Currency Return

April 14, 2017

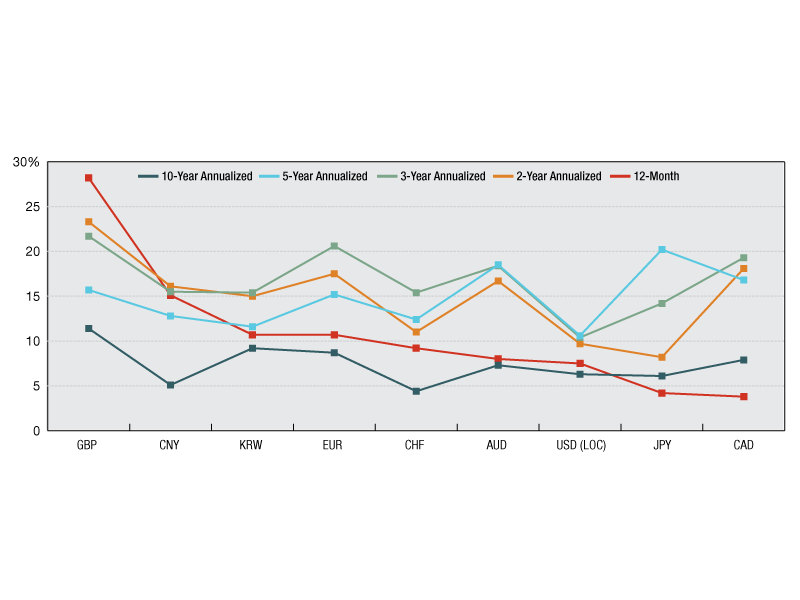

For U.K. based investors, the depreciation of the pound makes unhedged U.S. performance look rather attractive. For Canadian or Japanese investors by contrast, the picture changes depending on the return horizon.

U.S. total return over the last 10 years in various currencies

As an asset class, real estate has always had a strong home bias but cross border activity has been on the rise in recent years. While investors venturing outside of their home market have the option of hedging their returns, currency movements can still play a big role in shaping views on foreign investments. For example, looking at U.S. performance over the last ten years in various currencies shows how unhedged performance can differ. For U.K. based investors, the depreciation of the pound makes unhedged U.S. performance look rather attractive. For Canadian or Japanese investors by contrast, the picture changes depending on the return horizon.

You must be logged in to post a comment.