Economy Watch: CBRE Predicts Slower Office Market Growth in 2018

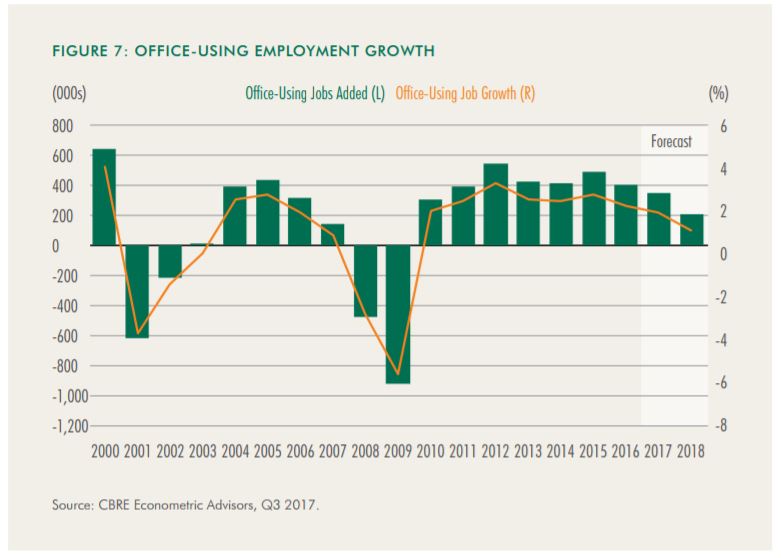

An influx of new supply and the tight labor market's impact on tenant demand will drive the slower pace of growth in the U.S. office sector this year, according to CBRE's latest real estate market outlook.

By D.C. Stribling, Contributing Editor

CBRE is still optimistic about the outlook for the economy in 2018, and its impact on commercial real estate, but less so than last year, according to its recently released U.S. real estate market outlook. “As a baseline,” the report said, “we expect moderate economic growth with slowing employment gains in 2018, and an economic slowdown in 2019.”

For the office sector in particular, CBRE expects continued growth in 2018, but it will be at a slower pace, mainly due to more new space coming on line, as well as the impact of a tight labor market on tenant demand. Not all office properties will enjoy good times, however. Older properties without the amenities preferred by millennials, and without the infrastructure to handle evolving technologies, will struggle to find tenants.

The tech sector has accounted for nearly 20 percent of major office leasing activity in recent years and will likely remain a primary demand driver in 2018 in markets such as the San Francisco Bay Area and Seattle, as well as in emerging, lower-cost tech hubs like Charlotte and Phoenix, the report said. The tech sector is expanding at about twice the rate of overall job growth, despite having slowed during the past few years.

Some suburban office markets, which have taken a beating at the hands of some core urban markets in recent years, have evolved to meet the challenge, CBRE noted. Those suburban submarkets that offer a range of housing and urban-like amenities, such as public transit and walkability, will be positioned to capture demand from millennials who are maturing.

Labor remains the primary challenge facing corporations in 2018. “Even as they lower their space requirements, many occupiers are reinventing or adapting their workplace standards to meet employee demand for amenity-focused, flexible, technology-driven work environments,” the report posited. Space-using companies will continue to reinvest in workplace enhancements that will help attract and retain employees.

You must be logged in to post a comment.