Global

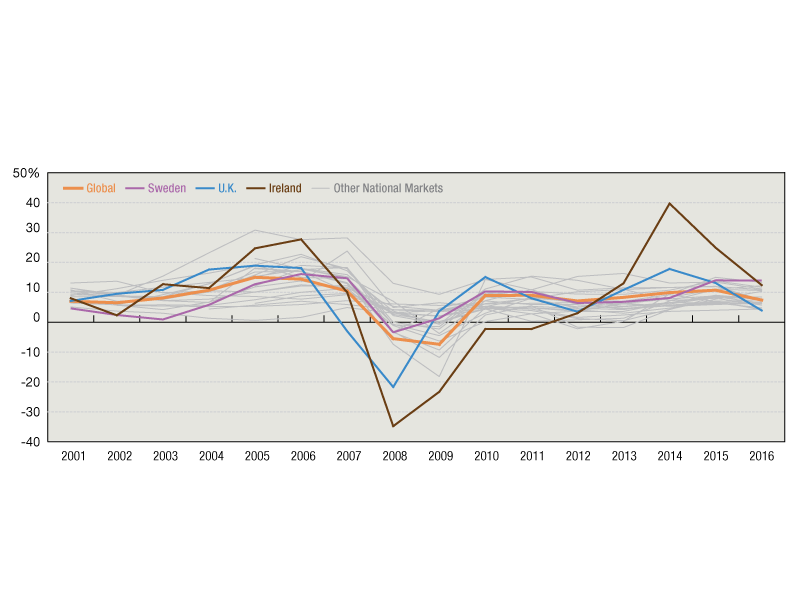

Direct Private Real Estate Returns

In the earlier part of the decade, the UK market had been one of the strongest performers but in a precipitous decline aided by the Brexit referendum result, the country recorded the lowest total return in the Global index at 3.9 percent in 2016.

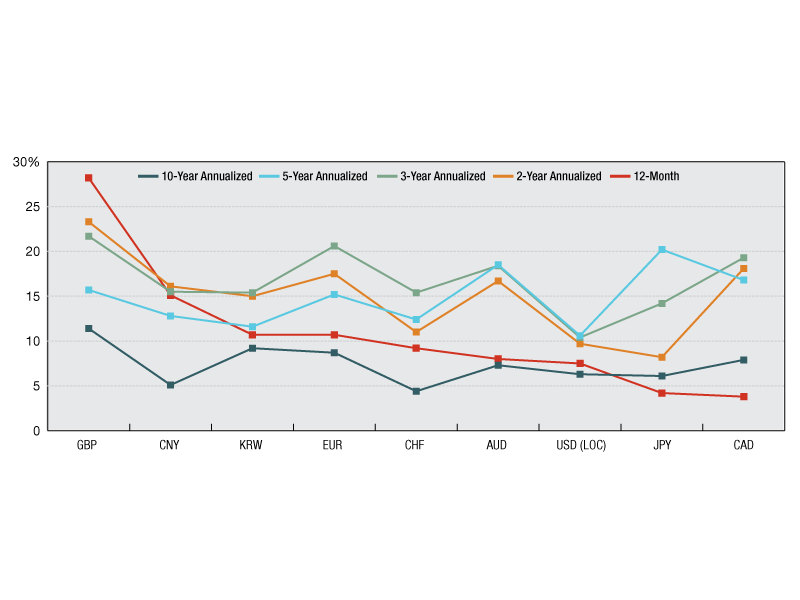

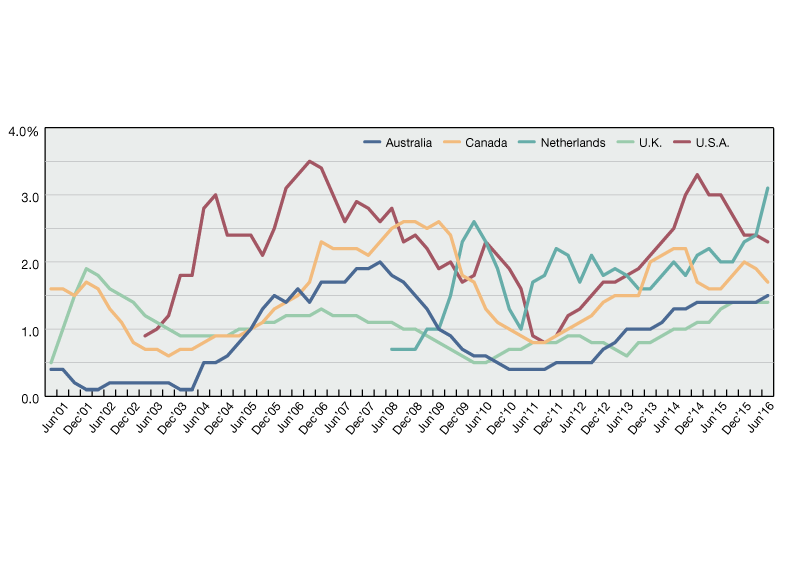

Currency Return

For U.K. based investors, the depreciation of the pound makes unhedged U.S. performance look rather attractive. For Canadian or Japanese investors by contrast, the picture changes depending on the return horizon.

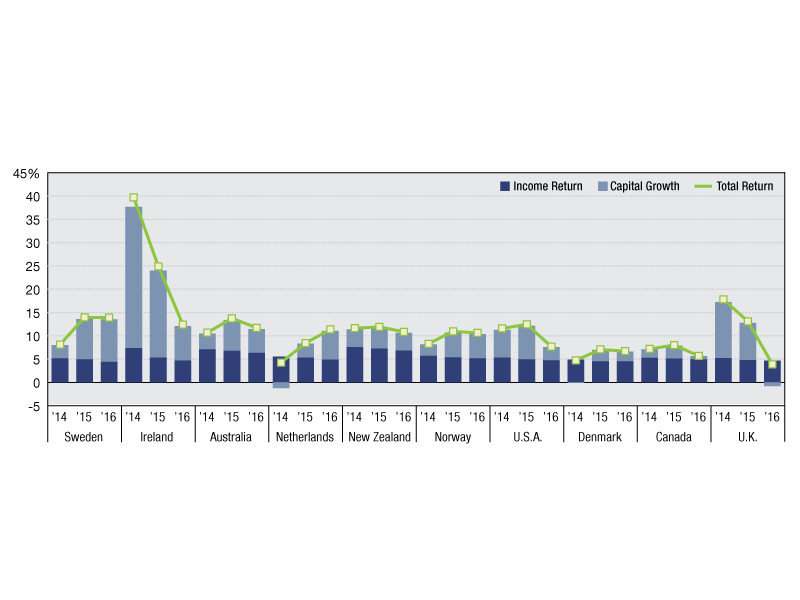

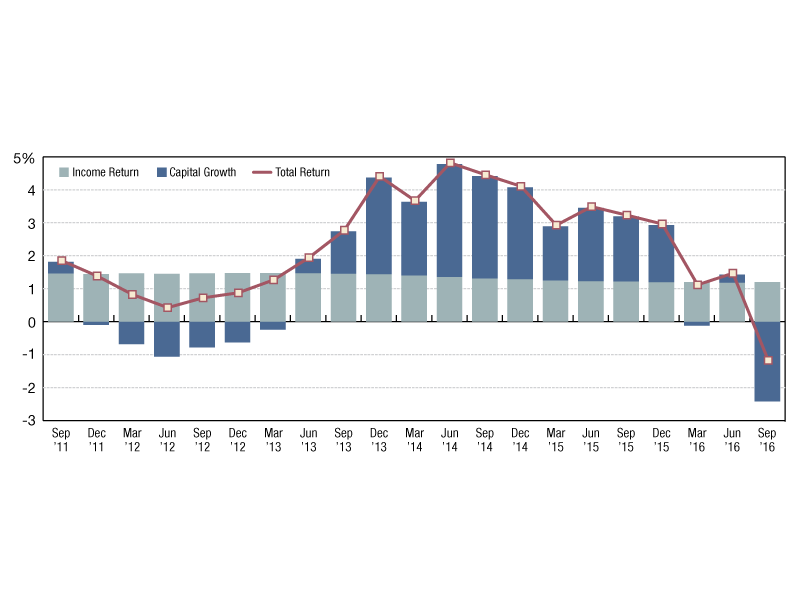

Income Return vs. Capital Growth

Total returns in Northern European countries—such as Sweden, Norway and Denmark—increased in 2015 but then decreased in 2016.

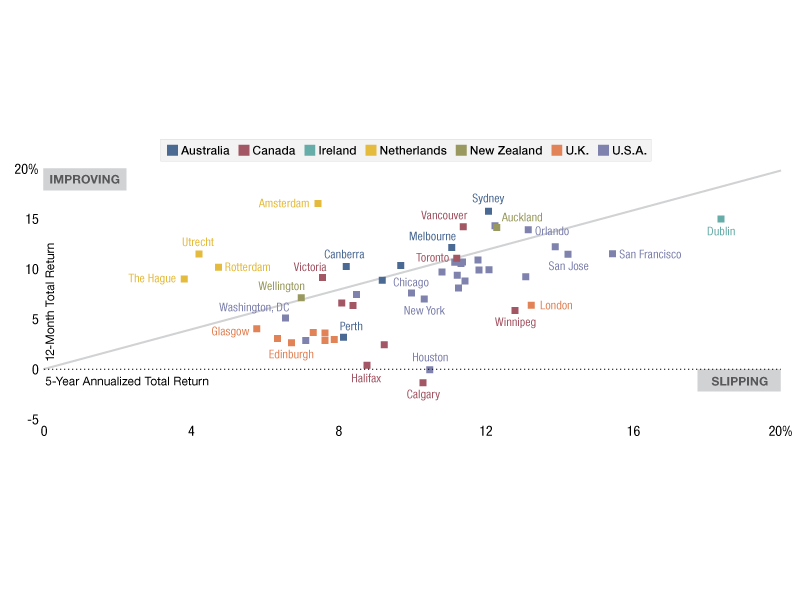

Globalized Total Return

Comparable annualized total return as at end of September 2016

The Brexit Effect

Brexit effect in the third quarter with a -2.4% capital growth contraction

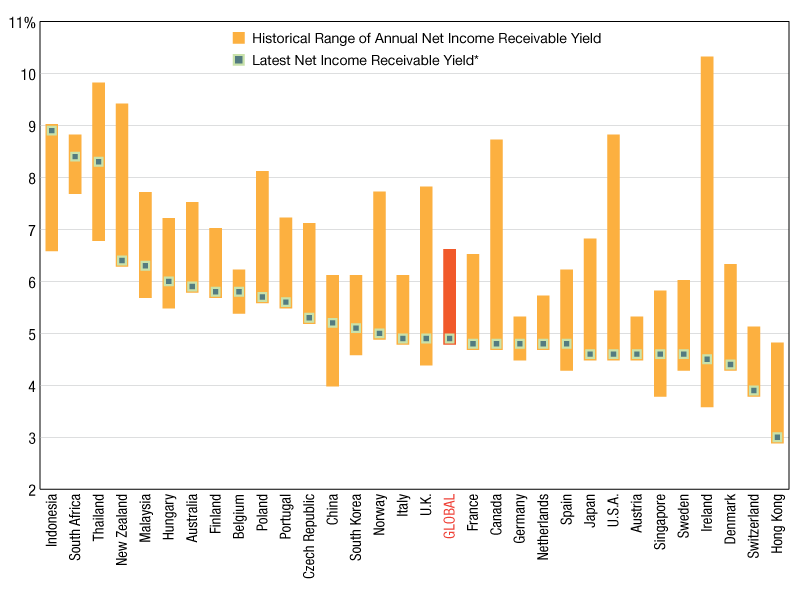

Net Income Receivable Relative to Local Market

Annual net income receivable yield by country, all property types, standing investments, as of September 2016

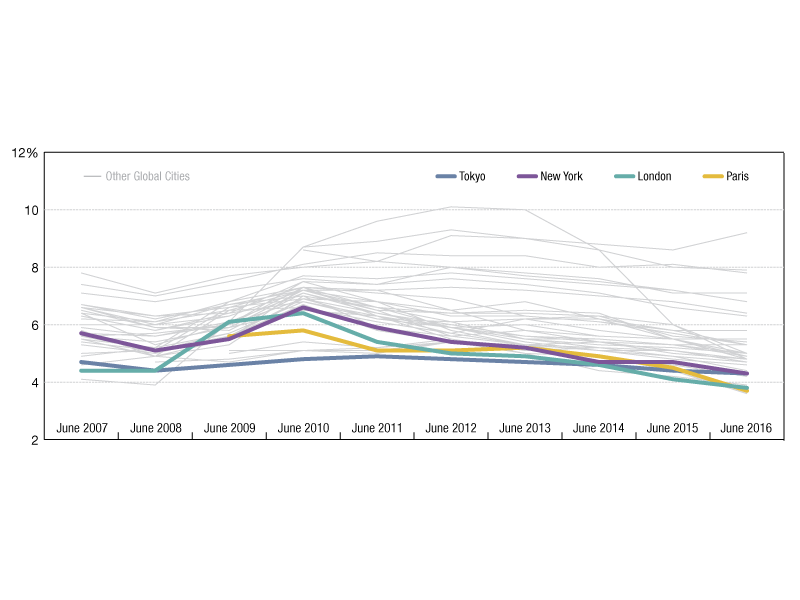

Global Real Estate Income Returns

All property income returns in local currency as of June 2016

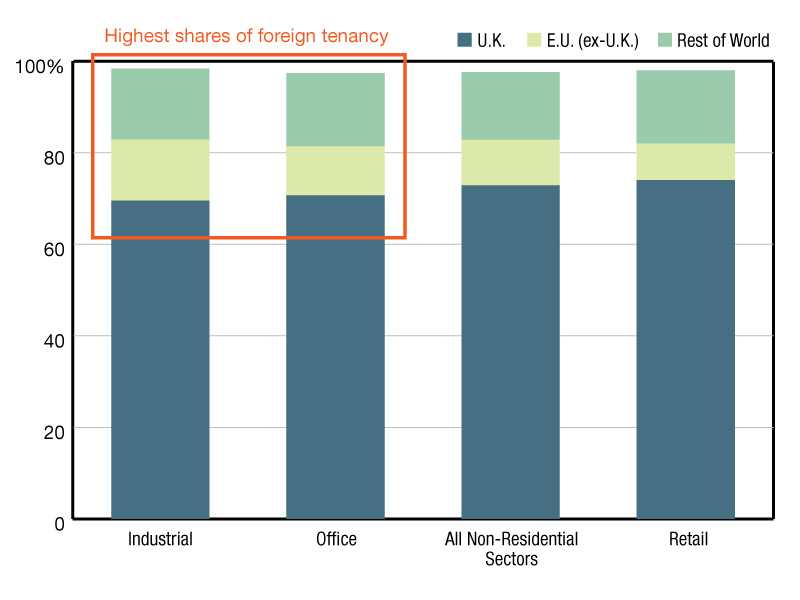

Brexit Vulnerable?

Read Sebastien Lieblich’s blog post “What Brexit May Mean for London’s Office Market.”