Fed Waits on Interest Rate Cuts

The central bank continues to leave the door open for adjustments later this year.

The Federal Reserve has again declined to adjust the benchmark federal funds rate, the central bank announced on Wednesday. The range of the rate will remain at 4.25 percent to 4.5 percent, where it has been since December, the central bank announced on Wednesday following the meeting of the Federal Open Market Committee.

That rate is lower than it was last year— peaking at 5 percent to 5.5 percent last summer—but elevated compared to most of the last decade, when the rate was effectively zero for long periods.

Today’s announcement signals that the Fed is continuing its cautious approach to monetary policy. In March, Fed Chair Jerome Powell cited uncertainty about the impact of the administration’s economic policies as a reason for caution. He reiterated that approach on Wednesday.

Even so, the Fed indicated again that it would lower its benchmark lending rate by half a percentage point sometime in 2025, provided conditions warrant the move. President Trump has been pressing the central bank to lower the benchmark rate. The next FOMC meeting will be July 29-30.

Keeping options open

In its announcement, FOMC was noncommittal about the timing of any future rate changes. “In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the committee will carefully assess incoming data, the evolving outlook, and the balance of risks,” FOMC said.

FOMC also said that the economy is expanding at a “solid” pace, but that inflation was “somewhat elevated.”

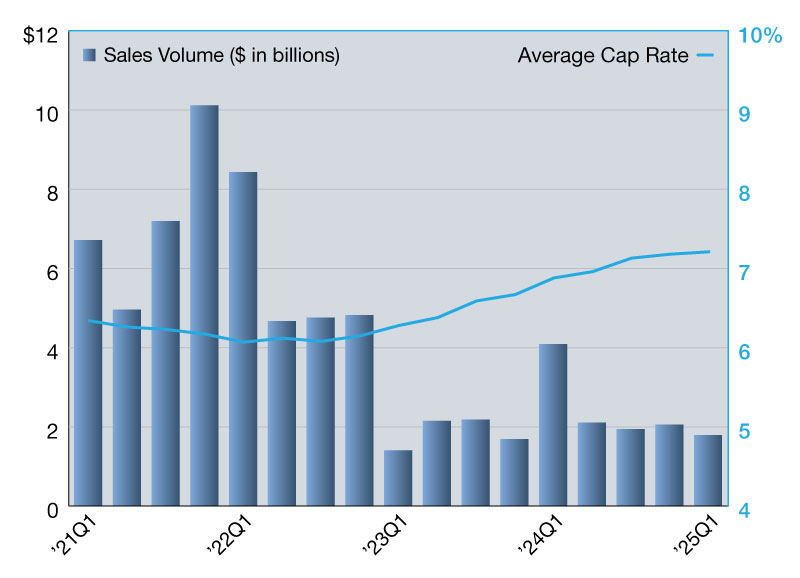

The non-movement by the Fed wasn’t a surprise to observers, since the market had predicted only a 0.2 percent probability of a rate cut, noted Aaron Jodka, director of research for U.S. capital markets at Colliers.

“A 25-basis-point reduction, while unexpected, would have eased borrowing costs for lending tied to SOFR,” Jodka told Commercial Property Executive. “Many market participants are focusing on the movement of the 10-year Treasury rate.”

As of Wednesday, the yield on the 10-year was about 4.375 percent, up slightly from a year ago, but more considerably from a recent low of 3.62 percent last September.

“I anticipate the Fed to remain data-dependent and remain in a holding pattern to gauge the health of the labor market and trajectory of inflation,” Jodka said.

You must be logged in to post a comment.