Expo Real 2017: The Rise of Logistics

Executives of Prologis, CBRE Global Investors, Allianz Real Estate and other high-profile players kicked off this year's Expo Real with an in-depth dialogue on the perks and challenges of logistics real estate.

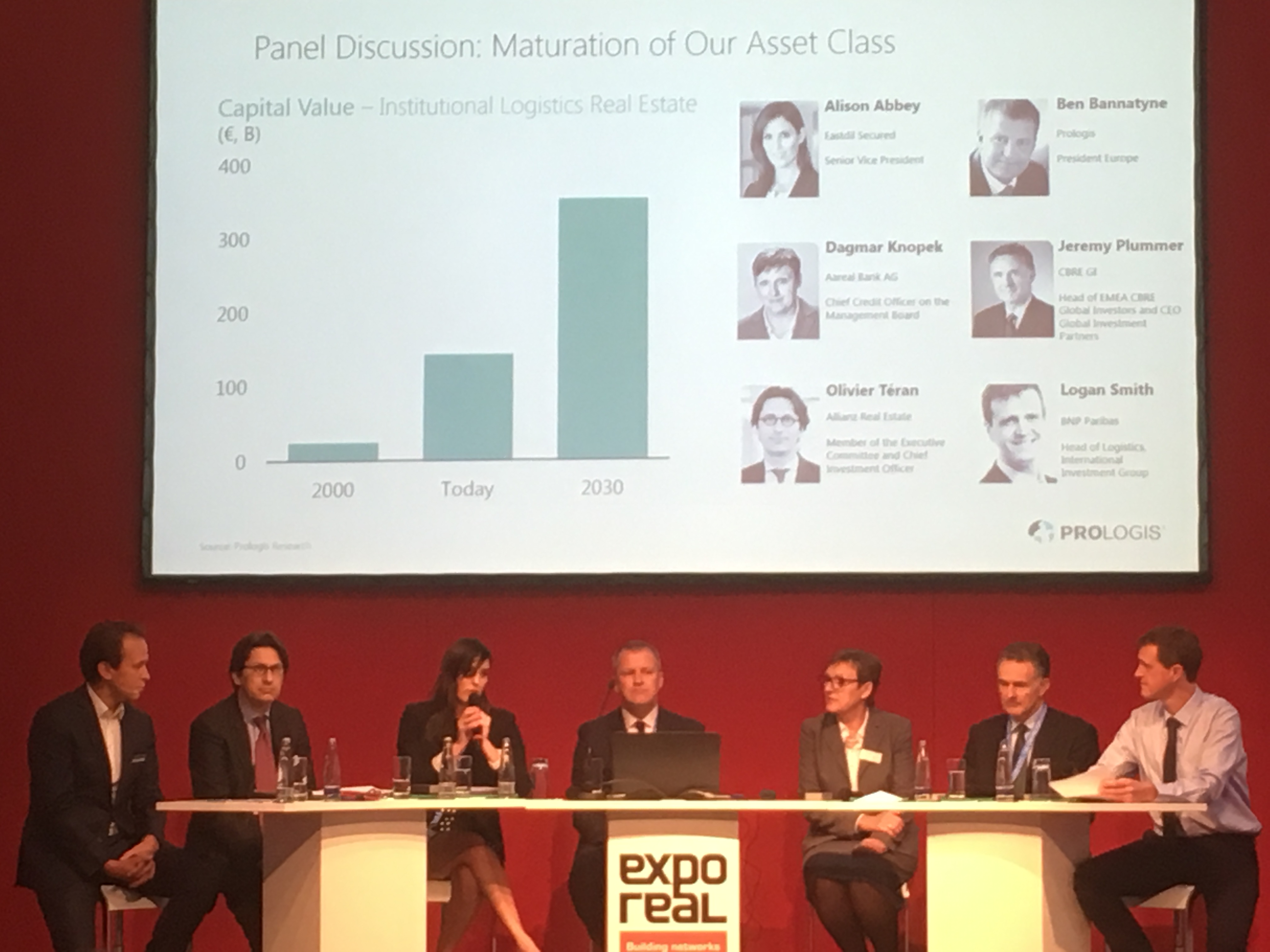

Expo Real, München’s flagship real estate conference, kicked off on Wednesday morning with a series of high-profile panels, including a discussion on the present and future of logistics and warehouse real estate.

“From revolution to evolution: The rise of logistics as an asset class,” brought together Alison Abbey, senior vice president of Eastdil Secured; Ben Bannatyne, president of Prologis Europe; Dagmar Knopek, chief credit officer of Aareal Bank AG; Jeremy Plummer, EMEA head of CBRE Global Investors & CEO of Global Investment Partners; Olivier Teran, chief investment officer with Allianz Real Estate; and Logan Smith, head of logistics for BNP Paribas’ international investment group.

E-commerce steam

Capital is available, the panelists agreed. And as fundamentals continue to strengthen, the logistics class is pushing its way to the forefront of European real estate. The three largest deals in the sector in the past 12 months—including the mammoth Logicor buy—roughly matched the total investment volume for all commercial real estate in Denmark, Belgium, Portugal and Poland put together.

Is this a ripple effect of e-commerce? The answer seems to be both ‘yes’ and ‘no’. Talking about the Prologis portfolio, Bannatyne offered an example: “Some 20 percent of all leasing transactions we have done this year in Europe have been, in some shape or form, related to e-commerce. On the other hand, 80 percent of the leases we’ve done have been with our traditional customer base … E-commerce is sort of a cherry on the cake.”

The current recipe certainly includes e-commerce, which is playing an ever-growing role. However, the broader narrative also includes discussions on supply chain reconfigurations, infrastructure and regulations, as well as the specifics of last-mile facilities, which Bannatyne called a field of ongoing “huge innovation” and “a massive area of untapped or just unknown demand.”

What about financing? According to Aareal Bank’s Knopek, steady lenders stick to the basics, the keys being cash flow, strong occupancy and location. And for some, stars are aligning: “What we have seen in logistics financing is that conditions have improved over the past year incredibly much. It’s mainly functional space, which creates good cash flow, and it’s space in the right locations, where you find not one asset, but an amalgamation of assets,” she said.

The conservative angle

When asked about speculative projects, Bannatyne was cautiously optimistic: “We learned from our mistakes from 2006-2007. From our point of view, 20,000- to 30,000-square-meter (roughly 200,000- to 300,000-square-foot) spec buildings are manageable and standard. In pockets across Europe we are building speculative, but one building at a time, and as that leases up the next phase comes on. Much more conservative as it has been in the past.”

As far as cautious strategies go, location remains king: “It worries me when people start buying anything, anywhere because that is definitely not a good long-term strategy,” Bannatyne later concluded. Location is followed by a stable NOI and tenant retention strategies.

Fundamentals are strong across most major European markets, but rent growth is underperforming everywhere except Southeast England. This has been a recurring issue for those in the logistics field for a while now, and Abbey argued that it might be a matter of timing.

“Europe is lagging the U.S. in the recovery and where we are in the cycle. If you look where U.S. rents are relative to peak, they are now about 15 percent above peak … If you look at the trend that we have seen in the U.S., which we are following, with the growth of the e-commerce sector, the expectation is that there should be continued rental growth as long as you are in the right locations,” she said.

Future disruptors

Panelists ended the forum by discussing technological innovations as acting or potential industry disruptors. Plummer mentioned that self-driving cars could bring changes in drive-time regulations. The alteration or removal of these regulations could, in turn, reshape patterns within the logistics field.

The sector will also change because, Bannatyne argued, the domination of electric cars will also imply a reconfiguration of the power supply chain, which will have a direct effect on logistics.

In terms of already emerging trends, Teran made a case for the Asian model of multi-story warehouses for land-constricted projects, while Bannatyne mentioned the efficiency of drone-assisted operations.

You must be logged in to post a comment.