CBRE Reports Q4 CRE Lending Surge

A strong year-end bounce is beginning to resemble pre-pandemic conditions, the firm’s latest study found.

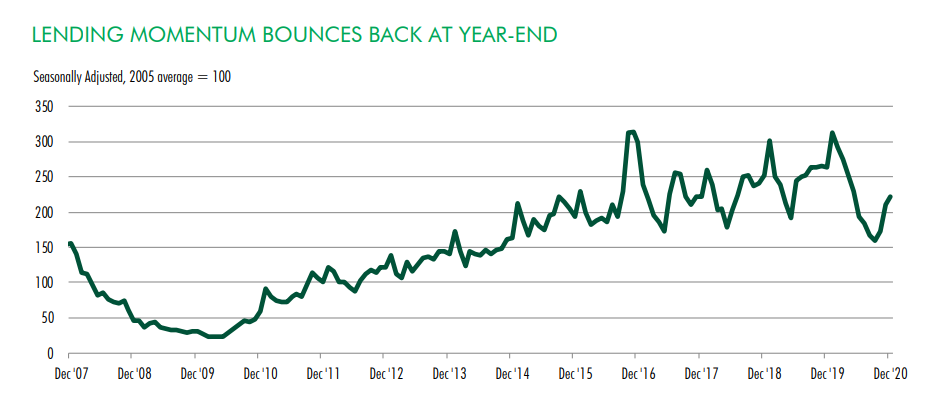

Increased liquidity, tighter credit spreads and somewhat looser underwriting standards led to “a sharp improvement” in commercial real estate lending in the fourth quarter, according to CBRE’s latest Lending Momentum Index.

READ ALSO: CRE Finance Outlook Brightens: Report

As of December, the index, which is based on loans originated or brokered by CBRE Capital Markets, stood at 221 (against a baseline of 100 set in 2005), which represented decreases of 16 percent year-over-year and nearly 24 percent versus its February 2020 pre-pandemic level. Still, the 221 figure was a healthy 38.2 percent jump from September.

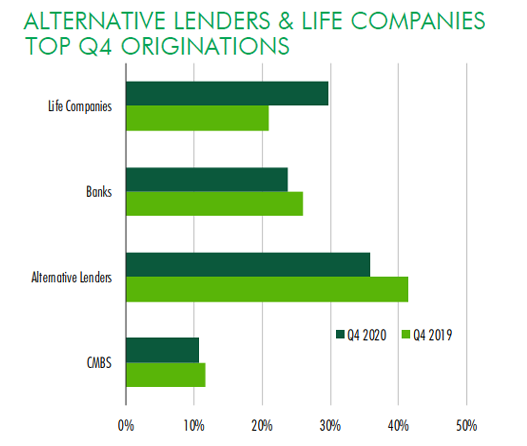

In announcing the results, CBRE attributed higher year-end lending volumes to rising equity prices and tighter corporate loan spreads. Meanwhile, since lending markets were anticipating the effects of additional government economic aid on growth and inflation, the fourth quarter of 2020 saw increased participation by alternative lenders and life companies compared to the third quarter. Some deals, principally those for retail, hotel and transitional assets “remained challenging to underwrite.”

Getting still better?

Reflects non-agency commercial/multifamily loans. Chart courtesy of CBRE Capital Markets and CBRE Research, Fourth Quarter 2020

Higher liquidity is coming in substantial measure from life companies, whose commercial real estate lending surged in late 2020 after a weak spring, from just over 20 percent of market share to nearly 30 percent. Their fourth-quarter originations, according to CBRE, were mostly low-leverage (53 percent average loan-to-value) permanent loans backed by industrial and multifamily properties.

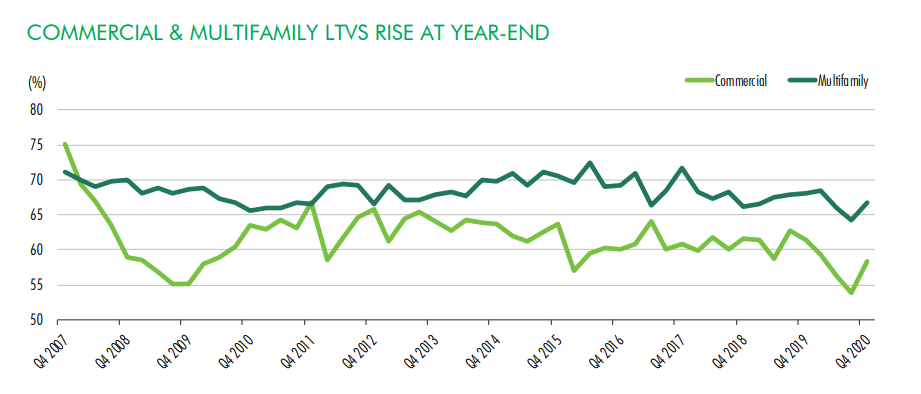

Underwriting became a bit less restrictive in the fourth quarter. The average LTV rose to 64.0 percent from 61.5 percent in the third quarter. The average interest rate slid to 3.08 percent from 3.34 percent in the prior quarter.

Overall, interest rates remained “quite low” on commercial mortgage loans closed in the fourth quarter, CBRE reported; more than 40 percent of these loans carried an interest rate of 3.0 percent or less.

Looking ahead, Brian Stoffers, global president of Debt & Structured Finance for Capital Markets at CBRE, told Commercial Property Executive: “Lenders of all sizes and types are ready to finance commercial and multifamily properties in 2021.”

“Life companies, banks, debt funds, GSE’s (Freddie, Fannie and FHA) and CMBS lenders all have large allocations ready to place in a variety of product types, including select hotels and retail,” he continued. “With the recent run-up in 10-year Treasuries, some borrowers are now opting for floating-rate structures indexed with LIBOR or SOFR.”

You must be logged in to post a comment.