2025 Industrial Sales Update

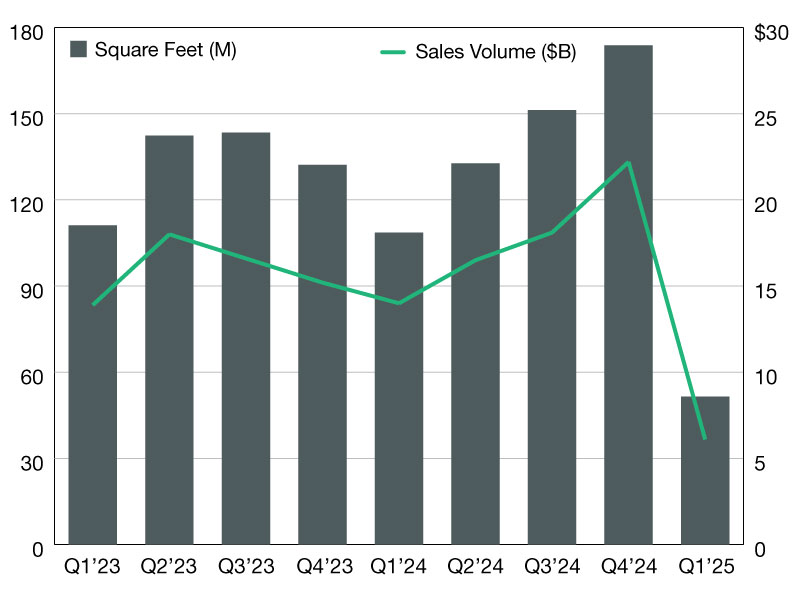

Industrial deals totaled more than $70 billion in 2024, CommercialEdge data shows.

So far in 2025, investors have closed 1,337 industrial transactions, covering 165.2 million square feet and totaling $21.4 billion, according to the latest CommercialEdge data. The average sale price per square foot during the first five months hit $132.92, inching past last year’s $130.76 benchmark—signaling steady demand in the sector.

READ ALSO: Manufacturing Investments

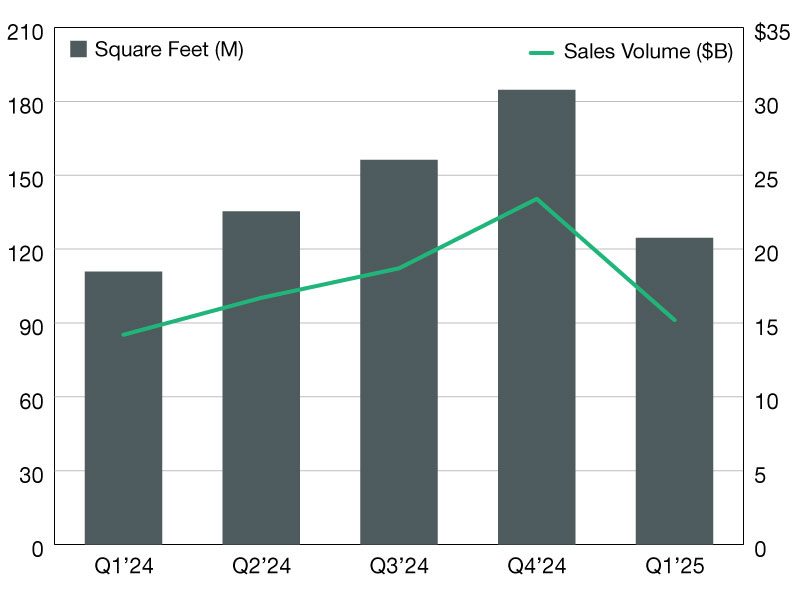

In the first quarter of the year, 1,006 of industrial deals closed across 124.6 million square feet, totaling $15.2 billion and marking a significant jump compared to the $14.2 billion year-over-year. The average sale price hit $123.51 per square foot, marking a 7 percent decrease when compared to the same months in 2024, when assets traded at an average of $133.33 per square foot.

Industrial investment’s growth potential

As for this year’s second quarter, investors closed 331 sales so far, encompassing 40.6 million square feet and generating $6.2 billion. Properties traded at $162.46 per square foot on average, representing a 32 percent jump from the last year’s second quarter value of $123 per square foot.

Nevertheless, there is still room for growth this year as the industrial market continues to adapt and shift to current conditions. Last year ended with 5,063 industrial transactions comprising 587.1 million square feet, that sold for a total of $73.1 billion.

—Posted on June 27, 2025

In 2024, $70.8 billion in industrial sales closed across 4,828 deals and involving 566.3 million square feet, according to the latest CommercialEdge data. Last year, the average price per square foot stood at $127.99.

Through 2024, investment activity increased as the year progressed: the first quarter ended with $14 billion in deals, while the second quarter posted $16.5 billion in transactions. Third-quarter sales volume totaled $18.1 billion, with investment activity reaching $22.2 billion during the last quarter—marking the busiest period of last year. The difference between 2024’s first and last quarters represents a 58.6 percent increase in activity.

READ ALSO: Industrial Real Estate’s Future Depends on Adaptability

Following the same industrial market trends, 1,040 deals closed at the end of 2024’s first quarter, a value that increased to the 1,381 deals registered at the end of the last quarter. In terms of square footage, properties totaling 108.6 million square feet changed hands January through March in 2024—the figure increasing to 173.8 million in the last three months of last year.

The industrial average sale price per square foot fluctuated in 2024—clocking in at $134.52 per square foot at the end of the first quarter and falling to $124.18 per square foot by the end of the second quarter. After this period, the figure dropped again to $121.63 per square foot at third quarter’s end, with the last three months of 2024 averaging a sales price of $132.23 per square foot.

A positive start for industrial sales in 2025

During the first two months of 2025, the average sale price per square foot for industrial sales stood at $126.55—a similar value to 2024’s average of $127.99 per square foot, CommercialEdge data shows. So far, this indicates a 1.1 percent drop from the previous year.

The same source shows that since the start of 2025, investors closed 389 transactions, comprising 51.5 million square feet of industrial space and added up to a total investment volume of $6.1 billion.

—Posted on March 26, 2025

You must be logged in to post a comment.