Global CRE Industry Optimistic About the Future: SIOR

On-schedule transactions increased across the board, while confidence in the industrial sector rose to its highest level since the start of the pandemic.

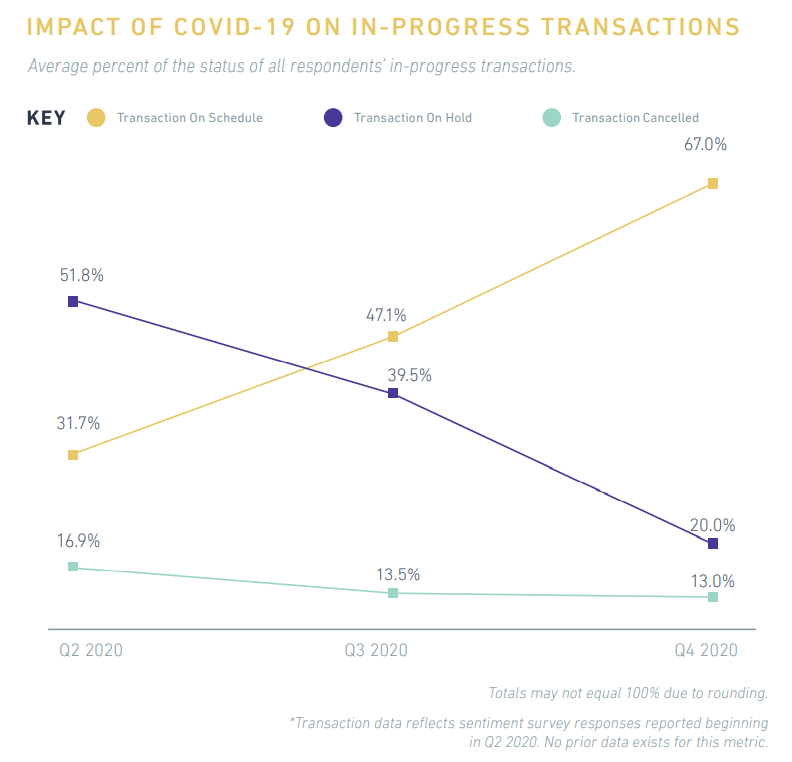

On-time office and industrial transactions rose to a reported 67 percent in the fourth quarter of 2020, from 43 percent in the previous quarter, according to the latest Snapshot Sentiment Report from The Society of Industrial and Office Realtors. The survey also found that confidence in the industrial sector was at its pandemic-era peak.

READ ALSO: CBRE Reports Q4 CRE Lending Surge

Globally, commercial real estate professionals’ outlook on the industry is becoming more positive, even as the COVID-19 health crisis—although, mitigated by the deployment of vaccines—rages on.

“The feedback related to how transactions across the board are moving forward at an improved rate [was unexpected],” Robert Thornburgh, CEO of the Society of Industrial and Office Realtors, told Commercial Property Executive. “Certainly, a positive signal for the industry ahead.”

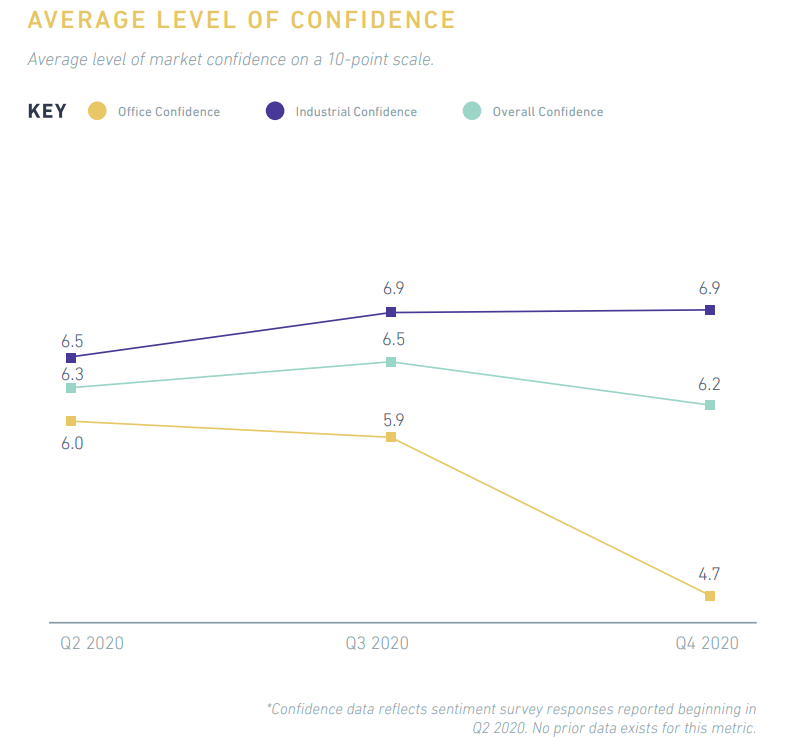

Taken individually, however, the survey findings were not entirely encouraging. “While overall confidence had been on the rise in the third quarter of 2020, SIOR reported a drop in market confidence in the fourth quarter of 2020 to its lowest confidence since it was first reported in the second quarter of 2020, noting a global confidence of 6.2 out of 10 as opposed to 6.3 in the second quarter,” according to the survey. Confidence ranked 6.5 in the third quarter of 2020.

However, on the whole, the results indicate that the respondents were in a better frame of mind about real estate at the close of 2020 than they were in the previous quarter. On-time transactions in the fourth quarter, for example, marked the highest number since the start of the survey.

Looking at fundamentals, overall leasing activity is improving, with 51 percent of SIOR members reporting minimal leasing activity in the fourth quarter, compared to 59 percent in the third quarter. However, the figure remains a long way off from the pre-pandemic minimal leasing activity figure of 13 percent. Additionally, the overall vacancy rate began to decline in the fourth quarter, as 42 percent of respondents reported little-to-much lower current vacancy compared to 22 percent in the second quarter.

The fourth quarter showed improvement but remained challenging. “The resilience of our members is commendable and what they have been able to do for their clients, despite the unprecedented circumstances, is quite incredible,” Thornburgh noted.

Sector disparities

Something that did not change from quarter to quarter was the tale of two asset types.”There are two distinctly different stories happening between industrial and office—one of prosperity, and one of challenge, but perseverance and optimism will guide both toward an eventual bright future,” Thornburgh said. In terms of confidence, industrial leads the way for the most positive outlook of the two sectors. Confidence in industrial continued to rise in the fourth quarter, reaching its highest level, 6.9 percent.

On the other hand, confidence in the office sector continued to decline, dropping to its lowest level of 4.7 out of 10. The news wasn’t all bad for the office sector, however, as office specialists indicated that 52 percent of all transactions were on-time in the fourth quarter, marking a quarter-over-quarter increase of 14 percent. “That’s a sign of a sector that is finding opportunities for expansion,” Thornburgh noted. Industrial brokers saw on-schedule transactions increase by the largest margin ever, going from 51 percent in the third quarter to 74 percent in the fourth quarter.

“The difference between office and industrial leasing activity is extreme, with office specialists reporting 88 percent of lower leasing activity in the fourth quarter versus only 34 percent for industrial,” according to the report. “Many industrial specialists noted that there is little-to-no vacancy available as product is going fast and becoming harder to find.” As for vacancies, 60 percent of office specialists reported higher vacancies in the fourth quarter, compared to 22 percent of industrial specialists.

Most members reported that the pandemic is the biggest factor in how the industry will perform in upcoming months, but also concur that an improved vaccination rollout could notably improve conditions in the second half of 2021. “Most SIOR members who were surveyed agree that if the pandemic does begin to abate, as many experts predict, the last two quarters of 2021 could be especially impressive,” Thornburgh concluded.

Read the full report by SIOR.

You must be logged in to post a comment.