Economy Watch: Most CRE Sectors to Perform Well in 2018

CBRE's annual U.S. real estate report revealed a largely positive outlook for the major property types this year.

By D.C. Stribling, Contributing Editor

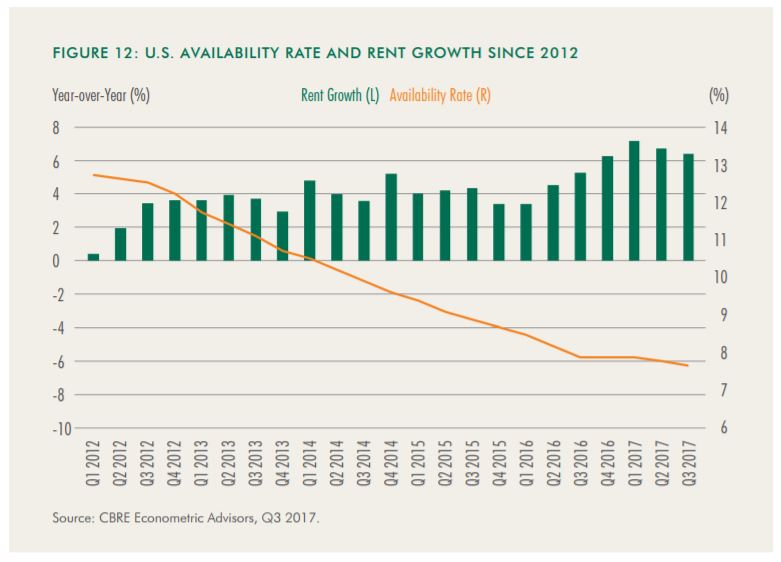

Much like in the office sector, demand for high-quality, well-located industrial real estate isn’t going to wane this year, spurred by demand from e-commerce/omnichannel operations, CBRE forecasted in its 2018 U.S. real estate market outlook. In fact, in most markets a lack of space options is challenging companies seeking to expand their supply chains. “As location is paramount, rising rents are not expected to curb demand as long as users continue to find options,” the report noted.

The retail market, on the other hand, will continue to be reshaped by changing demographics, consumer expectations, and omnichannel retail. Prime retail real estate will do well in 2018, but less desirable locations face diminished performance, as the bifurcation of retailing continues. Even so, CBRE said that across retail segments, landlords and retailers will strike up new partnerships to drive traffic and sales.

In the multifamily sector, developers are poised in 2018 to register the second-highest annual completions count of this cycle, down 9.2 percent from the peak in 2017. The new supply will mostly be absorbed over time. “Nearly a quarter of all [multifamily] units under construction in U.S. markets are in urban cores,” the report pointed out. Urban core multifamily should perform well over the long term, but in the short term, the best apartment development opportunities are in the suburbs.

The hospitality market ought to have a good year, CBRE predicted, considering that income and employment are growing, but hotel supply is not. “Over the medium terms, profitable hotel investment opportunities will generally favor properties that cater largely to leisure travelers,” the report said. “A few important city markets must contend with elevated risk from exposure to fluctuations in international travel.”

You must be logged in to post a comment.