Hard to Figure Out!

By Ken Riggs, President & CEO, RERC: With the recent disclosures and revelations about stock market high-frequency trading described in Michael Lewis’ new book, “Flash Boys,” many investors throughout the world have yet another reason to mistrust the stock market.

By Ken Riggs, President & CEO, RERC

With the recent disclosures and revelations about stock market high-frequency trading described in Michael Lewis’ new book, “Flash Boys,” many investors throughout the world have yet another reason to mistrust the stock market. We wonder what other advantages the public trading markets have over most investors and which are yet to be uncovered. This is in line with real estate mogul Sam Zell’s CNBC “Squawk Box” comments last week about his doubt as to the sustainability in the stock market. He did not see much correlation between recent highs in the stock market and the slow-growing economy, and in his opinion, stocks in general were overvalued.

Although this comment garnered much attention, viewers may have missed one of Mr. Zell’s other comments. “I’ve always been more interested in hard assets,” the chairman of Equity Group Investments said, about real estate. Zell, who sold Equity Office to Blackstone for a record $39 billion in 2007, noted that he did not believe commercial real estate today is overpriced. Yes, he is a commercial real estate investor at the core, but he also carries the moniker of the “Grave Dancer.”

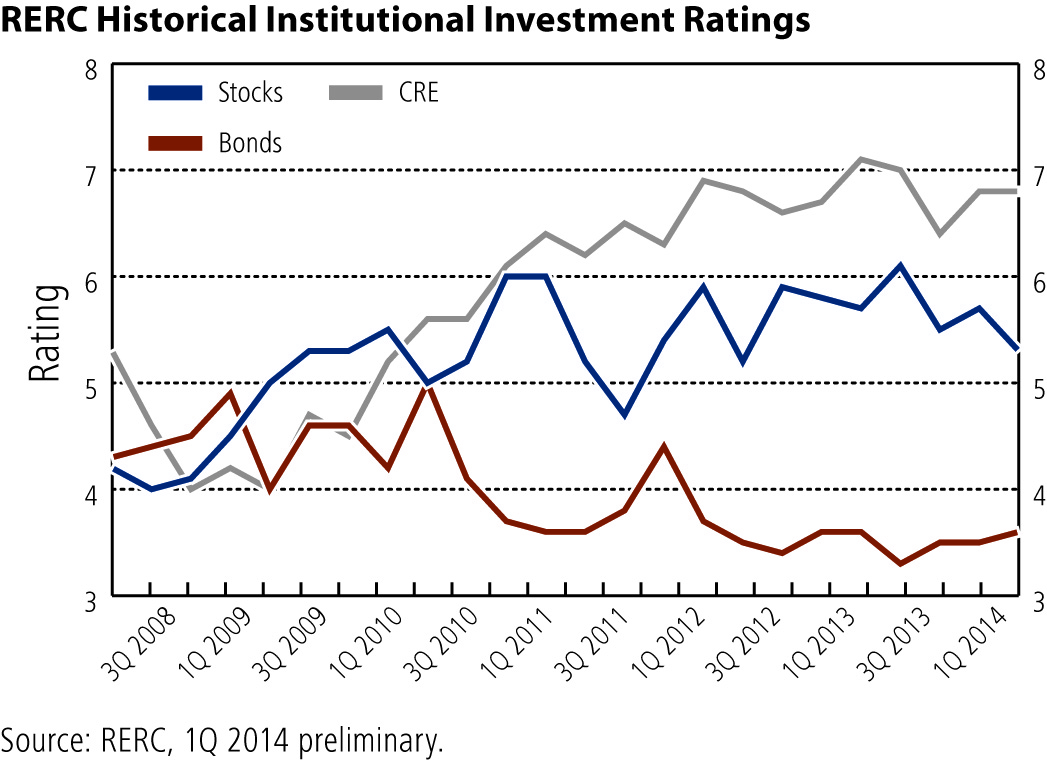

Zell’s comments are not surprising, as hard or tangible assets are almost always a preferred investment in periods of great uncertainty. As shown below, Real Estate Research Corporation’s (RERC’s) institutional investors continue to rate commercial real estate more favorably than stocks and bonds, as they have throughout this post-recessionary period, according to RERC’s first quarter 2014 preliminary findings.

A debate does loom, however, particularly among those who have found it difficult to get a place at the commercial real estate buying table. RERC’s institutional investment survey respondents continue to remark that there is still too much equity capital chasing too few solid opportunities, and that “style drift is rampant” in the industry. Other commercial real estate investors note that lenders are “finally” getting much more aggressive and competitive, and the investment environment is starting to correlate to those standards prevalent in 2006 and 2007. RERC maintains, however, that this is not a fair picture of the broad commercial real estate market for all U.S. markets and core property types today (though quite a few of RERC’s investment survey respondents have noted that apartment properties in many markets are becoming overpriced relative to value, and that they are also seeing a lot of new construction).

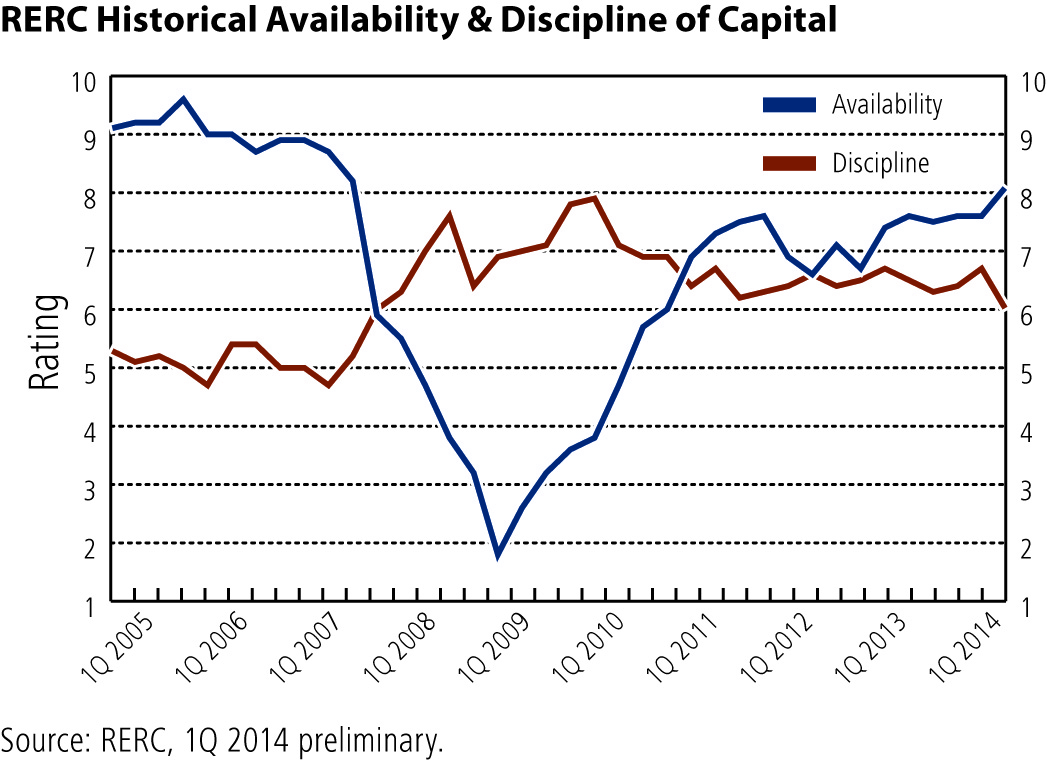

Although RERC has seen a relatively narrow gap between the availability (amount) of capital and the discipline (underwriting criteria) of capital since the credit crisis, this gap has been widening slightly over the past year, as shown below. It is important to note, however, that the current ratings overall are generally healthy compared to the glut of capital that was available before the credit crisis and the amount of capital outpaced underwriting by a margin of 4.0 (9.0 less 5.0), as well as the dearth of capital characterized during the recession. Even so, as the availability of capital increases and puts pressure on discipline, we expect underwriting to slip. (Stay tuned for future survey results as we continue to unravel this story!)

Although RERC has seen a relatively narrow gap between the availability (amount) of capital and the discipline (underwriting criteria) of capital since the credit crisis, this gap has been widening slightly over the past year, as shown below. It is important to note, however, that the current ratings overall are generally healthy compared to the glut of capital that was available before the credit crisis and the amount of capital outpaced underwriting by a margin of 4.0 (9.0 less 5.0), as well as the dearth of capital characterized during the recession. Even so, as the availability of capital increases and puts pressure on discipline, we expect underwriting to slip. (Stay tuned for future survey results as we continue to unravel this story!)

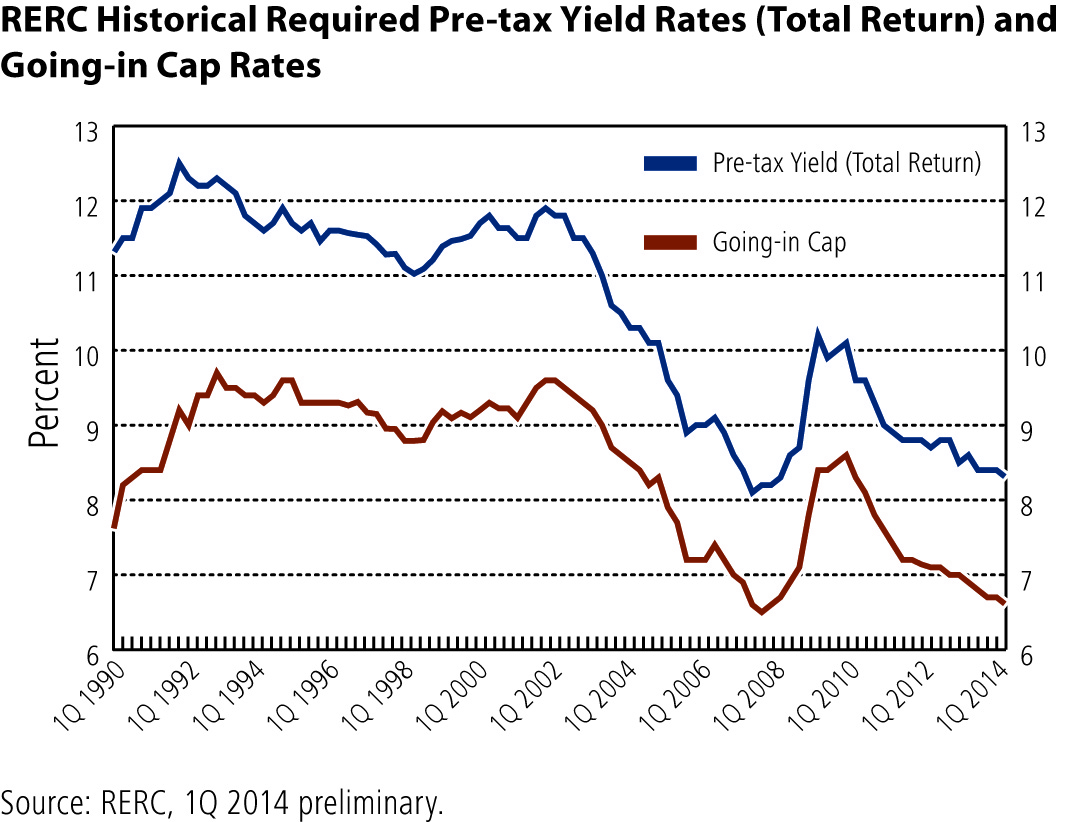

RERC expects that the level of commercial real estate capital will continue to keep downward pressure on cap rates for the broad commercial real estate market while keeping demand high. As shown in RERC’s early first quarter 2014 data, RERC’s required going-in capitalization rates generally continue to compress. The alarm bells are ringing for some major office transactions in New York City, but for now, these are isolated cases. We do see a shift in these markets to be a true buy for the long-term ownership position for a long-term investor. Further, we see rates at levels seen pre-credit crisis; however, RERC would quickly add that the yield on 10-Year Treasurys was not below 3.0 percent and the  underwriting of cash flows was much different pre-credit crisis versus what we see now.

underwriting of cash flows was much different pre-credit crisis versus what we see now.

Despite the concern about possible overpricing, investors continue to see the value of commercial real estate. One of the most compelling arguments for CRE is the relative spread of total expected returns over 10-year Treasurys, which stands at about 575 basis points. It is hard to argue with this relationship in a world that is seeing the compression of returns in a very unstable international arena. As a point of comparison, just before the credit crisis, we saw the spread at below 350 basis points and underwriting standards were crazy with heightened expectations. Today we have a high spread of almost 600 basis points while underwriting standards are still rational for our times.

Meanwhile, according to RERC’s first quarter 2014 investment survey, the overall value of commercial real estate compared to the price has been increasing and has held quite steady over the past year. Meanwhile, on an individual property type basis, the value versus price ratings for most property sectors increased, which shows strength overall, and that values are still higher than prices. At 5.8 on a scale of 1 to 10, with 10 being high, the industrial sector received the highest preliminary value versus price rating, as it has for the past year. A rating of more than 5.0 shows that value outweighs price, and is a generally good sign for the market. Clearly, commercial real estate has made steady improvement since the onslaught of the recent credit crisis. (Several years ago, many of the property type value versus price ratings dipped below 5.0, showing that the price of commercial real estate was outweighing the value.)

Regarding the value of the property sectors, one of our institutional investors may have said it best when he stated that the industrial warehouse market continues to see overall improvement in the fundamentals, and factors like “international trade, energy, new housing markets, and online retail spending” will further increase demand and value for this property type. (And although the hotel sector tied with the industrial sector in receiving RERC’s highest preliminary value versus price rating [5.8 on a scale of 1 to 10, with 10 being high], investor recommendations were quite mixed for the hotel sector.)

Investing—even in hard assets like commercial real estate—is not easy, particularly when user demand is not as strong as we would like it, as is the case in many regions of the country today. But we would like to reiterate that a “looming commercial real estate bubble” is not a reality for the broad market either, though we have seen pockets where a few assets have reached new peaks. The overall value of commercial real estate is still outweighing the price, and RERC does not see a disconnect.

Real estate is tangible, and it is more transparent than assets like stocks and bonds in that it provides roughly 75 percent of return in income with unleveraged total returns being pegged in at 6 percent income plus 2.5 percent capital appreciation for a total unleveraged return of 8.5 percent per year. Add some positive leverage, and you get into the low teens for a hard asset. As the comedian Adam Sandler would say, “Not too shabby…”

In addition, the capital for real estate investment continues to flow and interest rates remain low, and with the exception of the apartment sector, there is little new construction. There is stable cash flow, and although we expect appreciation on investment properties, and total returns by extension, to slow slightly in the next few quarters, returns are still very attractive on a risk-adjusted basis. And for long-term investors and owners, that is not a bad place to be.

You must be logged in to post a comment.