It Feels Like 2007 (But We’re Not There Yet)

By Ken Riggs, President, Situs RERC: Commercial real estate is rocking and rolling. Find out why.

By Ken Riggs, President, Situs RERC

Despite the perceived slowness to the economic recovery, it has been very rewarding for the majority of investors on a broad market basis in most domestic asset classes. Most investors in the stock market have more than recovered what was lost in the Great Recession, and over the past couple months, stock market readings for the Dow Jones Industrial Average, the S&P 500, and the Nasdaq indices have all reached new highs.

Commercial real estate is rocking and rolling as well, and with record prices of individual properties and portfolios reminiscent of the deals leading up to the credit crisis, it feels like the heady days of 2007 all over again. The recent sale of Willis Tower in Chicago for $1.3 billion (the highest price paid for a U.S. office town outside of New York City), Anbang Insurance Group’s purchase of the Waldorf Astoria Hotel in New York City for $1.9 billion (the single-largest hotel transaction ever), and the sale of GE Capital’s real estate assets for $26.5 billion (the largest deal since Blackstone’s acquisition of Equity Office Properties Trust in 2007), are both exhilarating and frightening when contemplated in the context of an overheated market.

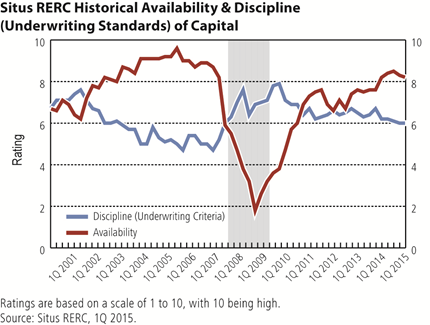

This is very much like the kinds of CRE transactions that took place before the credit crisis, when investment capital seemed too aggressive and was available for any type of deal. Availability of capital is outpacing discipline (underwriting standards) again today, although the spread between the availability of capital and the underwriting standards is not as wide as in 2007. According to Situs RERC’s institutional investment survey respondents, the availability of capital for CRE was rated at 8.2 on a scale of 1 to 10, with 10 indicating that the amount of capital was very high, in first quarter 2015. Perhaps more importantly, however, is that the discipline of capital (underwriting standards) has been declining for the past year and a half. As shown below, in first quarter 2015, the rating for discipline fell to 6.0 on a scale of 1 to 10, with 10 indicating the strictest underwriting standards possible, and with risk increasing as discipline declines.

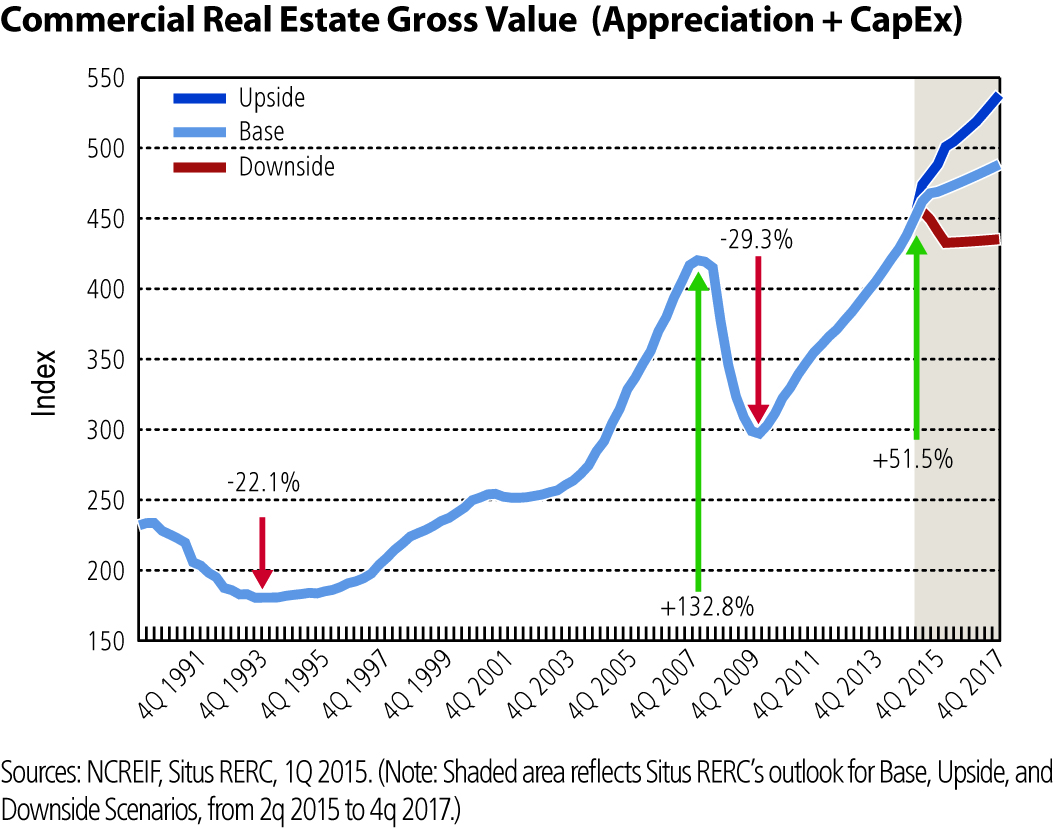

However, to put the above chart (which was a very telling path of decline and recovery for CRE prices over the past 10 years) into context, we should also look at values on a historical basis, in the graph below. In the 1990s, CRE gross value (appreciation plus CapEx) declined 22.1 percent, and by the time prices reached a new peak in first quarter 2008, value had increased 132.8 percent. Then gross value declined 29.3 percent in the first quarter 2010 trough, and by second quarter 2014, had reached its previous peak. Today, prices have increased 51.5 percent. From first quarter 1990 to first quarter 2015, the gross value of CRE has increased 94.2 percent, which is higher than the previous peak and is generally considered more risky.

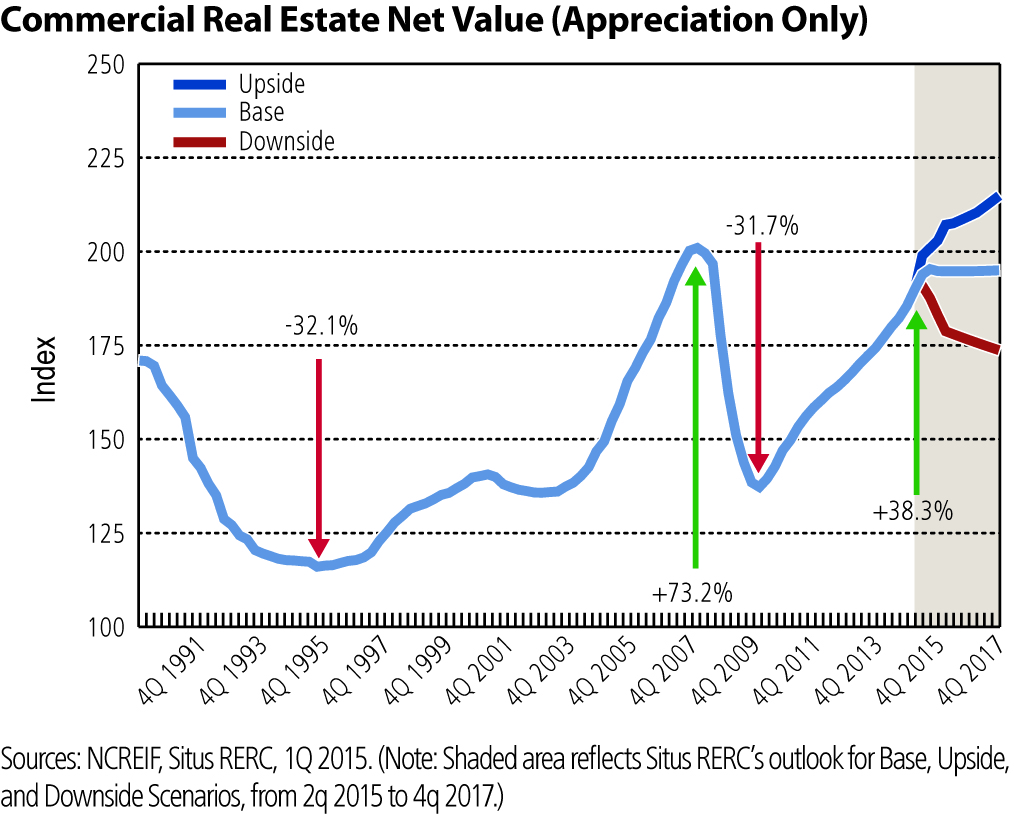

However, CRE net values (appreciation only) have not yet recovered to previous levels, and most investors believe there is still room for values and prices to increase before reaching their previous peak. Per Situs RERC’s analysis, CRE net value had increased 73.2 percent by first quarter 2008, but declined 31.7 percent by first quarter 2010, as shown in the graph below. While value has recovered 38.3 percent by first quarter 2015, prices are still slightly lower than pre-credit crisis levels. If appreciation continues in this recovery as it has in previous recoveries, CRE returns, as well as values and prices, can increase even more.

Given our perceived slow and tenuous economy—with first quarter 2015 GDP growth at only 0.2 percent, industrial production dropping for the fifth consecutive month, and consumer sentiment dipping to its lowest level of the year—the biggest risk may be that the Federal Reserve could further delay increasing the target range for the federal funds rate. But if economic growth remains positive and interest rates follow the path the Federal Reserve has charted for them, watch for CRE to continue to remain an attractive investment on a risk-adjusted basis, and to continue its march toward record prices.

How long do we have before the next peak and correction, which, by the way, is sure to come? That is the challenge and concern in the market. However, for now and over the next six to 18 months, it looks like CRE is going to do very well with record deals and prices. It is not 2007 yet, and we will keep you posted. Things may really work out differently this time (sure they will).

You must be logged in to post a comment.