Logistics Rents Climb Amid COVID-19 Crisis: Prologis

U.S. markets accounted for eight of the top 10 rental growth performers worldwide.

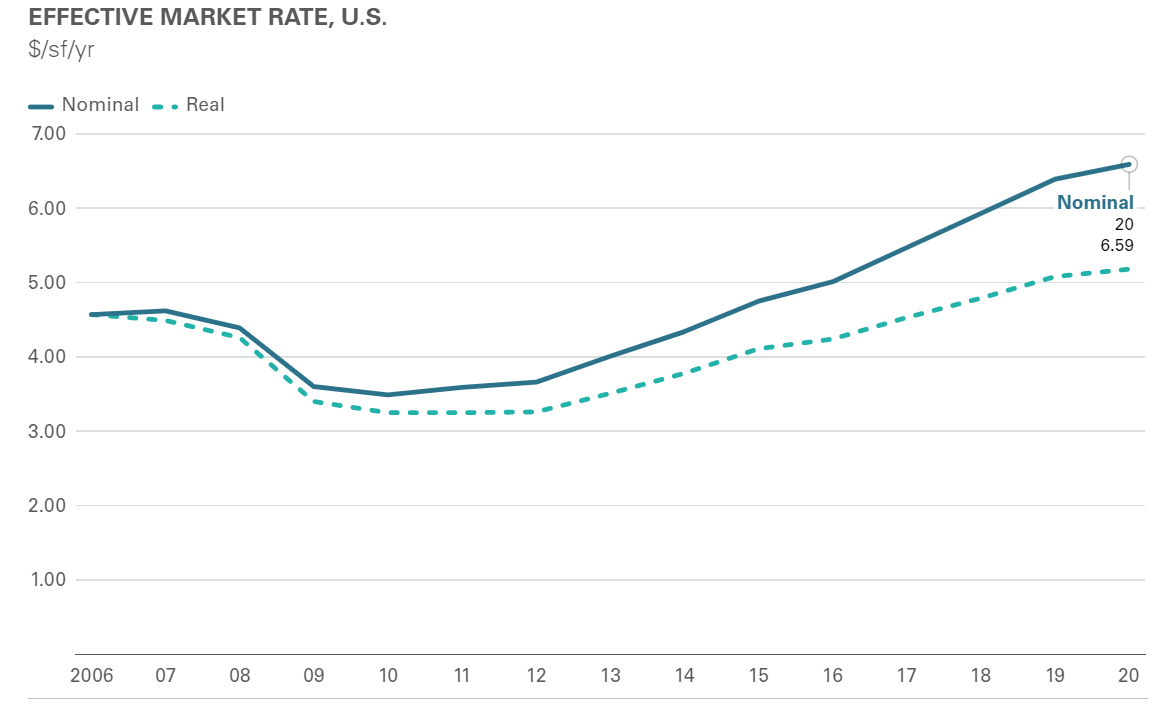

Despite a mid-year dip due to the pandemic, last year rent growth in key logistics markets in the U.S. and Canada rose 3.2 percent and 2.9 percent globally, according to the 2020 Prologis Logistics Rent Index.

READ ALSO: Amazon Reveals Striking Proposal for HQ2

In North America, the Baltimore/Washington, D.C., area, where rents rose more than 5 percent, saw the biggest increase. The Baltimore/D.C., market also topped the global list of the 10 best areas for rent expansion. Prologis notes the market may have benefited from companies that couldn’t find space in larger locations like New Jersey and Virginia.

Toronto was the only Canadian city to place in the Top 10 of U.S./Canada top rental growth performers, placing third on the list. The other markets, all in the U.S., were California’s Central Valley (second); Reno, Nev. (fourth); Nashville, Tenn. (fifth); New Jersey/New York City (sixth); Pennsylvania (seventh); Atlanta (eighth); Columbus, Ohio (ninth); and Louisville, Ky. (10th).

Rio de Janeiro was the only market outside North America to make the top 10, ranking eighth overall.

The index notes Toronto and the New Jersey/New York City markets saw rent growth due to strong trade and local consumption drivers and high barriers to supply. Other leaders in the U.S. were the Inland Empire in California, Pennsylvania, Dallas and Atlanta.

While rents grew overall, Prologis points out that the pace of rent growth actually decelerated in the U.S. and Canada—from the 8 percent increase in 2019—because of new supply, which was expected, and the surprise factor of COVID-19. However, most markets experienced quick recovery from the pandemic and demand was driven by the acceleration in e-commerce, reassessment of inventory levels and the requirement for speed to market. Those factors combined to keep historic vacancies low, even with more than 300 million square feet of new space coming online.

In North America, Prologis expects there will be intensifying competition for available parcels, which is expected to drive up the land costs in many U.S. markets. “At the same time, increasing regulatory barriers and community resistance is limiting development, adding costs and extending timelines,” the report states. “These trends should amplify the supply-demand imbalance, especially in infill areas.”

Those factors, especially as last-mile distribution capabilities are built out, should lead to future rent growth.

Global overview

North America and Brazil (up 5.9 percent) led the 2020 rent growth around the world, according to the index. Uncertainty from the pandemic led to negative growth in the second quarter of 2020 in most parts of the world except Japan and Brazil, which both recorded stable or positive growth throughout the year. Markets that saw the biggest dips were in markets with a large supply of logistics properties including Houston in the U.S., Poland and West China. But as in the U.S., most global markets experienced quick recoveries as demand remained healthy.

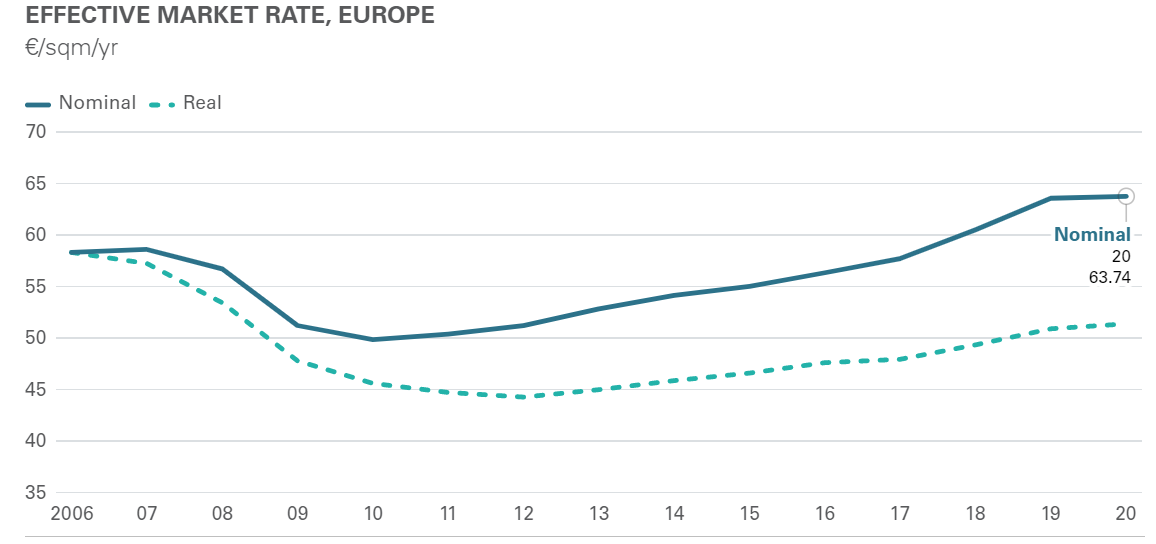

In Europe, rent growth remained positive for 2020, but only inched up by 0.3 percent.

“Despite all the Brexit turmoil, U.K. rental rates remained stable on the whole, driven by robust demand and limited new deliveries,” Prologis reported.

The Greater London markets claimed the first spot in the top performers for Europe, with German markets taking the next four spots in the Top 5—Hamburg, Frankfurt/Rhein-Neckar, Hanover and Munich.

In Asia, Prologis states Japan market rents held steady because of low vacancies, while market rates in China fell about 4 percent overall mainly due to oversupply.

Looking ahead

Disruptions from the ongoing pandemic will likely continue in 2021, but Prologis does not expect the volatility to be as severe as it was in 2020, considering that supply chains have improved. As economies open and more people are vaccinated across the globe, Prologis expects the economy to improve and generate more demand in 2021, particularly in the second half of the year. The logistics real estate giant expects 2021 to be a “steady year of growth for most markets.”

Still there are areas to watch. Prologis notes that the logistics real estate sector has attracted significant equity because of its resilience and so it will be “monitoring how this wall of capital now targeting the sector could lead to areas of oversupply.”

There is also the need for more modern logistics properties to handle the growing demand from e-commerce. Properties will need to incorporate more updated technologies to improve efficiency.

Read the full report by Prologis.

You must be logged in to post a comment.