Economist’s View: Formulas For Growth

GDP’s Components Hold Clues to 2017 Trends

By Hugh F. Kelly, PhD, CRE

Hugh F. Kelly, PhD, CRE

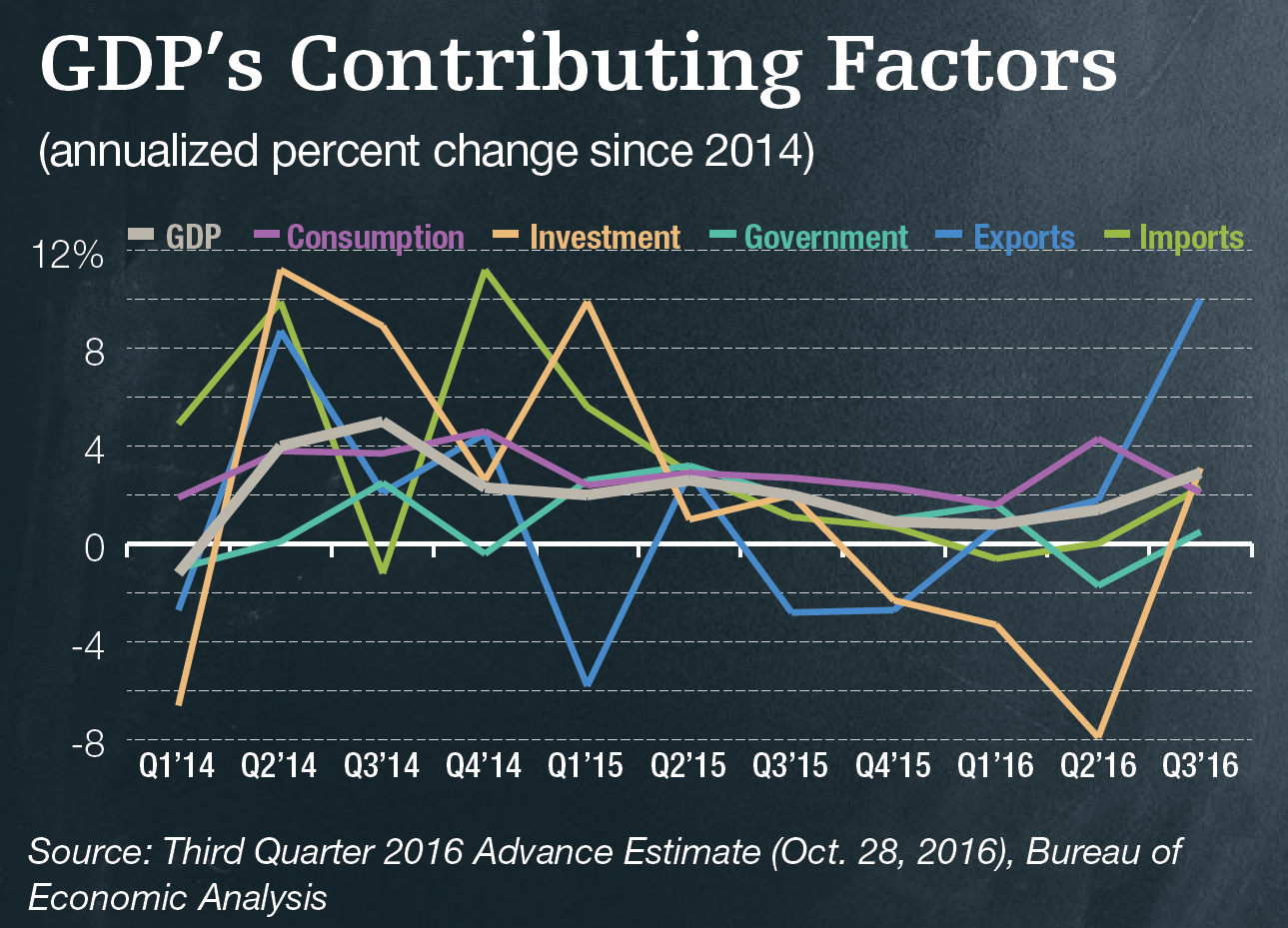

Every student in Econ 101 learns the formula for Gross Domestic Product: C+I+G+(x-m). If it’s been a few years since that introductory class, but that stands for Consumption plus Investment plus Government spending, plus or minus the balance of trade (Exports minus Imports). GDP is the best shorthand indicator for the American economy, since it measures the total output of goods and services across the entire spectrum of activity.

As we look toward the prospects for the U.S. economy in 2017, and its implications for real estate, GDP is a handy tool to help us navigate a complex map of data and expectations. Consumption represents 70 percent of GDP, $12.8 trillion as of September 2016, and is rightly considered the bellwether of the nation’s economic health. Yet many in the real estate world conflate consumption with the performance of retail properties—and this broad identification is quite misleading.

Consumption Assumptions

On the whole, personal consumption expenditures and disposable personal income are expected to rise 2.3 to 2.5 percent in 2017. That would represent a noticeably slower pace than the most recent 12-month change (through September 2016) of 3.7 percent. This strong year-over-year growth reflected a robust 4.6 percent advance in services consumption, tempered somewhat by a lesser 1.8 percent gain in merchandise sales.

Final demand for goods sold in retail stores, therefore, should not be expected to grow vigorously in the year ahead, despite the recent news that household incomes are rising ahead of the inflation rate. The mixed performance of the still oversupplied retail property sector will likely persist in 2017.

After several years of solid improvement, growth of housing services (that is, rent and homeownership spending) and hospitality demand is likely to decelerate. Some may see this as a good thing—nipping a potential residential bubble in the bud. But given the ultra-low cap rates for multifamily assets, slower rent growth will cramp overall returns in the near term.

For hoteliers, declining room-night demand comes just as many new properties are opening their doors. Hotel profitability has been good, and industry consolidation is reducing overhead. But 2017 could bring some stress to the real estate hospitality sector.

The brightest spot in the consumer sector is the performance of eating and drinking establishments, which have rung up a 5.5 percent annual gain, according to the Census Bureau’s October report on sales.

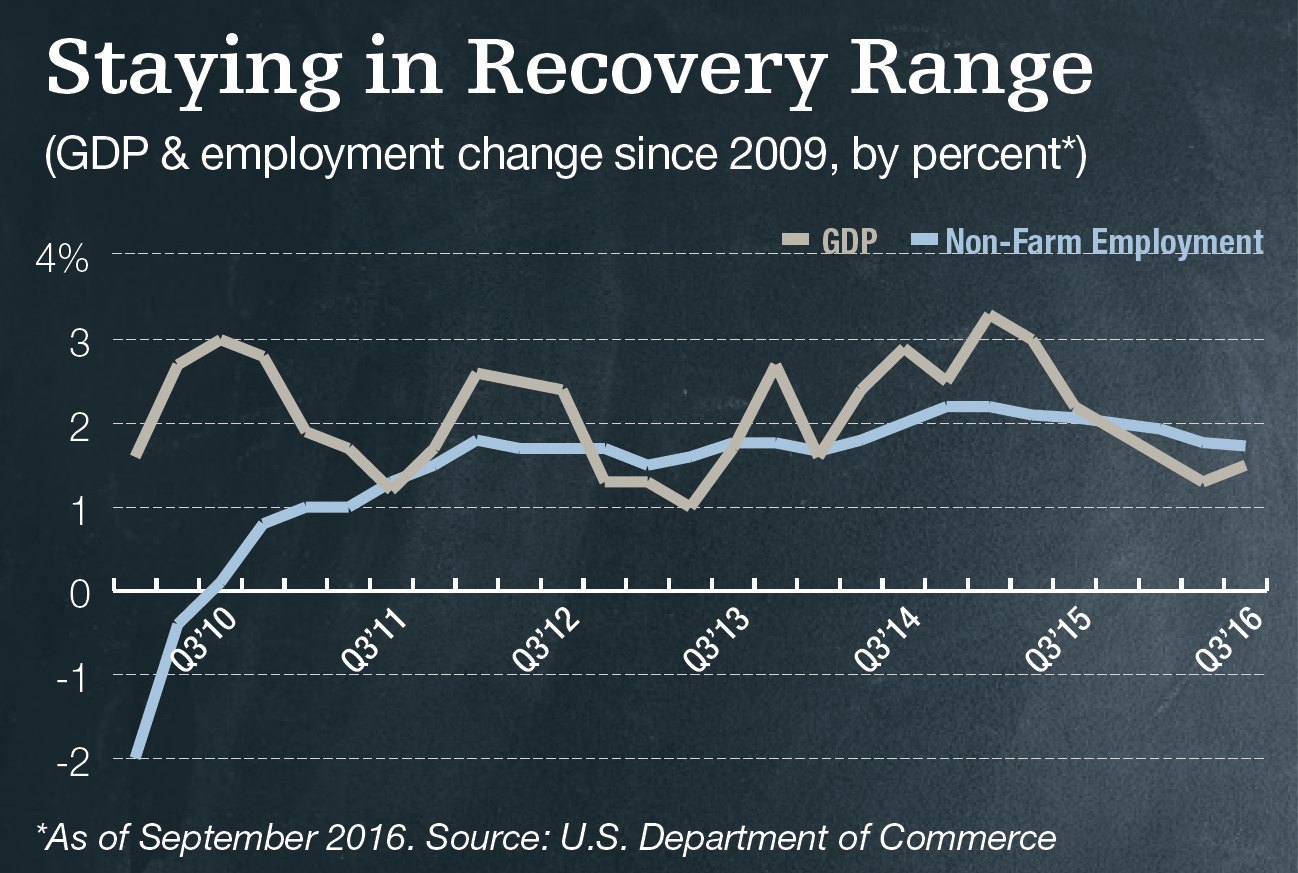

Consumers may not share economists’ somewhat dour outlook, though. The Conference Board’s confidence index has been rising since last spring, and if forecasts of continued job growth, real income gains and sub-5 percent unemployment prove accurate, there could be some surprises on the upside for stores (and for non-store retailing, including e-commerce).

Setting the Stage

Investment is a complex factor as well, critical to both immediate economic activity but more important, setting the stage for longer- term growth. Thus, investment punches above its weight (just 16.7 percent of GDP) as a key measure of vitality. There was good news in the advance third quarter 2016 GDP data, which showed a 3.1 percent annual growth rate for investment; that is a turnaround after three quarters of reductions in private investment. In particular, it is encouraging to see a 5.4 percent increase in private investment in non-residential structures and a 4 percent gain in intellectual property investment, as these sectors have significant multiplier effects.

Investment is a complex factor as well, critical to both immediate economic activity but more important, setting the stage for longer- term growth. Thus, investment punches above its weight (just 16.7 percent of GDP) as a key measure of vitality. There was good news in the advance third quarter 2016 GDP data, which showed a 3.1 percent annual growth rate for investment; that is a turnaround after three quarters of reductions in private investment. In particular, it is encouraging to see a 5.4 percent increase in private investment in non-residential structures and a 4 percent gain in intellectual property investment, as these sectors have significant multiplier effects.

Real estate investment, specifically, has slipped in 2016 compared with the previous year, according to Real Capital Analytics data. This news is actually somewhat welcome, as it may allay fears that commercial property may be facing a new threat of an asset bubble. Investors do not appear to be searching for yield willy-nilly, but are adopting a program of selectivity and discipline in matching capital commitments to market performance.

Low cap rates make this essential, since initial returns must be complemented by some real opportunity for rent growth and/or appreciation in order for investments to make sense. A willingness to avoid deals that fail to match such a profile is a sign that some of the Great Recession’s hard-earned lessons are sticking.

Lagging the Field

Government spending presents something of a mixed bag. It is close to private investment in order of magnitude, accounting for 17.6 percent of GDP. That amounts to $3.3 trillion, about 38 percent of it federal spending and the rest contributed by state and local governments. Of note, federal spending has not merely lagged other components of GDP; in absolute terms, it has been a negative factor in each of the past four years, since the end of the stimulus spending created by the American Recovery and Reinvestment Act of 2009.

Strikingly, this has been true of both defense and non-defense spending. The resulting drag on GDP (which I attribute to Washington gridlock, particularly in the U.S. House of Representatives) bears much of the blame for the anemic overall performance of the economy in recent years. Since 2011, state and local spending has made up for some, but not all, of the underfunding at the Federal level.

Strikingly, this has been true of both defense and non-defense spending. The resulting drag on GDP (which I attribute to Washington gridlock, particularly in the U.S. House of Representatives) bears much of the blame for the anemic overall performance of the economy in recent years. Since 2011, state and local spending has made up for some, but not all, of the underfunding at the Federal level.

Looking forward, we might hope for capital gridlock to ease and for a return to a reasonably stimulative fiscal policy, perhaps taking the form of infrastructure investment that would provide some further tailwind to the economy. The Fed can accomplish only so much through monetary policy. Even with some modest interest rate increases likely in store next year, the Fed will seek to keep the cost of funds low enough to spur growth. But GDP will remain in slow-growth mode as long as Congress blocks defense and infrastructure spending increases that I would argue are essential to our security and economic interests.

My September column for CPE focused on trade. There are unquestionably risks and opportunities in the international trade factors that will affect GDP in 2017. The good news is that trade has been a net positive for GDP change during recent quarters, if only because the current account deficits are easing somewhat. Nonetheless, the trade deficit of $540 billion is just a 2.9 percent element in an $18.6 trillion economy.

Whatever the future holds for trade policies, two things seem clear. First, there is little that the U.S. can do to forestall the trends toward globalization. Second, the best strategy for reducing the trade deficit is boosting investment programs in both the private and public sectors that enhance the quality and quantity of domestic production of goods and services. In the end, that’s what’s best not only for the GDP top line but for American jobs and incomes.

—Hugh F. Kelly, PhD, CRE, was a clinical professor at the NYU Schack Institute of Real Estate for more than 30 years. He is a Regent of Realtor University, a degree-granting institution sponsored by the National Association of Realtors. In 2014 he served as chair of the Counselors of Real Estate. His most recent book, 24-Hour Cities: Real Investment Performance, Not Just Promises, was published earlier this year by Routledge.

Originally appearing in the December 2016 issue of CPE.

You must be logged in to post a comment.