Economy Watch: US Economic Growth Stable in 2018, To Dip in 2019

A slight pickup in consumer spending in March suggests there is still room for growth in the coming quarters, with corresponding boosts to GDP, according to the Fannie Mae Economic and Strategic Research Group's May 2018 Economic and Housing Outlook.

By D.C. Stribling

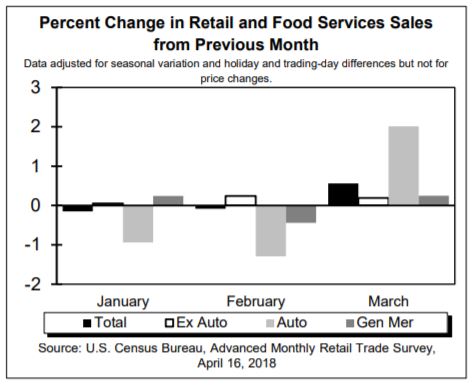

Source: U.S. Census Bureau

The forecast for U.S. GDP growth for all of 2018 remains unchanged at 2.7 percent, according to the Fannie Mae Economic and Strategic Research (ESR) Group’s May 2018 Economic and Housing Outlook, which the GSE released on Thursday. That’s despite a relatively sluggish first quarter of 2018. On the other hand, Fannie Mae dropped its forecast for 2019 economic growth to 2.3 percent, due to a fading fiscal stimulus and a tightening labor market.

First-quarter economic growth slowed due to dampened consumer spending. In particular, there was a drop in motor vehicles and parts spending, following the fourth-quarter 2017 surge to replace hurricane-damaged vehicles. Still, a slight pickup in consumer spending in March suggests growing momentum and sets the stage for a sizable pickup in the coming quarters, with corresponding boosts to GDP.

The ESR Group also expects the recent tax and budget acts to benefit business investment and government outlays. Consumer and business confidence measures, including the Home Purchase Sentiment Index, remain at or near historical highs, amid favorable labor market conditions.

Rising oil prices pose a downside risk to the economic outlook, as they might negate some of the increase in disposable income from the recent tax cuts, while also putting upward pressure on headline inflation. Such inflation could induce a more aggressive monetary tightening timeline from the Federal Reserve, the report posited. For now, the ESR Group continues to project two more interest rates hikes in 2018, including one next month.

You must be logged in to post a comment.