Emerging Trends 2021: The Changes a Year Can Make

The Urban Land Institute and PwC released the 42nd annual Emerging Trends report, which highlights the biggest trends and challenges in today's real estate landscape.

The Urban Land Institute and PwC released the 42nd annual Emerging Trends in Real Estate 2021 report at ULI’s virtual fall conference, which showcases challenges and trends shaping the real estate industry over the next year. The data includes insights from more than 1,600 experts in commercial real estate, sharing the latest effects from the impact of COVID-19.

The panel was moderated by PwC’s U.S. Real Estate Practice Leader Byron Carlock Jr. and included commentary from PwC Management Services LP’s Director, Real Estate Research Andrew Warren, as well as a follow-up discussion including BentallGreenOak’s CEO Sonny Kalsi, KKR’s Partner, Head of RE Americas Chris Lee, Clarion Partners LLC’s Managing Director Onay Payne and Macro Trends Advisors LLC’s Managing Partner Mitchell Roschelle.

Topics of discussion included the economy, market rankings, social justice and racial equity, and the largest trends for during and after the recovery.

READ ALSO: Emerging Trends 2020: Stay Alert to These Changes

“It’s a unique world we’re living in today,” said Warren. “Things are changing, they are different and uncertain. We’re trying to work through that the best we can.”

Major topics of interest included the coronavirus, the beginning of the election cycle, geopolitics and social unrest. However, with all the challenges the industry faces, many of those surveyed didn’t think the impact would be as bad as it has been. Forty-three percent of respondents said that epidemics had little importance to them when it came to real estate performance and 80 percent felt good about next year’s profitability outlook.

Markets for success

The top 10 emerging markets are as follows:

- Raleigh/Durham, N.C.

- Austin, Texas

- Nashville, Tenn.

- Dallas/Fort Worth

- Charlotte, N.C.

- Tampa/St. Petersburg, Fla.

- Salt Lake City

- Washington, D.C./ North Virginia

- Boston

- Long Island, N.Y.

These metros feature an attractive quality of life and have markets that support the economy, thanks to multiple industries with solid performance. This geographical shift is expected to impact construction, production and deals.

Lessons learned

The pandemic has created many new challenges within real estate, both in the market and within the industry itself. “Take nothing for granted,” said Roschelle. “I’ve been pleasantly surprised with how resilient our working economy is. It gives me hope that going forward won’t just be doom and gloom.”

Trends during and after recovery will continue to impact the economy, ruled by the mandated shutdown transitioning into reopening policies, as well as unprecedented moves by the FED. The great fiscal challenge reduced revenue and rising costs and will have a long-term impact on taxes and services. The economic shutdown has raised concerns related to affordable housing, but “will solutions lead to more problems?,” noted Warren.

One of the largest shifts within the industry has been racial and oriented toward social equity. The larger discussion of diversity and inclusion has been ongoing among firms and real estate as a whole, making companies more accountable for having these forward-thinking conversations on how to include more women and people of color into leading roles. “What is the difference between a moment and a movement? Sacrifice,” Payne shared. “I am optimistic that the industry will make the sacrifices needed to turn this moment into a movement for decades to come.”

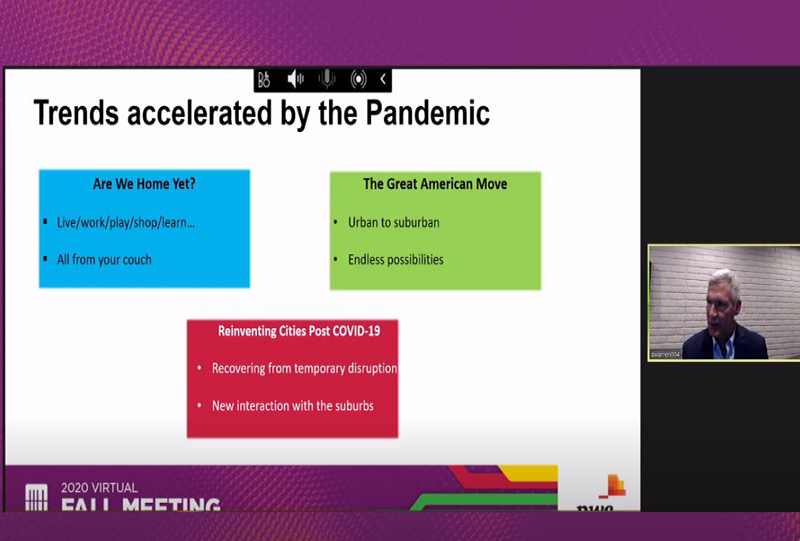

Additionally, workers have grown to show a new appreciation for remote work. It’s not something that is new by any means, but now it has proven to be successful with the majority of workers being at home. The trend is transitioning into shopping and learning from home as well. Productivity went up at the beginning of the pandemic, but engagement went down. Going forward, more firms are going to look at finding a balance. But is the real estate industry losing anything by working fully remote? Some would say yes. “It’s all those casual encounters you’d normally have in the workplace that aren’t happening,” said Roschelle. “Those in my view are where innovation comes from. Businesses know that in order to grow we need to get the workforce back together.”

You must be logged in to post a comment.