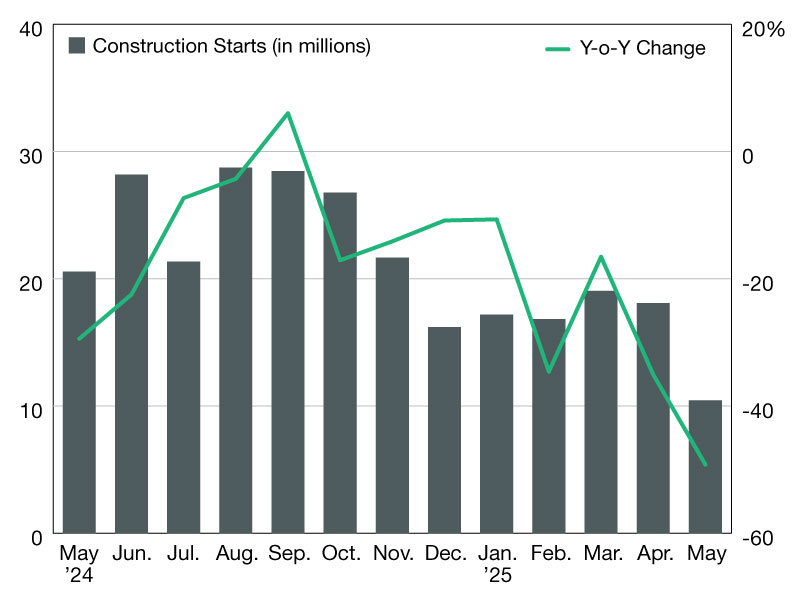

Industrial Construction Starts Plunge in 2025

Groundbreakings declined sharply this year, compared to the same period in 2024, according to CommercialEdge data.

Industrial construction starts saw a significant slowdown from 2024 to 2025. In 2024, industrial construction activity demonstrated both growth and volatility. Some months recorded strong performances—such as April with 27.85 million square feet of starts—but the overall trend pointed toward deceleration as the year progressed. Several months, including May, July and December, posted year-over-year declines exceeding 20 percent, signaling a cooling development pipeline.

READ ALSO: NAIOP Special Report: Will Tariffs Tax CRE’s Industrial Sector?

The tapering became more evident at the start of 2025. January saw industrial construction starts fall to 17.2 million square feet, down 26.9 percent compared to the same month in 2024. February and March continued this trajectory, with starts declining by 34.6 percent and 16.2 percent year-over-year, respectively. By May 2025, the volume had dropped to just over 10.4 million square feet—a steep 42.2 percent decrease from May 2024.

This steady contraction marks a significant shift from the robust activity seen the year prior. The consistent, double-digit year-over-year decreases throughout the first five months of 2025 suggest a meaningful slowdown in developer activity, possibly driven by shifting market conditions or a recalibration after years of aggressive growth. The data points to a more cautious, restrained industrial development pipeline taking shape in 2025.

—Posted on June 27, 2025

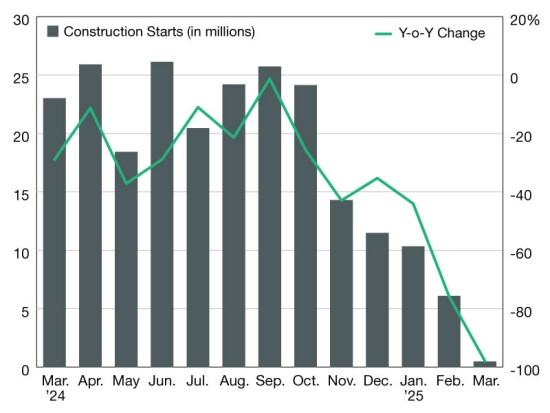

Industrial construction starts saw a dramatic slowdown at the beginning of 2025, with sharp year-over-year declines highlighting the sector’s cooling momentum. In February, new project starts totaled just 6.1 million square feet—a staggering 75.8 percent year-over-year drop from the 25.2 million square feet recorded in February 2024.

January also saw a steep contraction, with industrial construction starts falling to 10.3 million square feet, a 44 percent year-over-year decrease from January 2024’s 18.5 million square feet. By contrast, January 2024 had already begun on weak footing, as it posted a 57.2 percent drop from January 2023. The sustained slowdown between 2024 and 2025 suggests that the industrial sector’s development pipeline has been shrinking for some time, likely due to rising interest rates, cautious developer sentiment and a cooling demand for new space.

Early 2025 adjustments vs. 2024’s performance

Looking back at 2024, industrial construction activity fluctuated, but remained significantly stronger than in early 2025. The year began with a brief rebound in February, before experiencing inconsistent performance. By midyear, June posted a peak of 26.1 million square feet of industrial construction starts, though still 28.9 percent below June 2023. The second half of 2024 marked a clear downtrend, culminating in a steep drop in November (14.3 million square feet, down 42.9 percent year-over-year) and December (11.5 million square feet, down 35.3 percent).

The decline in industrial construction starts in early 2025 reflects a market adjustment, with developers taking a more measured approach amid ongoing economic hurdles. While activity remains lower than in early 2024, the shift suggests a more strategic pace of development as the industry adapts to current market dynamics.

—Posted on March 25, 2025

You must be logged in to post a comment.