Multifamily REITs Hold Strong Despite Softening

By Griselda Bisono, Assistant Vice President & Analyst, Moody's Investors Service: Why multifamily REITs remain on a positive trajectory despite the expected peak in their development pipelines this year.

By Griselda Bisono, Assistant Vice President & Analyst, Moody’s Investors Service

Multifamily fundamentals are beginning to soften, after several strong years, with apartment completions expected to peak in 2016. This peak should result in an increasing vacancy rate over the next two years. Notwithstanding these early indicators, multifamily REITs are expected to outperform REITs in other sectors, given ongoing preference to rent versus buy within the markets in which they operate, limited development exposure, and good rent and same-store NOI growth. Of the seven traditional multifamily REITs that we rate, five have a positive outlook and two are stable, reflecting continued earnings growth and solid balance sheet and cash flow metrics in the sector.

Multifamily fundamentals are beginning to soften, after several strong years, with apartment completions expected to peak in 2016. This peak should result in an increasing vacancy rate over the next two years. Notwithstanding these early indicators, multifamily REITs are expected to outperform REITs in other sectors, given ongoing preference to rent versus buy within the markets in which they operate, limited development exposure, and good rent and same-store NOI growth. Of the seven traditional multifamily REITs that we rate, five have a positive outlook and two are stable, reflecting continued earnings growth and solid balance sheet and cash flow metrics in the sector.

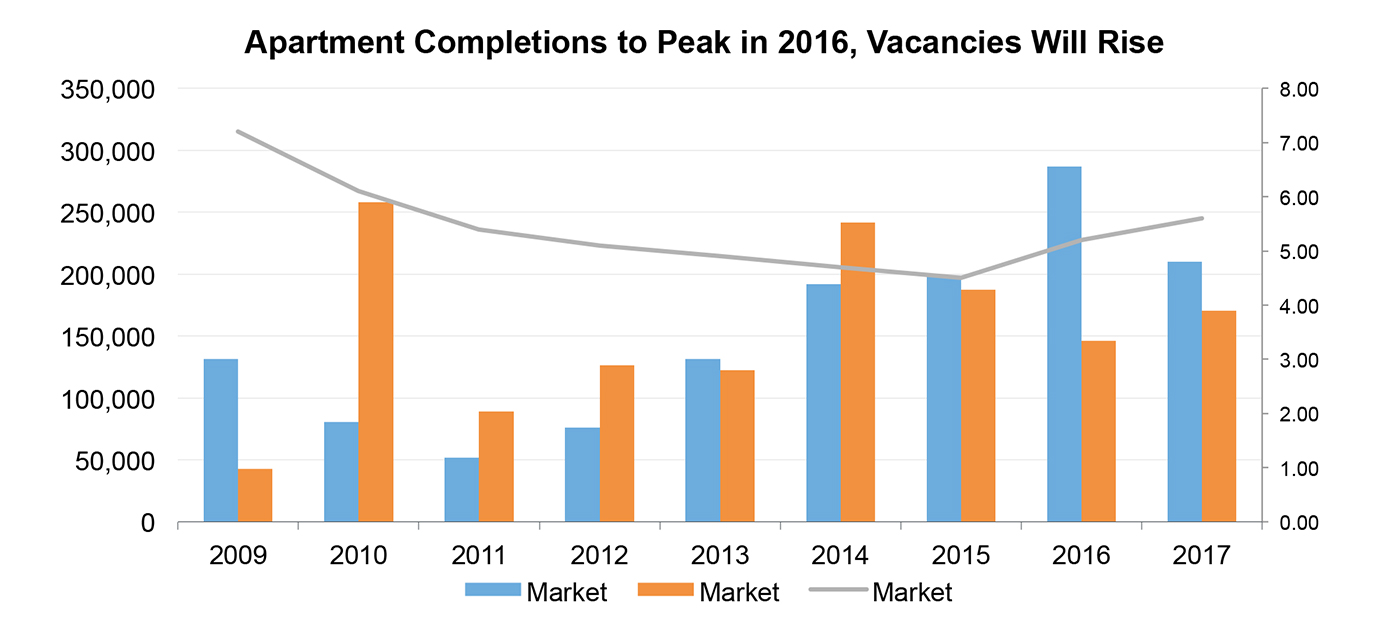

In addition, apartment fundamentals are beginning to moderate but are still at healthy levels. In 2015, apartment completions surpassed net absorption of units for the first time since 2009, signaling the beginning of an oversupply of apartments. This year, we anticipate completions to exceed absorption by more than 100,000 units, which will likely cause the vacancy rate to increase by about one percentage point (see chart 1 at left). Markets such as Las Vegas, Miami, Nashville and the suburbs of Washington, D.C., will see a more pronounced change in apartment completions versus absorption.

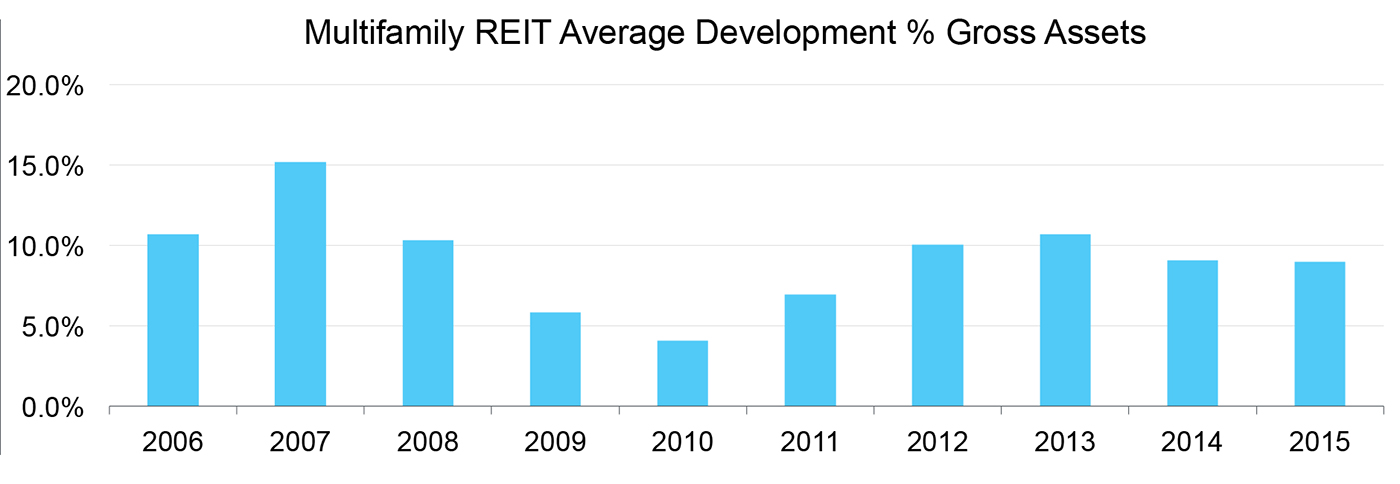

REIT owners of second-tier buildings in these markets will perform better than owners of first-tier buildings from an occupancy and rent growth perspective. The lower price point of second-tier apartments will insulate them from a rise in vacancy as a result of new construction. Development pipelines for multifamily REITs are expected to peak in 2016 and gradually decline thereafter because yields have contracted from earlier in the real estate cycle (see chart 2 at right). The multifamily REITs’ development pipelines are manageable and well below prior peaks, and should fall considerably by 2017.

REITs are overall on a positive trajectory. Multifamily REITs have experienced average annualized same-store NOI growth of approximately 6.3 percent over the past five years; this number should remain north of 5 percent in 2016. During this time period, they have taken advantage of the low-interest-rate environment to increase fixed-charge coverage, refinance secured government-sponsored enterprise (GSE) debt with unsecured debt, and extend their debt maturity profile. Leverage has improved through a combination of strong earnings and asset sales, executed in a very favorable cap rate environment. Asset sales have also improved the overall quality of the portfolio and allowed the REITs in many cases to exit non-core markets.

Despite softening fundamentals, the financial and credit profile of Moody’s rated multifamily REITs has improved, and we therefore expect upwards ratings movement in 2016. In addition, as we enter the latter stages of the current real estate cycle, the REITs will be poised to take advantage of acquisition opportunities, and further M&A is possible.

You must be logged in to post a comment.