Lessons Old, Lessons New

By Ken Riggs, President & CEO, RERC, a Situs Co.: As the year 2014 comes to an end, RERC sees that the U.S. economy has finally turned the corner on the credit crisis.

By Ken Riggs, President & CEO, RERC, a Situs Co.

As the year 2014 comes to an end, RERC sees that the U.S. economy has finally turned the corner on the credit crisis. With growth of more than 3 percent during the past two quarters, the Federal Reserve has ended its monthly purchases of securities as planned and is considering changing its communication about how long short-term interest rates will remain near zero. In addition, job growth is increasing, average gasoline prices have dipped to levels not seen for five or more years, and consumer confidence has increased to its highest level in eight years.

There are still many risks facing the economy and financial markets, however. We have not addressed a federal debt of more than $18 trillion, and we have just seen the biggest drop in a week’s time in the DJIA Index since September 2011 (mostly because of the drop in oil prices). Further, 10-year U.S. Treasury rates dipped to 2.10 percent at the end of the week, while the 10-year government bond rates dropped to 0.64 percent in Germany and 1.85 percent in the UK. If this weren’t enough to plant seeds of doubt about the risk dominating the investment environment, Fannie Mae and Freddie Mac just announced an option for expanding the LTV ratio for “qualified homebuyers” to 97 percent with a down payment of only 3 percent. Stay tuned: there is still a final leg of adjustment for the financial markets down the road likely in late 2016.

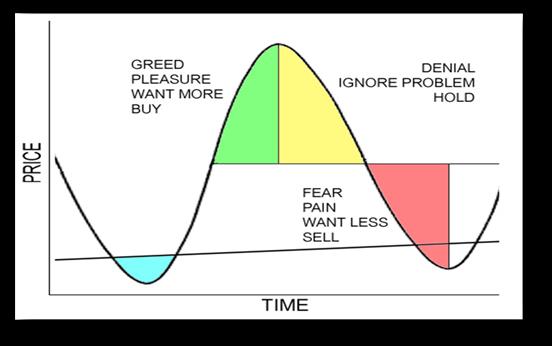

Investors insist that this time, things are different. We are smarter, and we think that there is more transparency into investment opportunities. We have learned from the past, and we won’t make the same mistakes again. But investor psychology shows that memories are short and investor behavior does indeed repeat itself. As shown in the graph below, when prices are up, our greed or pleasure in buying investments increases. However, as we approach the peak of the investment cycle, a period of denial and ignoring problems inevitably follows, and the fear and pain of loss will start again.

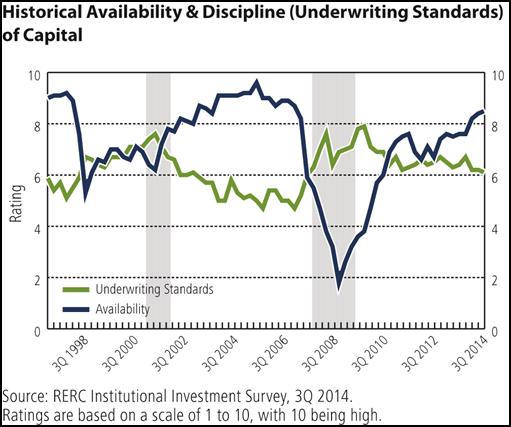

One of the more interesting replications of investment activity is demonstrated by RERC’s historical ratings for the availability and discipline (underwriting standards) of capital. We can see that the most recent time that availability outpaced discipline to the degree we witnessed in third quarter 2014, was in second quarter 2007—shortly before the credit crisis that preceded the Great Recession. Commercial real estate was selling for top prices then too (remember Blackstone’s purchase of Equity Office Properties Trust for $39 billion in the world’s biggest leveraged buyout in late 2007?).

Today, the abundance of capital in the U.S. and from abroad continues to pressure commercial real estate prices to increase, especially for top assets, despite the risk involved. Although at some point prices will outstrip values and a price correction will occur, that is not the case now.

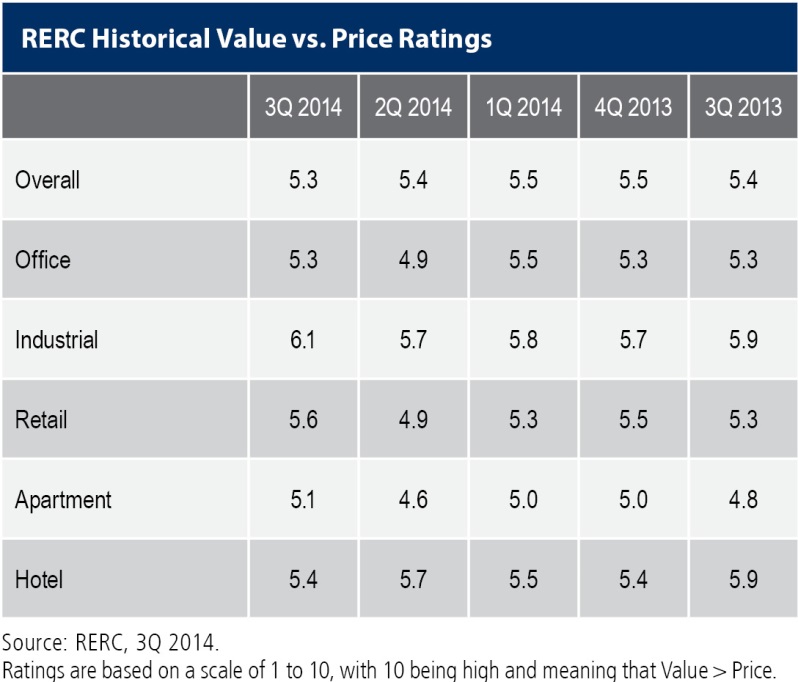

In fact, according to RERC’s third quarter 2014 return vs. risk ratings as reported in the RERC Real Estate Report, “Prices Pressure Values,” commercial real estate returns are expected to increase for all property types (except for the hotel sector) compared to the amount of risk involved. The return vs. risk rating for the apartment sector increased the most, from a rating of 4.8 on a scale of 1 to 10, with 10 being high, in second quarter 2014, to a rating of 5.8 in third quarter, indicating the increased return potential of this sector during risky times. (A rating below 5 indicates that returns are less than the amount of risk, a rating of 5 is neutral, and a rating above 5 indicates that returns are greater than the amount of risk.) The industrial sector earned a return vs. risk rating of 6.6, indicating that returns are expected to be strong compared to the amount of risk involved.

RERC’s third quarter 2014 value vs. price ratings reflect the same trend and have increased over second quarter ratings (except for commercial real estate overall and the hotel sector), despite the continued increase in property prices. With value vs. price ratings all higher than 5.0 in third quarter, RERC’s investment survey respondents believe that value still outweighs the price for commercial real estate. (A rating below 5 indicates that the value is less than the price, a rating of 5 is neutral, and a rating above 5 indicates that the value is greater than the price.) As shown below, the industrial sector earned the highest value vs. price rating.

No one has a clear picture of the future, but all evidence suggests that commercial real estate will demonstrate solid risk-adjusted returns and that values and prices will further increase in 2015. (That doesn’t mean they should increase, but it is what the market is doing nonetheless.) The economy is likely to keep slugging along, but at some point, the final leg to this adjustment will take effect, the financial markets will correct, and interest rates will start to increase. But until then, commercial real estate will remain a preferred investment alternative.

You must be logged in to post a comment.