EV-Driven Manufacturing Surges Across the US

A new report from CBRE tallies more than $150 billion of electric vehicle–related projects.

Tesla produces the most electric vehicles in the U.S., having delivered more than 466,000 units in the second quarter of 2023. Image courtesy of Adriana Pop

Driven by increasing numbers of electric vehicles being built and purchased in this country, more than $150 billion of manufacturing plant projects are underway across 16 U.S. states, with further activity in the leasing of EV-centered facilities, according to a new CBRE report.

The company notes that, in the context of “increased consumer demand for EVs and government incentives designed to boost EV sales and production in support of zero-emission goals,” the Edison Electric Institute projects that EVs in this country will soar from 3 million today to 26 million by 2030.

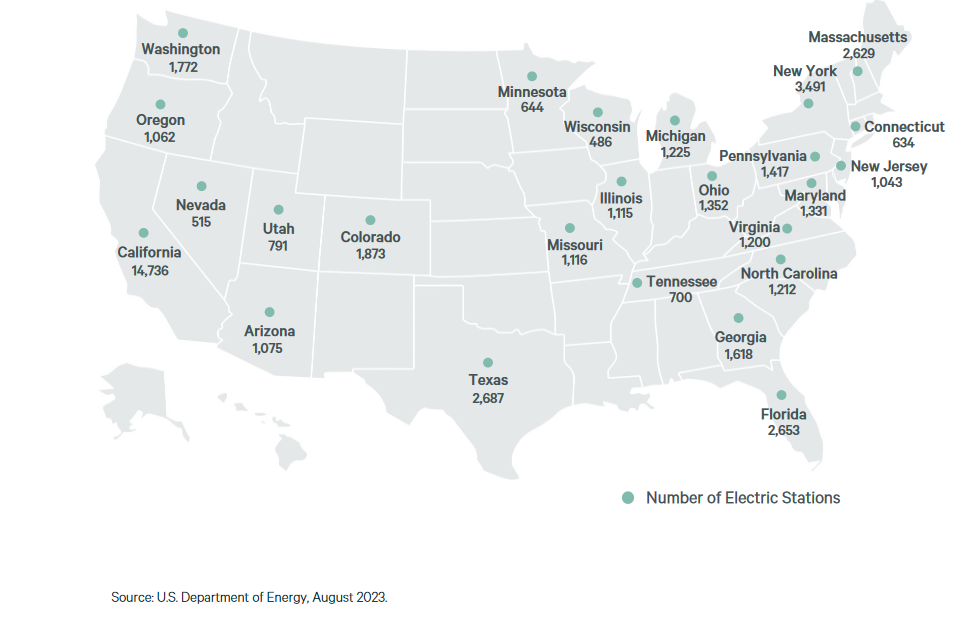

In parallel with that, there is increasing demand for charging stations, batteries and other elements of the EV ecosystem, which “will require strategically located distribution centers and manufacturing spaces that are often near renewable energy sources.”

READ ALSO: Caution This Year, Some Recovery Next Year

EVs accounted for 7.2 percent of U.S. new car sales in the second quarter of 2023, up from 5.7 percent a year earlier. Tesla, which produces the most EVs in the U.S., delivered a record of more than 466,000 units in the second quarter. Traditional automotive manufacturers Ford, General Motors and Hyundai are also increasing their EV production.

There is now a massive commitment to the expansion of EVs from both the federal government and corporations, John Morris, CBRE’s President of Americas Industrial & Logistics, commented in prepared remarks. He also warns that even though EVs were once considered a futuristic idea, the time for commercial real estate investors to prepare for them is now.

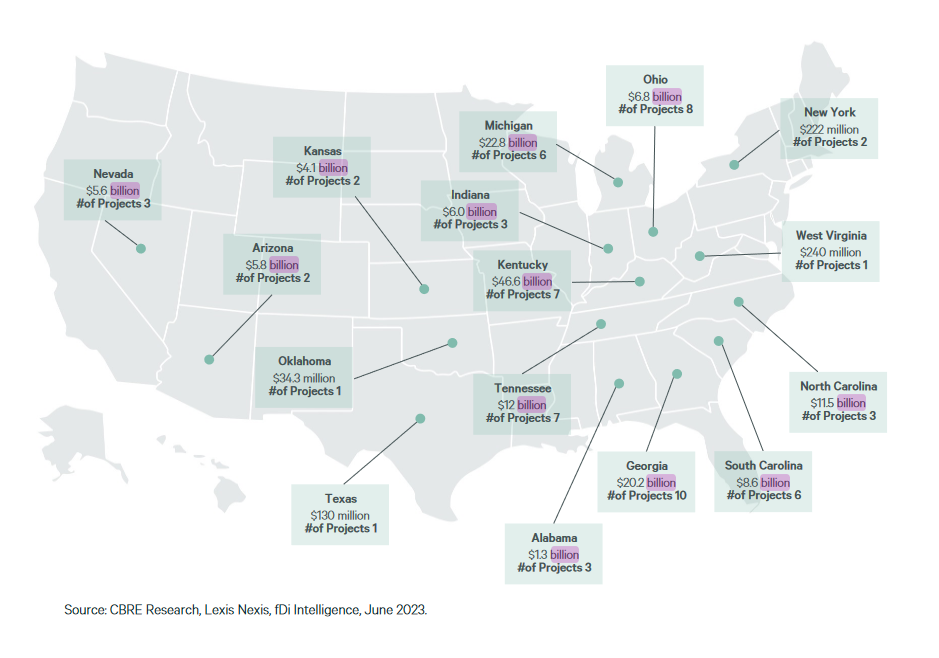

Map of select EV manufacturing investments to new or existing facilities. Courtesy of CBRE Research, Lexis Nexis, fDi Intelligence

Though demand for EV manufacturing space is heavily concentrated in the Midwest and Southeast, because of logistical, economic and labor market advantages, California and Texas are also likely to see significant investment, according to CBRE.

Among the challenges faced by manufacturers and developers of the spaces they need are:

- The need for high-voltage power supplies;

- The need for specialized personnel, such as EV-specialized electrical engineers and technicians;

- A lead time of three to five years to complete an EV manufacturing project;

- A robust supply chain for sourcing such key raw materials as lithium, cobalt and rare earth metals.

These issues aside, the extent of automakers’ commitment can hardly be overstated. As of May, CBRE notes, Ford had under construction nine EV facilities collectively valued at $18.7 billion and GM had 11, collectively valued at $14.6 billion.

READ ALSO: Manufacturing Thrives Amid Construction Surges

Many EV plants are in the South, CBRE reports. “Alabama, Georgia, Kentucky, North Carolina, South Carolina and Tennessee are home to over $64 billion of EV development investments. The Midwest has projects valued at about $33 billion, under construction in Indiana, Michigan and Ohio.”

Although many EV plants are owner-occupied, the industry’s growth has also led to more leasing activity for specialized manufacturing and distribution centers, typically bulk lease transactions of 100,000 square feet or more.

Over the past five years, there have been 15 markets where more than 1 million square feet of industrial space was leased to EV occupiers. The top five such markets were Chicago (3.6 million square feet), Detroit (3.1 million), California’s Central Valley (2.5 million), Silicon Valley (2.4 million) and Memphis, Tenn., (2.3 million), according to CBRE.

Plenty of juice

Just in the past couple of months, Commercial Property Executive has reported on multiple EV-related deals.

In July, Canadian auto parts supplier Magna International announced that it will invest almost $800 million to build two supplier facilities at Ford Motor’s BlueOval City mega-campus in western Tennessee. The facilities will produce battery enclosures, in support of Ford’s eventual production of 500,000 electric pickup trucks at the campus.

At the beginning of August, VinFast broke ground on a $4 billion EV manufacturing facility on an approximately 1,800-acre site in Chatham County, N.C. The project will be the first EV plant in the state and VinFast’s first facility in the U.S.

Almost the same day, Cnano Technology USA unveiled its plans to build a $95 million, 333,365-square-foot facility in metro Kansas City. The plant will create liquid conductive paste, a component used for a variety of electronic applications, including batteries for electric vehicles.

And most recently, ICL broke ground in metro St. Louis on a $400 million, 140,000-square-foot plant to produce lithium iron phosphate batteries, which are used in EVs.

You must be logged in to post a comment.