How Deals Will Fare in 2023: PwC

Look for office, industrial and retail transactions to focus on higher-quality assets in the new year.

Despite macroeconomic headwinds including inflation, rising interest rates and uncertainty, PwC expects commercial real estate deal activity to slow but remain resilient in 2023, particularly for industrial which continues to have strong fundamentals.

Those headwinds will create opportunities for most CRE sectors in the new year, according to the professional services firm’s US Deals 2023 outlook. The report notes investors will adapt to the headwinds with a focus on both flight-to-quality and flight-to-safety, driven in part by intensified underwriting assumptions putting more attention on high-quality, performing assets. PwC stated portfolios will be adjusted and rightsized to ensure exposure to those high-quality assets, which are likely to be newly constructed and redeveloped assets with strong ESG credentials rather than older properties.

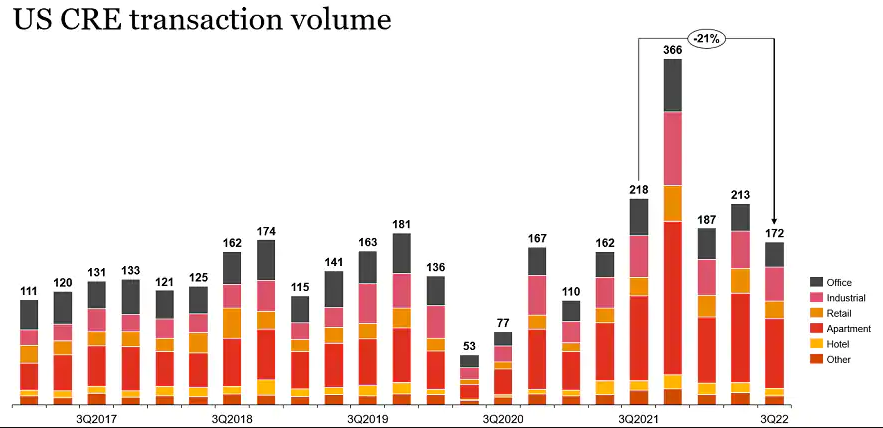

The report does acknowledge that total third-quarter 2022 transactions across the board were down 21 percent year-over-year but notes that is in comparison to a “searing third-quarter of 2021.” When you compare third-quarter deal activity to the same periods in 2020 and 2019, transactions were up by 123 percent and 6 percent, respectively.

Office was the sector with the steepest decline in the third quarter, down 33 percent compared to the third quarter of 2021. The drop in office transactions is driven by a lag in the return to the office following the pandemic, as well as an increase in subleases combined with record lease expirations. The combination means supply continues to outpace demand, creating a challenging environment, particularly for older office properties. PwC said companies that offer workers more flexible schedules in smart buildings should save money because they will be able to more easily retain workers in a happier, healthier workplace.

Deals also dropped in the third quarter for the industrial sector, decreasing 18 percent compared to the third quarter of 2021, which was a “red-hot” period. PwC states the sector should remain “buoyant” in 2023 because companies are still trying to build up logistics and storage capabilities to meet the demands of the e-commerce market and capacity-constrained supply chains.

READ ALSO: The Watchwords for 2023 Are Uncertainty and Stress

While transaction volume has decreased, PwC stated fundamentals are strong. Rents have continued to climb because of the lack of supply and slowed delivery due to inflation. However, rents are expected to slow in some markets as the supply does come online.

PwC noted third-quarter retail transactions were down by 9 percent compared to the post-pandemic surge in the third quarter of 2021. Flight to quality is also playing a role in sales of retail properties. That bifurcated trend is expected to continue in the new year with high-quality, well-located retail assets favored over older, poorly located and technologically obsolete assets that will face headwinds and may have to be repurposed. The outlook calls the situation a “tale of two halves” and states consumers are spending money at high-quality assets in good locations that have experiential retail offerings as well as popular omnichannel strategies such as click-and-collect, curbside pickup and ship-from-store.

Deal-making strategies

PwC’s outlook states companies should be reviewing their portfolios to see if there are assets that can be divested, and capital allocated to the most promising businesses. The report calls divestures “a critical tool in transforming and reconfiguring a firm.” Divestitures done in a timely manner can increase a company’s chances for value creation.

The firm also advises a “return to capital discipline” because of the higher costs of capital and inflationary environment. However, PwC notes dry powder levels remain at all-time highs with increasingly higher levels being raised through private vehicles including non-traded REITs and private equity funds.

The report states non-traded REITs raised record levels of capital during the first half of the year, including Blackstone with $11.6 billion followed by Starwood at $3.3 billion. While new players can enter the space, PwC expects more merger and acquisitions in 2023 on the heels of large M&A deals in 2022.

You must be logged in to post a comment.