Is CRE Lending Bottoming Out?

As conditions begin to stabilize, an uptick in deal volume is expected in the second half of 2024, according to CBRE’s latest report.

Although transaction activity remains modest, it appears that borrowing costs might have peaked, presaging renewed stability in the commercial real estate lending market, according to the third-quarter CBRE Lending Momentum Index, which was released Monday.

CBRE Research states that the index declined by 3.0 percent since the second quarter, which in comparison to a fall of 47.9 percent year-over-year, suggests perhaps the worst is coming to an end.

The CBRE Lending Momentum Index, which tracks the pace of CBRE-originated or CBRE-brokered commercial loan closings in the U.S., closed the third quarter at 187. The base value of 100 represents average activity for 2005.

READ ALSO: Emerging Trends for CRE in 2024 and Beyond

According to prepared remarks by James Millon, CBRE’s U.S. president of Debt & Structured Finance, there are signs that lending conditions may be stabilizing for certain asset classes, despite capital markets headwinds. As credit is gradually loosening, cap rates are resetting higher and the Fed’s rate hiking campaign may be near the end, Millon expects an uptick in deal volume in the second half of next year.

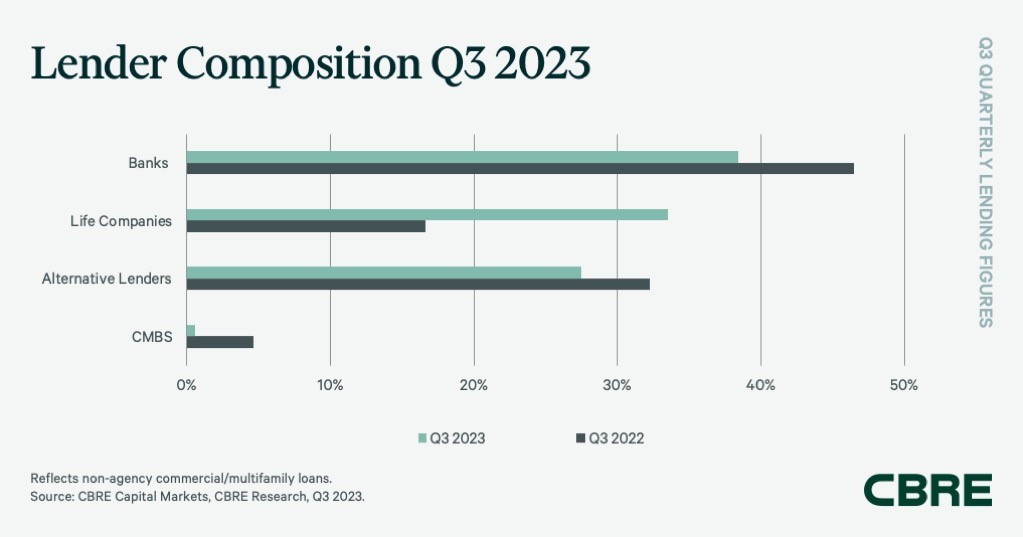

For the sixth straight quarter, banks accounted for the largest share of CBRE’s non-agency loan closings, having originated 38.4 percent of the third-quarter total, versus 43.3 percent in the second quarter. Construction loans accounted for about half of the third-quarter volume, one-third were for refinancing deals and the rest supported property acquisitions, CBRE reported.

In the third quarter, life insurance companies gained about as much market share as banks lost, with 33.5 percent of origination volume, compared with 26.8 percent in the previous quarter, predominantly in fixed-rate acquisition and refinancing loans for multifamily, industrial and retail assets.

Diving a bit deeper

Alternative lenders such as debt funds and mortgage REITs continued to be hemmed in by high short-term borrowing costs, though these entities did account for 27.5 percent of third-quarter loan volume.

Collateralized loan obligations managed just $6 billion in lending for the first nine months of 2023, a substantially fall from the $27.3 billion over the same period in 2022.

CMBS conduits too are not as productive so far this year, accounting for less than 1 percent of non-agency loan volume in the third quarter, versus 3.7 percent in the second quarter. Similarly, industrywide CMBS origination hit only $26.4 billion year-to-date (through the third quarter), a significant drop from $64.4 billion for the same period in 2022. Underwriting criteria saw little change in the third quarter, CBRE reported. The average underwritten cap rate rose by 16 basis points to 5.68 percent, while the average loan-to-value increased to 61.4 percent, from 58.3 percent in the second quarter.

You must be logged in to post a comment.