Kansas City’s New Look

The metro is in the midst of a transformation, growing as a financial and research center, with increased investment in infrastructure, all of which support multifamily fundamentals, Yardi Matrix data shows.

By Alexandra Pacurar

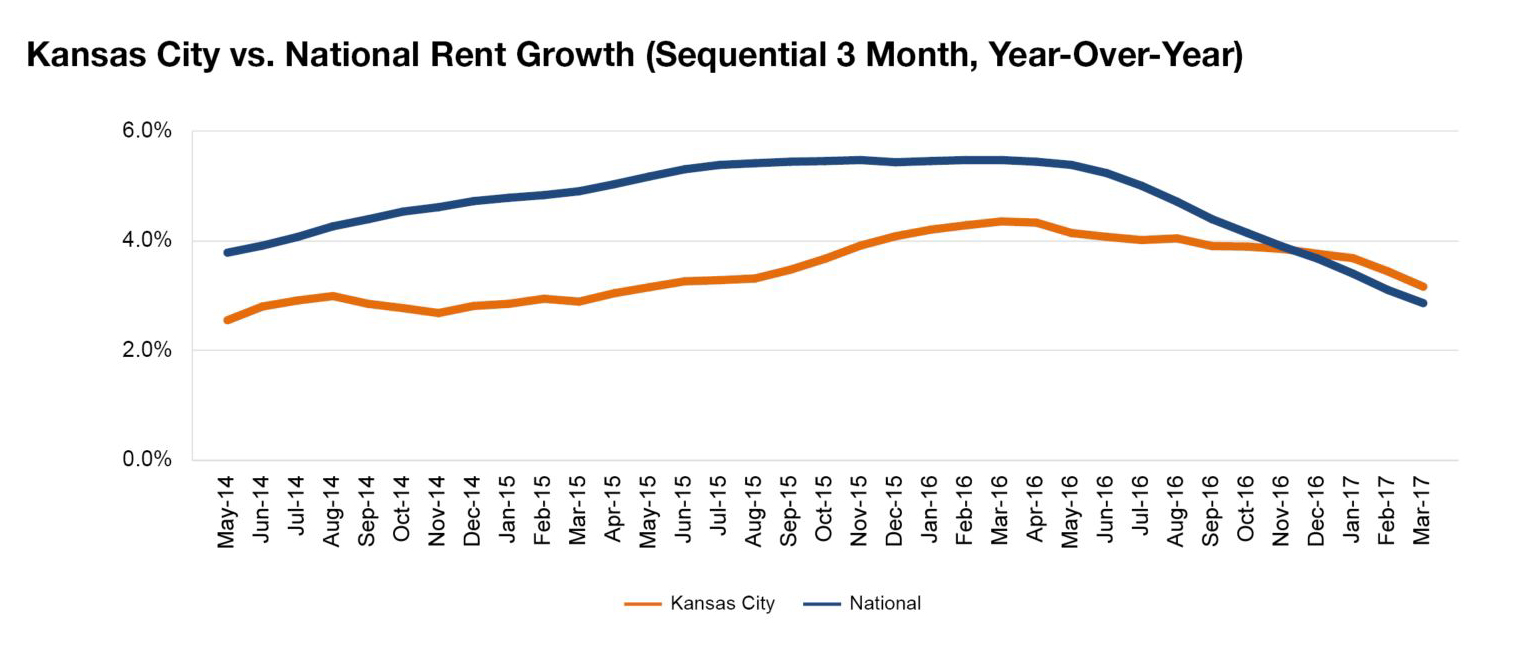

Kansas City rent evolution, click to enlarge

Kansas City is in the midst of a transformation, growing as a financial and research center, with increased investment in infrastructure, all of which support multifamily fundamentals. Demand is healthy as young professionals move into the city, although a wave of new supply is expected to moderate rent growth.

The metro is consolidating its status as a financial services hub. The sector added 4,500 jobs over the past year, leading all employment segments. Kansas City is also seeing a growth in tech-oriented businesses, the most notable being Cerner’s Innovations Campus, which just completed the construction of its first two towers. The metro’s central location and its status as one of the biggest rail centers in the U.S. attracted large e-commerce and distribution companies. In the past year, Amazon and Spectrum Brands leased a total of roughly 1.8 million square feet in Logistics Park Kansas City.

The vibrant and diverse economy is drawing in investors, which pushed the total transaction volume for multifamily properties to more than $800 million in 2016. Rent growth will continue to be moderate. Demand should remain high—particularly in the urban core—but with 6,200 units under construction, new supply will dampen rent growth to 3.1 percent in 2017.

Read the full Yardi Matrix report

You must be logged in to post a comment.