Multi-family

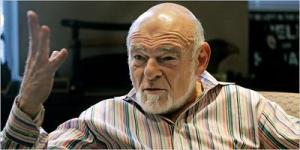

Equity Residential Buying Luxury at Low Prices

February 2, 2010 By Allison Landa, News Editor Sam Zell’s Equity Residential is acquiring luxury at budget prices. The company is in the process of purchasing several high-end properties in Manhattan – perhaps in the hope of buying low to sell high. Earlier this year, Equity nabbed Shaya Boymelgreen’s stake in a lot at Tenth Avenue and West 23rd Street for the price of $11.25 million, along with paying $750,000 to other parties for land use. Zell reportedly is planning a 13-story project for the property, which will include 96 apartments as well as other facilities. Now Equity has announced…

$3B Debt Forces Tishman and Blackrock to Return Peter Cooper/Stuyvesant Town Property to Creditors

Peter Cooper and Stuyvesant Village residents are wondering what is next after Tishman Speyer and BlackRock returned their keys to creditors.

Morgan Stanley Gives $110M Boost to Hard-Hit Affordable Housing Market

Morgan Stanley has given a $110M boost to Chicago-based Low Income Tax Credit syndicator National Equity Funds Inc. in order to inject necessary funding into low-income multifamily projects across the nation.

Economy Watch – Homebuyer Tax Credit Sees Some Cheating

In testimony reminiscent of dogs getting credit-card applications approved back during the mid-2000s credit bubble, a Treasury Department inspector told Congress that kids as young as four years old have been able to receive $8,000 first-time homebuyer tax credits. “Some key controls were missing to prevent an individual from erroneously or fraudulently claiming the credit,” J. Russell George told the House Ways and Means Committee’s oversight panel on Thursday.

The Graying of America: Age and Opportunity

The graying of America may arguably be one of the single most dramatic demographic megatrends shaping our landscape. Although the U.S. population growth for individuals age 55 and over during the past nine years hasn’t been impressive—from 21.06 percent to 24.17 percent—growth for individuals age 55-64 increased by 30 percent over the same period. Given that the oldest Boomers turned 63 this year, maybe it’s time investors consider the opportunities this megatrend offers.

Investors Prepare to Increase Activity in MF Market in 2010

The multifamily market has not escaped the ravages of the economic downturn, but investors are bullish on the commercial real estate sector for 2010. According to Jones Lang LaSalle’s 2010 Multifamily Forecast Survey, 90 percent of the 200 owners and operators surveyed plan to boost their activity in the sector next year, compared to the 68 percent of respondents who had such plans last year.

- « Previous

- 1

- …

- 151

- 152

- 153