DRA Advisors JV Buys San Francisco Office Park for $265M

Marina Village’s new owners have tapped JLL to spearhead leasing and are primed to transform 200,000 square feet of the 1 million-square-foot property’s available offerings into premier life sciences space.

Marina Village, a 1 million-square-foot office/research park in Alameda, Calif., is getting a new owner and a new destiny. DRA Advisors LLC and Local Capital Group recently acquired the San Francisco Bay Area asset from Brookfield Properties for a reported $265 million, and now the partners have brought JLL aboard to spearhead leasing as part of the campus’s rebranding as The Research Park at Marina Village.

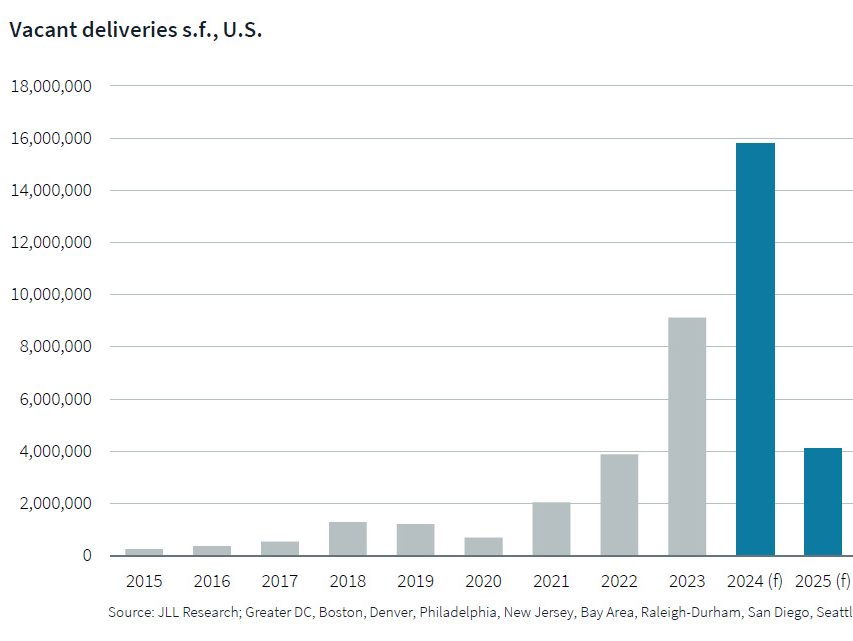

Developed in three phases over a 10-year period ending in 1997, Marina Village encompasses 27 low-rise buildings occupying 60 acres roughly 2 miles from downtown Oakland, in the Bay Area’s East Bay region. Plans for the waterfront property call for the conversion of a vast majority of vacant space into state-of-the-art life sciences and research accommodations. “Regional demand for life science space is high and there is little available inventory,” Sam Swan, managing director with JLL, told Commercial Property Executive. “There is nearly 200,000 square feet of high-quality, single-story R&D buildings readily convertible to life science space.” The San Francisco Bay Area ranks second only to the Boston-Cambridge area as the top life sciences market in the country. Along with Swan, JLL’s Grant Yeatman and Scott Miller will lead leasing efforts at Marina Village.

Existing and prospective tenants across the board can expect other changes at Marina Village. “New ownership has plans for major common area improvements and creating the amenity offerings today’s tenants seek to support their newly renovated buildings,” Swan added.

Alameda rising

The Alameda office market is on the upswing. “As the regional office market continues to strengthen and downtown is seeing tremendous rent growth and tenant migration from San Francisco, Alameda has seen a huge uptick in office and R&D leasing activity as tenants look for high-quality, functional space,” Swan said. Located 15 miles across the Bay from Alameda, San Francisco recorded an office vacancy rate of just 6 percent in the first quarter of 2019, making it the tightest office market in the U.S., according to a report by JLL.

You must be logged in to post a comment.