multistory logistics facility on the East Coast when it came online in 2022. A bonus for developers—the property was already zoned for industrial use and the location provided access to 10 million consumers within 15 miles. Featuring 28- to 32-foot clear heights, 106 loading doors and 664 interior parking spaces for cars and sprinter vans, the property is 53 percent leased to Amazon, CommercialEdge data shows. In May, Innovo and Affinius completed a $334 million recapitalization of the property with existing construction lender, Bank OZK, providing a $250 million senior mortgage and PIMCO loaning $84 million in mezzanine financing.

Other New York City multistory warehouses case studies include Red Hook Logistics Center, a 385,510-square-foot facility in Red Hook, Brooklyn, with a 31-foot clear height, eight drive-in doors and 19 dock-high doors, and the Borden Complex in Long Island City, Queens, a 680,000-square-foot property with a 28-foot clear height, 12 drive-in doors and 46 dock-high doors slated for completion next year. The report also cites Bronx Logistics Center, a 1.3 million-square-foot multistory facility that is the largest industrial development in New York City. The development features two, 250,000-square-foot warehouse floors, 48 loading docks, a 32-foot clear height and the largest amount of parking in the market. 640 Columbia, also located in Red Hook, is a three-story property with a total of 379,000 square feet and 336,500 square feet of warehouse space.

The only non-New York City site included in the case studies is 1237 W. Division in Chicago. It’s the region’s first multistory logistics facility and is in the Goose Island neighborhood. The 1.2 million-square-foot property has a 36-foot clear height and up to 1,600 vehicle parking spaces. The location serves $2 billion in e-commerce customers within a 5-mile radius.

You must be logged in to post a comment.