How Automation Will Fill Supply Chain Gaps: Report

The sector is facing skilled labor shortages and a lack of well-located space to meet accelerated pandemic-related demand, two areas that new technologies can address, according to the latest Prologis Research report.

A critical shortage of industrial space, exacerbated by the increased demand for modern logistics facilities, could occur within the next five years, especially in last-mile delivery locations.

According to a Prologis Research report, automation can bridge that gap by improving productivity, enhancing capabilities and opening up new locations.

READ ALSO: Demand for Modern Industrial Facilities Fuels the Pipeline

“Improving productivity will allow users to accommodate growth of their businesses in locations where logistics space is not available, helping to alleviate the shortage of space,” Melinda McLaughlin, Prologis vice president, global head of research and author of the two-part series, told Commercial Property Executive.

Entitled Automation and Logistics Real Estate #2: How Automation Can Help Navigate Urgent Supply Chain Challenges, the report is the second in a two-part series. The first report, released in late November, pointed to three trends that are combining to drive higher levels of automation: Greater absenteeism due to the COVID-19 crisis, which stresses labor availability; improvements in technology that are expanding capabilities and reducing costs; and labor-intensive operations, particularly at e-commerce sites, which are growing quickly because of the surge in pandemic-driven e-commerce.

Increased automation creates more opportunities for users and allows them to expand locations they can choose. But the first report noted that adoption of both fixed and mobile/semi-mobile automation technologies was still low, though rising particularly at e-commerce and e-fulfillment sites.

“We may be at an inflection point for automation, where increasing demands on customer businesses intersect with improving technologies and ROI. Growth is focused on mobile and modular technologies that can flex with supply chains,” McLaughlin said.

The latest report takes a closer look at both shortages facing the logistics sector—of skilled labor and of well-located space—and notes that users who are not beginning to implement automation technologies at their properties will be left behind. The acceleration of supply chain trends like e-commerce could lead to a deficit of logistics space by as much as 140 million square feet over the next five years.

Demand drivers

Prologis cites several forces driving demand for logistics space in the near to medium term including e-commerce. Online sales are expected to grow from about 15 percent of retail goods to more than 25 percent, resulting in about 100 million square feet of extra demand per year on top of economic growth.

Other factors include the shift in supply chain inventories from just-in-time to just-in-case, which should add between 57 million square feet and 114 million square feet of demand per year for the next five years and economic growth of about 1.5 to 2 percent each year, which could add 150 million square feet to 175 million square feet per year of demand. Demand from the pandemic, including increased need for medical equipment and vaccine distribution facilities, are expected to also add near-term space needs.

McLaughlin said automation may be integral for future competitiveness, especially when considering supply chain challenges that are expected to intensify.

“Automation can help customers stay ahead of these challenges, but is unlikely to alter the broad trajectory of the logistics real estate industry where demand exceeds supply,” she told CPE.

Asked about solutions for occupiers who want more space but must stay in their last-mile current locations due to the lack of supply, McLaughlin said that is precisely where automation comes in. “Improving efficiency of existing operations can accommodate growth in volumes, service levels and services offered,” she said.

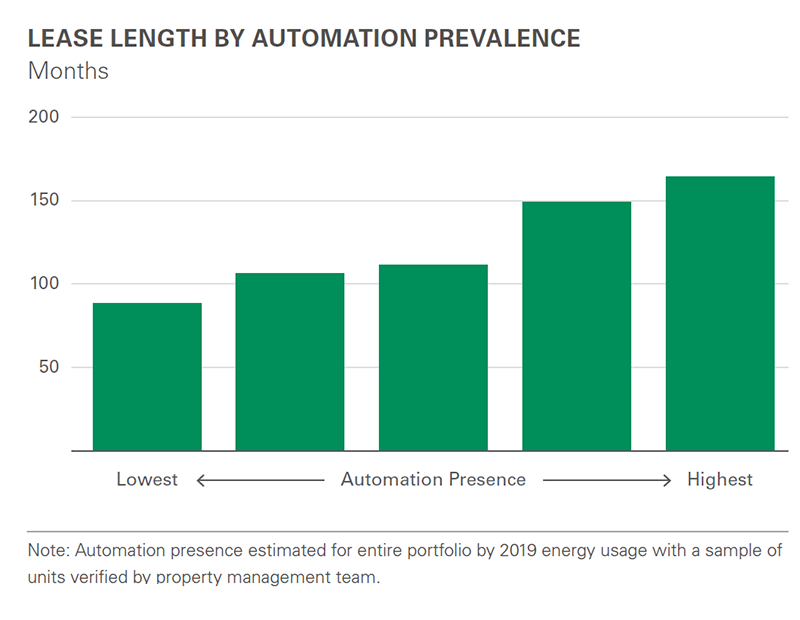

The report notes that investments in automation technologies can also boost the value of modern facilities and lift the investment performance of logistics assets. Prologis Research states that users making automation investments tend to sign longer leases. The top energy users, which often are largely automation adopters, sign leases that are on average 50 percent longer than the average logistics occupiers.

You must be logged in to post a comment.