Economy Watch: Chinese Investment in US CRE Plunges

Following the Chinese government’s announced restrictions on outbound capital flow, the country's investments in U.S. commercial real estate dropped significantly in 2017, according to Cushman & Wakefield's 2017 China-U.S. Inbound Investment Capital Watch report.

By D.C. Stribling, Contributing Editor

Chinese investment in U.S. commercial real estate dropped dramatically in 2017 after China’s State Council implemented a framework regulating outbound investments, according to a report released by Cushman & Wakefield on Tuesday. In March, the Chinese government further clarified capital controls under which investments in real estate and hospitality assets are classed as restricted, but not prohibited.

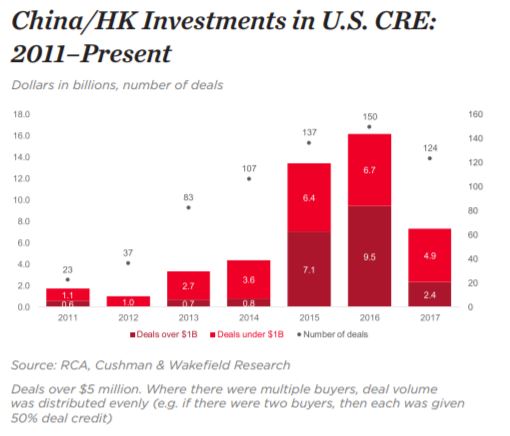

The 2017 China-U.S. Inbound Investment Capital Watch report estimates that Chinese investment into U.S. CRE dropped 55 percent in 2017. All together, investment totaled $7.3 billion last year, compared to the country’s frenetic buying spell in 2016, when Chinese capital snapped up $16.2 billion in American properties.

Much of the drop was at the high end of the investment spectrum. The total volume of deals over $1 billion was down 75 percent year-over-year in 2017. By contrast, the total volume of deals under $250 million fell only 12 percent.

According to the report, Chinese investment is concentrated in five U.S. markets: New York, San Francisco, Los Angeles, Chicago and Seattle. Between the two of them, New York and San Francisco account for two-thirds of all Chinese investment in U.S. commercial real estate. Non-institutional players dominated acquisition activity in 2017, with sovereign wealth funds and insurers pulling back.

China fell from being the United States’ No. 1 investor to being No. 3, with Canada having re-assumed the No. 1 spot and Singapore coming in at No. 2, Cushman & Wakefield reported. While Chinese investment in U.S. CRE declined, global outbound investment set a new record, with the U.K. being a prime beneficiary despite, or perhaps because, of Brexit.

You must be logged in to post a comment.