Mass Transit’s Importance in Major Office Metros

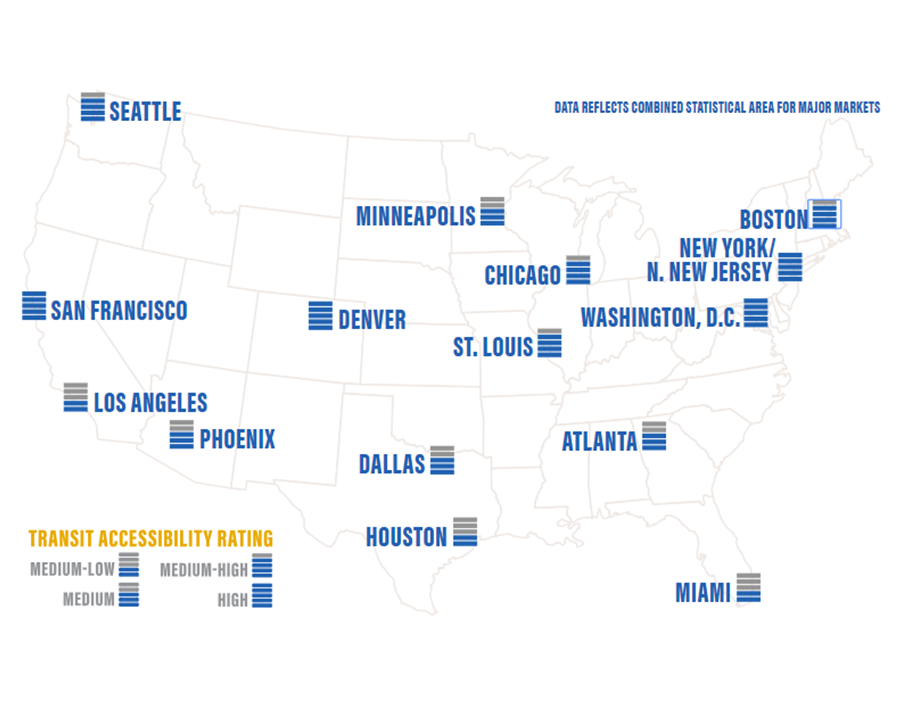

A new report from Transwestern analyses how public transportation near office buildings affects office vacancies and average rents across 15 major metros.

By Corina Stef

In the last couple of years, there has been a massive migration toward the suburbs due to the skyrocketing rental rates in the country’s major metros. Both Millennials and Baby Boomers were looking for more affordable alternatives, and companies followed along as well. Businesses repopulated the traditional suburban office campuses or nested in what we know today as live-work-play communities.

However, this move didn’t leave downtowns vacant. Demand for office space continues to be high, especially in large cities. When choosing a location, companies take into consideration a series of major factors, and not only demographic trends. One of them is the presence—or lack thereof—of mass transit options near their offices. With a large part of the workforce concentrated in bedroom communities or suburban areas, both landlords and tenants recognized that attracting and keeping talent depends on their employees’ accessibility to public transportation options.

A new report from Transwestern examines 15 major metros and mass transit’s influence on the market. Transit-accessible buildings are considered those within a 10-minute walk from a subway, commuter rail or light-rail facility.

On the right track

People and companies of Denver are truly lucky, as the metro’s transit-accessible office buildings reached 71 percent. This rate has been pushed by the recently signed Senate Bill 1, which allocated spending in the near future $645 million on highways and transit. The only metro reaching the above the 50-percent mark—58 percent, to be more precise—was New York. The metro boasts a 6.7 percent average vacancy in these buildings, which is a testimony to the fact that vacancies in transit-accessible office assets are lower than average. Washington, D.C., and San Francisco scored a 49 and 46 percent accessibility, respectively.

Chicago encompasses 158.1 million square feet of office space (a 43-percent rate) located close to transportation options. The booming Seattle metro, an emerging tech hub and home to some of the nation’s biggest corporate players, reached a 41-percent rate. However, Amazon’s rapid expansion near the urban core will make things harder for commuters. Rents in transit-accessible metros are also 65 percent higher than market average rents. A good example is Boston (36 percent of transit-accessible office buildings), which with its average rates of $41.78 per square foot falls behind San Francisco and New York. St. Louis recorded a 34 percent transit accessibility.

The roads less traveled

With a 33 percent accessibility rate, Atlanta is situated below the national average rate. The recent population growth, traffic congestion and densification throughout the metro are a result of a development swoon. Office buildings in Dallas are 30 percent transit-accessible, followed by Phoenix (22 percent). These Sunbelt cities are essentially suburban in character and despite new development coming online in transit access each year, a large deal of their inventory is scattered across the metro. The only exception is Minneapolis, which encompasses 35.8 million square feet of transit-access office space, meaning 25 percent of its total office inventory.

Houston has been battling mass transportation issues for years now, and only 20 percent of its office inventory is transit-accessible. The metro’s roads are often under construction to meet the demands of continuing growth—an example is Interstate 45, which connects the city with Dallas. Additionally, its transportation system dates back only to 2004, and prior to that, Houston was the largest city in the U.S. without a rail transit system. Even today, the light rail doesn’t go further than the downtown area.

Despite its status as a booming office market, Los Angeles scored a 19 percent rate of accessibility. Office development in the area is diffused in an unorganized way. Miami has the lowest number of transit-accessible office buildings (28.8 million square feet, or a 16 percent of its total office inventory). The highly suburban metro’s transportation system runs mostly in the central areas.

Case in point, approximately 39 percent of total office inventory across the 15 metros is considered transit-accessible, while the rest of it is largely dependent on cars. Additionally, national average rents for these assets are 65 percent higher than the average market rent.

Image courtesy of Transwestern

You must be logged in to post a comment.