How Northern California Industrial Maintains Its Edge

Northern California's industrial market stands apart for both its stability and upside potential, according to JLL's Erik Hanson.

Northern California’s performance isn’t accidental. It’s built on three fundamental advantages: geographical supply constraints, a diverse technology-driven tenant base and strategic positioning that consistently delivers through market cycles.

Northern California’s peninsular geography and limited developable land create natural barriers to entry that few other markets possess. This scarcity premium has consistently driven investor interest through numerous market cycles, proving particularly valuable during periods of market recalibration.

LIKE THIS CONTENT? Subscribe to the CPE Capital Markets Newsletter

The Bay Area’s long-established development constraints stand in stark relief against the national construction pipeline’s contraction to 241 million square feet. While other markets face absorption challenges with recently delivered product, Northern California’s existing inventory remains coveted precisely because replacement options remain limited.

Tech-driven demand

While traditional industrial uses remain important, Northern California’s tenant landscape has evolved significantly. Advanced manufacturing has emerged as a dominant driver of absorption, reflecting the region’s position as the epicenter of technological innovation.

This trend aligns with national data showing manufacturing tenants achieved their highest quarter of leasing activity to date in Q2, accounting for 6 percent of total leasing volume. In the Bay Area, this manufacturing focus is heavily concentrated in tech-intensive sectors that require specialized facilities— exactly the kind of high-value industrial space that Northern California excels at providing.

Additionally, Silicon Valley’s leadership in AI development has created unique space requirements that blend traditional industrial characteristics with specialized infrastructure. This convergence of technology and industrial real estate generates demand for facilities that can accommodate complex manufacturing processes, specialized power requirements and enhanced building systems. As evidence, recent leases in the market from tenants such as MiTAC, Sanmina, Aivres, Nvidia and Quanta Computer helped drive absorption in the region.

Size-based advantage

JLL’s national data reveals a clear advantage for smaller industrial spaces, which Northern California has in abundance. Spaces under 100,000 square feet currently have a national average vacancy rate of just 5.4 percent compared to 10.4 percent for larger spaces (500,000 to 750,000 square feet). These smaller spaces also command premium rents, averaging $11.55 per square foot nationally, and accounted for 78.7 percent of all leasing activity in Q2 2025.

This size-based dynamic particularly benefits Northern California’s industrial landscape, which has historically featured more modest-sized facilities suited to the region’s land constraints and specialized uses.

Capital markets resilience

Northern California’s industrial capital markets continue to demonstrate notable stability. Debt financing conditions have improved significantly, with national data showing nearly 250 lenders quoting on industrial loans in Q2 2025, up more than 60 percent from the market trough in Q4 2023.

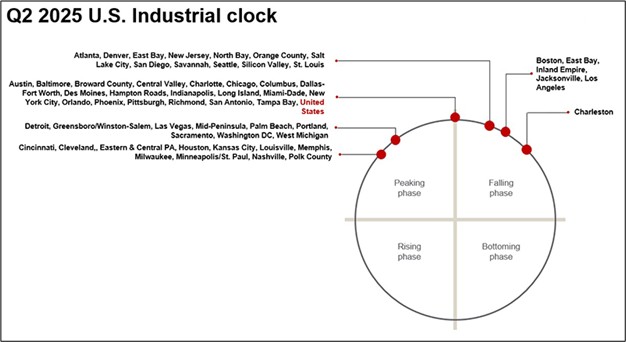

Additionally, JLL’s Q2 2025 Industrial Dynamics report positions the region within the “Rising Phase” of JLL’s Industrial Clock, which is particularly significant for investors. Markets in this phase typically experience increasing rental growth momentum, strengthening landlord leverage and improving absorption trends after passing through market bottoms. This positioning places Northern California alongside high-performing markets such as Atlanta, Denver, New Jersey and Seattle.

Investment sales activity continues across the spectrum, though with increased selectivity. Properties featuring strong locations, medium-to-longer term leases, credit tenancy and newer construction continue to attract significant interest—characteristics that define much of Northern California’s premium industrial inventory.

With manufacturing reshoring trends accelerating and space requirements evolving, Northern California’s combination of limited supply, diverse tenant demand and strategic location creates compelling opportunities for investors with longer-term horizons. As we look ahead, it’s clear that the market is gaining momentum rather than peaking, suggesting additional runway for rent growth and value appreciation as supply constraints continue to favor landlords.

For capital seeking industrial exposure, Northern California offers something increasingly rare: structural advantages that transcend market cycles.

Erik Hanson is a senior director at JLL Capital Markets.

You must be logged in to post a comment.