More Commercial Mortgages for Regional, Local Banks: When Is Enough?

Yardi Matrix Director of Research Paul Fiorilla assesses the risks some financial institutions face at this late stage in the economic recovery.

By Paul Fiorilla

Paul Fiorilla

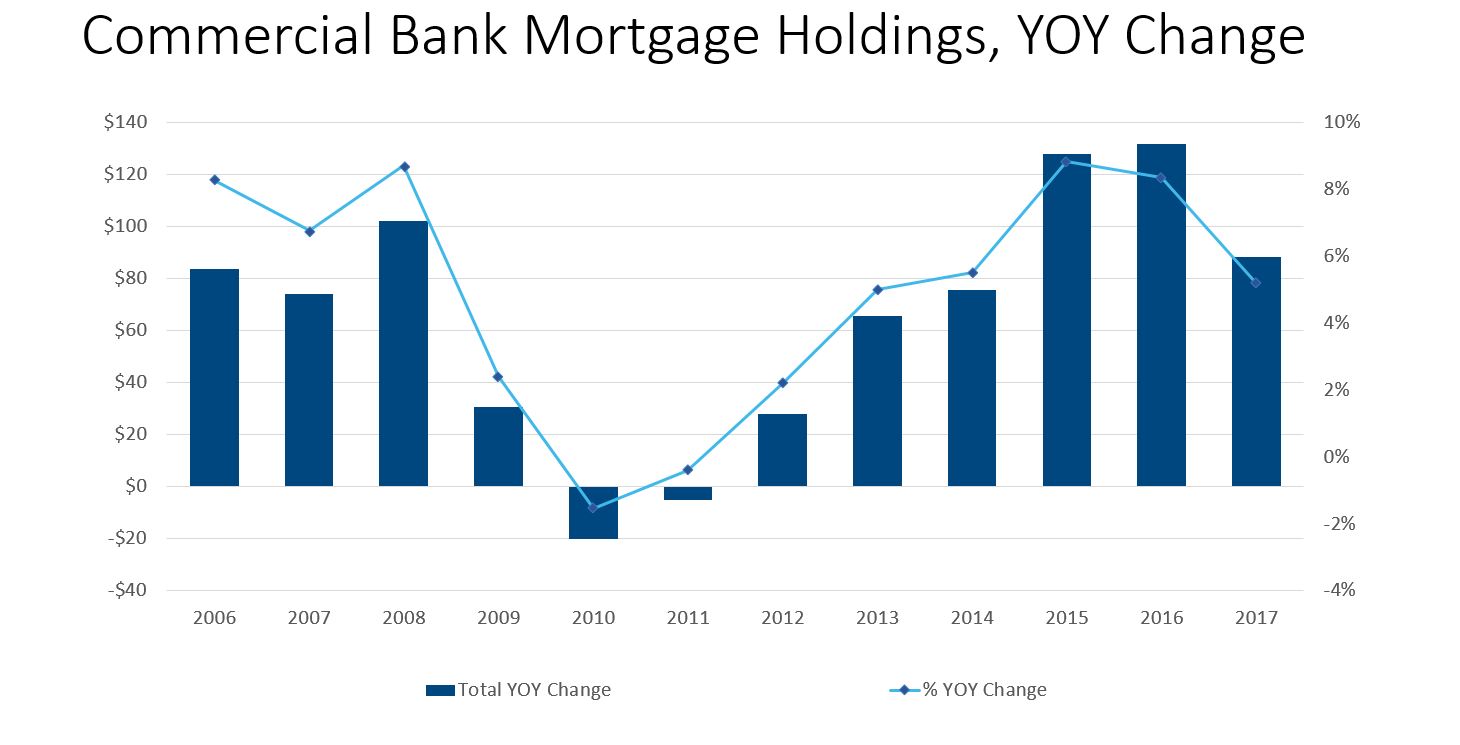

The post-financial crisis expansion has been a heady time for banks in commercial real estate. As of year-end 2017, banks held $1.8 trillion of commercial and multifamily mortgages, up nearly $500 billion (37.4 percent) since the recovery began in earnest in 2012 and 50 percent more than the $1.2 trillion banks held 10 years ago at the height of the last lending boom.

Commercial mortgages are also rising as a share of banks’ overall business. Commercial and multifamily loans represented 10.3 percent of bank assets as of year-end 2017, up from 9.0 percent in 2012. They represented 18.5 percent of all bank loans in 2017, up from 17 percent in 2012.

Sources: Yardi Matrix, BankRegData

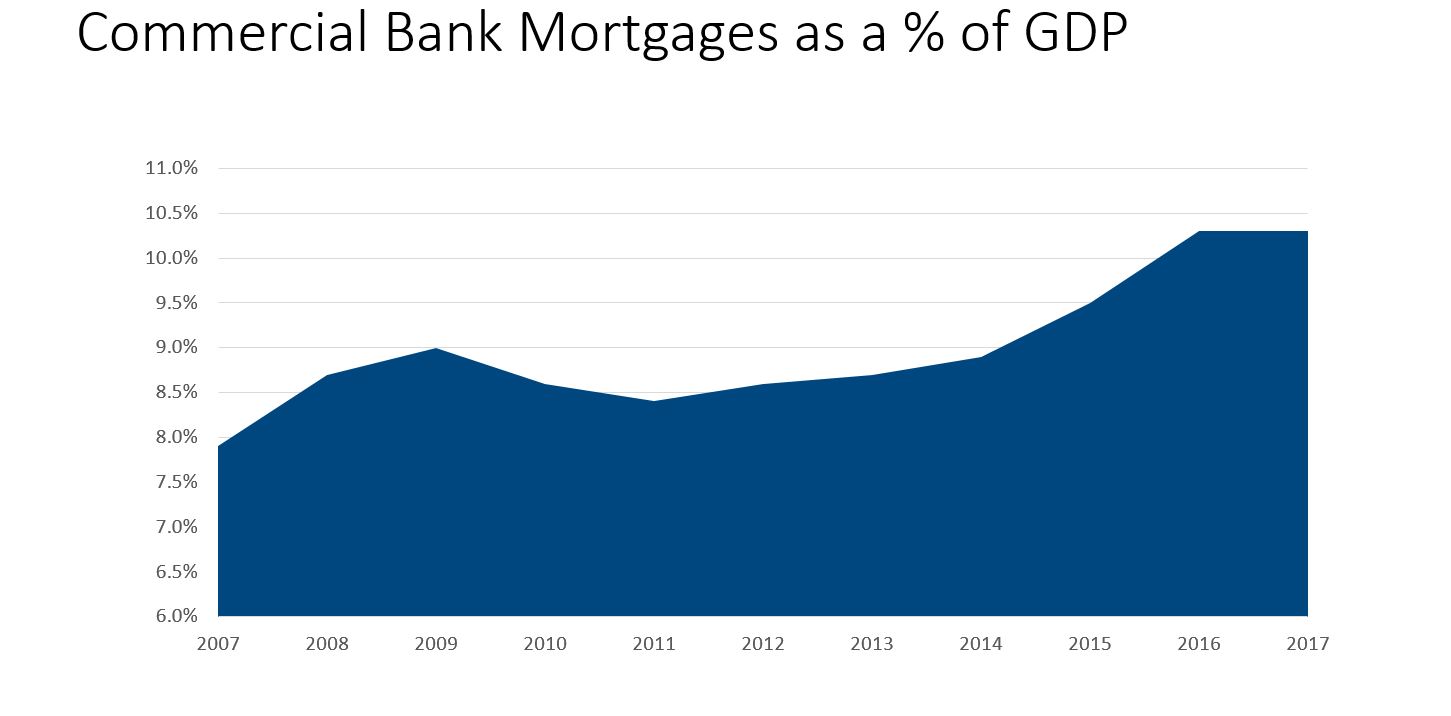

Because property values are rising much faster than the economy—values are roughly 25 percent above the 2007 peak, per various indexes—bank mortgage holdings are growing as a share of GDP. As of 2017’s fourth quarter, commercial and multifamily loans represented 10.3 percent of U.S. GDP, up from 8.4 percent in 2011 and 7.9 percent in 2007. The growth reflects the extent to which commercial property values have risen, in large part due to strong capital markets forces.

Sources: Yardi Matrix, BankRegData

Regional, Local Banks Lead in Growth

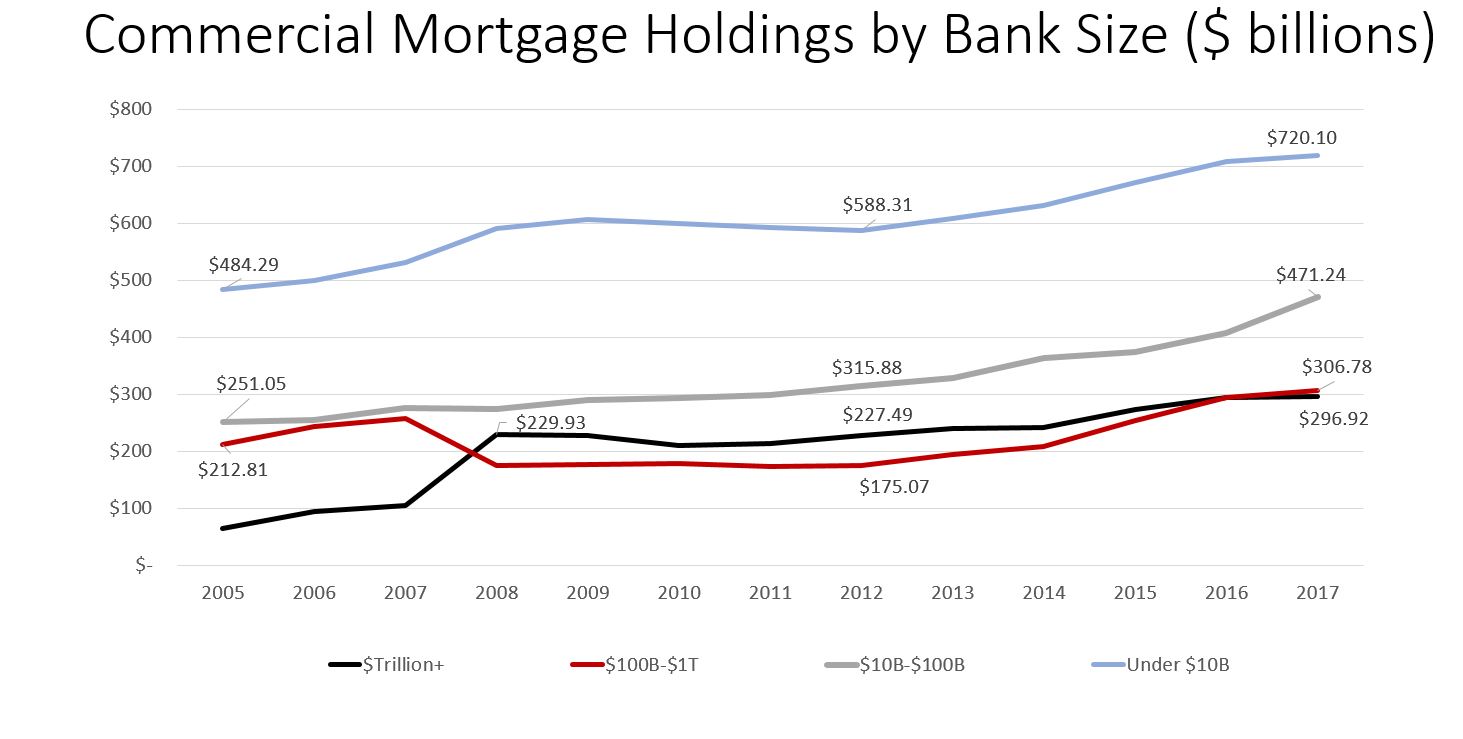

While all categories of banks have increased lending, data shows that portfolios of regional and local banks are increasing at a faster rate than the relatively few national and money-center banks.

In 2017, bank commercial and multifamily mortgage portfolios rose by $88.2 billion, and $63.8 billion—almost three-quarters—came from banks in the $10 billion to $99.9 billion category. Bank lending statistics in this report come from BankRegData.

Sources: Yardi Matrix, BankRegData

As a percentage of total assets, commercial mortgage holdings of $10 billion to $99 billion banks rose to 18.2 percent at year-end 2017, up from 12.2 percent in 2012. This growth in commercial mortgage lending not only increased regional banks’ share of the overall bank market, but of their share of all commercial mortgage lending. Small and regional banks comprised 18 percent of all commercial mortgage lending in 2017, double their share in 2011 when total originations were much smaller, according to Real Capital Analytics.

What’s driving the growth in commercial mortgage activity of regional and local banks? The product fills a need and it is expedient. Mortgages provide more yield than other investment products, and that looks even better on a risk-adjusted basis since loan defaults are less than 1 percent.

Another factor is the availability of the business. Large banks have many more revenue sources, such as investment banking and wealth management. For small banks, mortgages are more readily available than consumer and industrial (C&I) business loans, and they usually come in larger chunks. That’s an important factor to banks looking for growth. Many local banks operate in rural areas, so their increase in lending comes later in the economic cycle and increases as the economy begins a decline. What’s more, commercial mortgages are easier to source than loans to small businesses. Property owners put mortgage assignments up for bid, and banks can control volume based on how aggressively they bid.

Risks of Overheating?

Banks’ lending freely makes for a liquid and healthy market—if loan underwriting remains disciplined. Bank commercial mortgage holdings rose as a share the overall economy in the run-up to the last financial crisis, so the current trend could be a worrying sign. On a broader level, some of the risks involved with the growth in lending of regional and local banks include:

Sources: Yardi Matrix, BankRegData

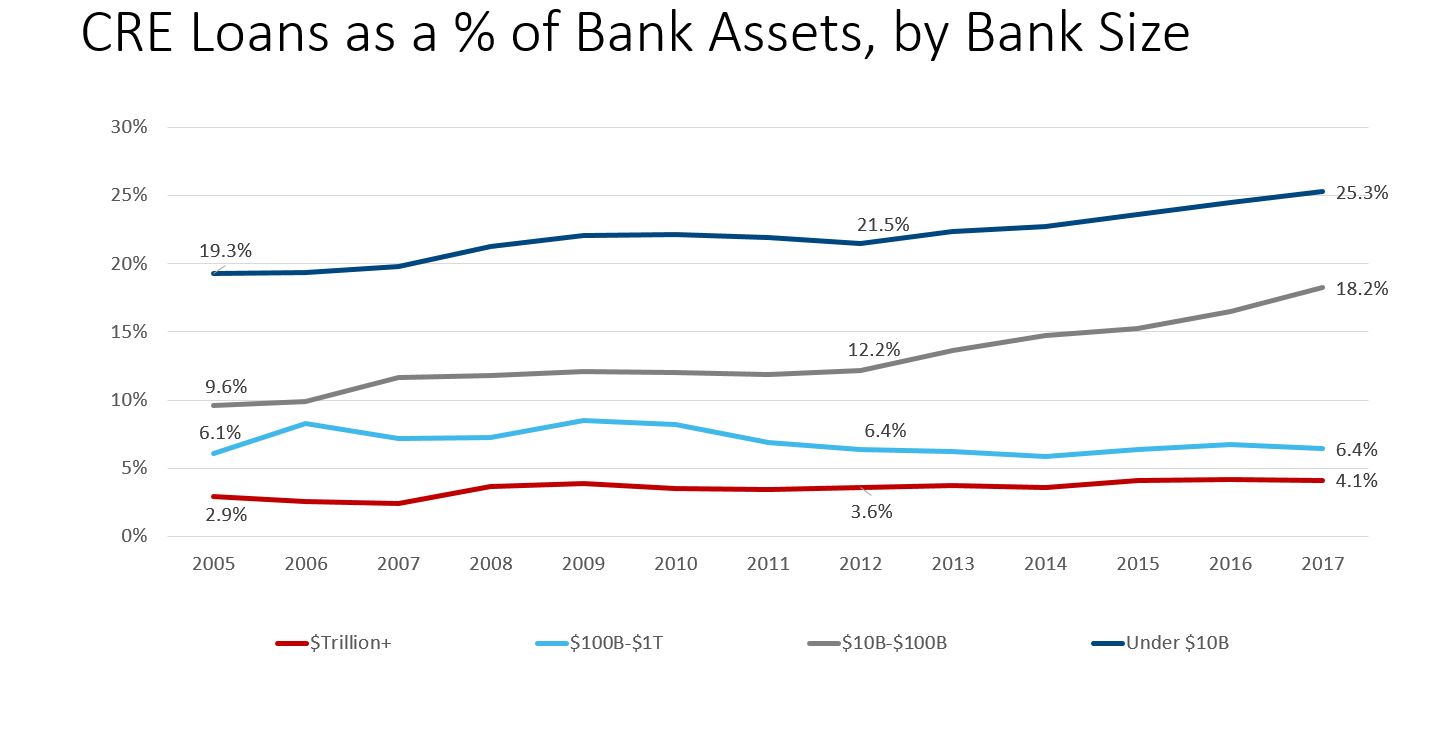

Concentration risk: Generally, the smaller the bank, the larger the concentration of commercial mortgages. Banks with $10 billion to $99 billion in assets have 26.6% of loan portfolios in commercial mortgages and 18.2 percent of total assets. For banks smaller than $10 billion of assets, the concentration is 36.2 percent of loan portfolios and 26.3 percent of total assets. For money-center banks, commercial mortgages represent only 8.6 percent of loan books and 4.1 percent of assets. Few small banks undertake the type of sophisticated cross-product allocation models that large institutions use to make sure they are not overexposed to a sector. A downturn in commercial real estate would have a significantly larger impact on regional and local banks.

Interest rate risk: Virtually all commercial mortgage holdings in banks’ portfolios were originated during a time of historically low interest rates, with fixed-rate loan coupons in the 4 percent range. If the Federal Reserve keeps increasing the federal funds rate, and interest rates increase as many expect, the gap between the banks cost of capital and yield on their investments—the net interest margin—will shrink or disappear entirely. That would sharply reduce bank profits, which is a big reason they have invested so heavily in the segment.

Maturity risk: Banks have shown during this cycle an unusual willingness to originate fixed-rate loans and loans with maturities between five to 10 years and sometimes even longer. Consequently, banks are increasingly investing short-term depository capital in a long-term product. More simply, they are borrowing short and lending long, which has a history of failure in real estate downturns in the past.

Can Banks Maintain Discipline?

Although lending standards do not appear to be extraordinarily frothy, the growth in commercial mortgages as a share of GDP is a warning sign. For now, the banking system doesn’t appear to be at risk. Leverage levels remain conservative by historical standards, and small banks don’t seem to have enough market share to create systemic risk. However, historically small banks have played a major role in some of the markets biggest busts, so caution is warranted.

You must be logged in to post a comment.