How Alternative Sectors Rose Above the COVID-19 Fray

Zach Bowyer of JLL on why institutional capital is increasingly attracted to these resilient categories.

Zach Bowyer

The COVID-19 pandemic has shifted several of the more traditional commercial real estate norms and has had a diverse impact on market valuations by asset class, that, in most cases, is unique compared to past recessionary periods. Most of the alternative asset sectors, however, have maintained consistent performance in 2020, and we expect that trend to continue through 2021 and beyond.

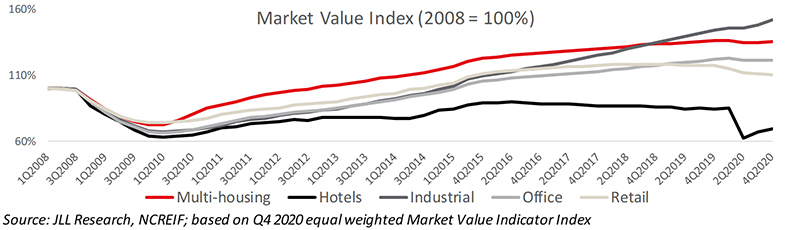

According to the National Council of Real Estate Investment Fiduciaries Equal Weighted Market Value Indicator Index, the pandemic’s impact on core asset class valuations ranged from a year-over-year decrease of nearly 15 basis points for hotels to an increase of nearly 8 basis points for industrial. Multi-housing and office valuations nearly flatlined with a slight dip after a decade of stable growth, and the retail sector accelerated an already downward trend.

Prior to the pandemic, investors already were expanding their portfolio diversification to alternative asset sectors, as competition to deploy capital increased in a yield-constrained market environment. Investment volume in alternative sectors rose to 9 percent between 2017 and 2019 versus 6 percent from 2005 to 2007.

Alternative assets—including self-storage, life sciences, manufactured housing communities, medical office, data centers and senior housing—collectively represented nearly 14 percent of total commercial real estate investment volume in 2020, totaling more than $58.2 billion.

As the U.S. economy begins to reopen, there is still uncertainty surrounding the future performance of some of the core property types. The $5 trillion fiscal stimulus deployed in 2020 and recent $1.9 trillion COVID-19 relief bill—though much needed to keep the economy moving and otherwise distressed assets from falling into default—makes it difficult to understand true market fundamentals and only amplifies the uncertainty surrounding market valuations.

According to Trepp research, the delinquent balance of office, industrial, retail, multi-housing and hotels totaled $4.67 trillion in the fourth quarter, a 54 percent increase from the third quarter of 2020, and approximately $4.2 trillion above pre-pandemic distress levels in the fourth quarter of 2019. With lending volume ramping back up, strong economic recovery is critical to allowing market valuations that are currently being propped up by government-infused stimulus to stand on their own again.

Shifting to alternative asset sectors, each subclass within alternatives showed varying levels of resilience throughout 2020 despite the majority of government stimulus packages targeted at core asset classes, with emergence of historically quiet sectors such as life sciences. This resilience continues to attract capital at all levels. We are seeing a significant increase in the commitment of resources by major financial institutions to better understand alternative sector asset classes. Coupled with an increase in market transparency as more data is readily available, and limited market supply, the fundamentals behind market valuations for alternative sectors are much more intact.

The senior housing market was one of the more negatively impacted alternative sectors, as the pandemic directly threatened the health and well-being of its target population, testing the traditional recession resilient narrative of the sector. As more people are vaccinated, senior housing occupancy levels that dipped in 2020 should increase. The reduction in new construction, coupled with the demographic tailwinds created by the aging U.S. population, only magnifies the long-term supply shortage. This growth, along with loosening of the labor market, signals senior housing is an investment with solid long-term fundamentals and the ability to deliver strong returns for decades to come.

Positivity about the economy continues to abound. JLL Research indicates that calendar-year growth in 2021 should reach its strongest level since 1984. We are already seeing an increase in transactional volume in all asset classes, with alternative asset sectors being targeted more than ever. Dry powder remains near all-time highs as investors search for sectors and investments that are relatively insulated from the negative impacts of COVID-19 and finding solitude in alternative sectors.

Zach Bowyer, MAI, is managing director and head of Alternatives Asset Sectors for JLL Valuation Advisory.

You must be logged in to post a comment.