Economist’s View: Why the Old Rules May Not Apply Today in CRE

Major disruptions, like AI and work from home, are shaking long-standing assumptions, according to columnist Hugh F. Kelly.

For the past couple of years, we have all been urged to “follow the science” in making decisions in a variety of areas of human behavior, from public health to public policy, as though scientific understanding provided a unique and unambiguous guide to what we ought to do. I have argued for decades that we need to take a more comprehensive approach to decision-making. Data and analysis—the quantitative approach where science excels—needs to be supplemented by good judgment, an area where science is appreciated as a powerful method in truth-seeking but requires the balancing virtues of values and even creativity to develop a solid approach to the future. Remember that the last several economic crises did not arise because people didn’t know how to do math, but because they lacked prudential judgment.

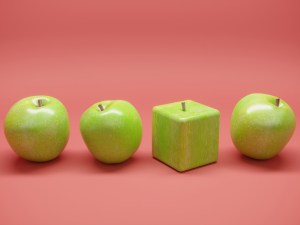

We are prone to fall into ruts in our thinking, economists no less than any other discipline. Following well-grooved patterns of thought is sometimes termed “path dependence.” The concept holds that history builds upon itself, and successful patterns persist because of their adaptability over time. It is rare to find claims nowadays that path dependence is absolutely determinative. Otherwise, how would we account for innovation? And it would be simply Pollyanna thinking—not science at all—to suggest that established patterns are the most efficient or the most correct. Gottfried von Liebnitz long ago reminded us, “Nature has established patterns originating in the return of events, but only for the most part.”

One such pattern enjoys much currency in the economic thinking of the present era. Much of the debate over the direction of Fed policy since the re-emergence of high inflation has revolved around the trade-off between monetary restraint and the prospects for recession. A typical discussion could be found in a J.P. Morgan Wealth Management piece that states, “The Fed seems clear: Control inflation at the expense of growth.”

For those trained in neo-classical economics such a trade-off is familiar. It harkens back to the Phillips Curve, a supposed inverse relationship between the level of unemployment and the rate of inflation. A recent Senate Finance Committee hearing with Fed Chair Powell saw Sen Elizabeth Warren characterize explicitly (and in my mind, falsely) a rise of 2 million unemployed and the cost of bringing inflation under control as a cause-and-effect relationship. Needless to say, in a complex economy, this is not a forced-choice alternative.

The foundation of such a bivariant perspective is also expressed in a second familiar economic concept: NAIRU, the non-accelerating inflationary rate of unemployment. Both the Phillips Curve and NAIRU are theoretical constructs that envision some level at which the economy achieves (or at least tends toward) equilibrium, a balance that is sustainable and healthy over time. The question is not whether such an ideal balance is possible, but whether the condition of economic stasis adequately describes the complex adaptive system that we actually live in.

The Edge of Chaos

As it happens, the scientific literature provides us with another model to look at, a model called “punctuated equilibrium.” This hypothesis maintains that, for long periods of time, change is a fairly gradual phenomenon. Incremental improvements dominate, and competitive advantage accrues “on the margin.” But there are times of rapid alterations to systems, be they biologic or economic, when there is evolutionary advantage to large-scale change. Under such conditions, it may make sense to question long-standing assumptions, such as those undergirding the Phillips Curve or NAIRU, as inadequate guides to economic behavior.

Evidence is accumulating that we are living through just such a period of rapid and large-scale change. Real estate is now required to cope with major alterations in conditions on many fronts. Climate change and its impacts on the built environment and on population migration is one example. After several decades of rapid but incremental advances in technology, we are witnessing a potentially revolutionary leap in applied artificial intelligence. While it is still subject to debate as to whether we are in ‘post-Covid’ or ‘late Covid” era, the disruption of the pandemic has certainly altered long-standing patterns of property utilization across virtually all property types. And, both in the U.S. and abroad, the very basic system of free-market capitalism is subject to a reconsideration of the relationships between the public and private sectors, a reconsideration that still requires some open-mindedness as to outcomes.

Scientists studying complex dynamic systems have noted that, as a mathematical property, the acceleration of rates of change across multiple dimensions drives such systems to “the edge of chaos.” This term does not carry a dystopian bias, but simply indicates that simple forms of change, such as cycles and linear trends break down or become unpredictable in such a disrupted environment. So, at a very minimum, we ought to be cautious about our confidence in anticipating the economic environment in which we do commercial property investment in 2023, and likely for several years to come.

In other words, the price of risk in real estate should be systematically more costly than it has been for most of our careers.

Hugh F. Kelly is director of graduate programs & chair of the executive advisory council curriculum committee at the Fordham University Real Estate Institute, and chair of the institute’s executive advisory council curriculum committee. He is a principal at Hugh F. Kelly Real Estate Economics, a consultancy. Kelly is the author, most recently, of 24-Hour Cities: Real Investment Performance, Not Just Promises (Routledge/Taylor & Francis).

You must be logged in to post a comment.