Delinquency Rates Still Low

Defaults for commercial and multifamily borrowers remained low in the third quarter of 2018, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Delinquency Report.

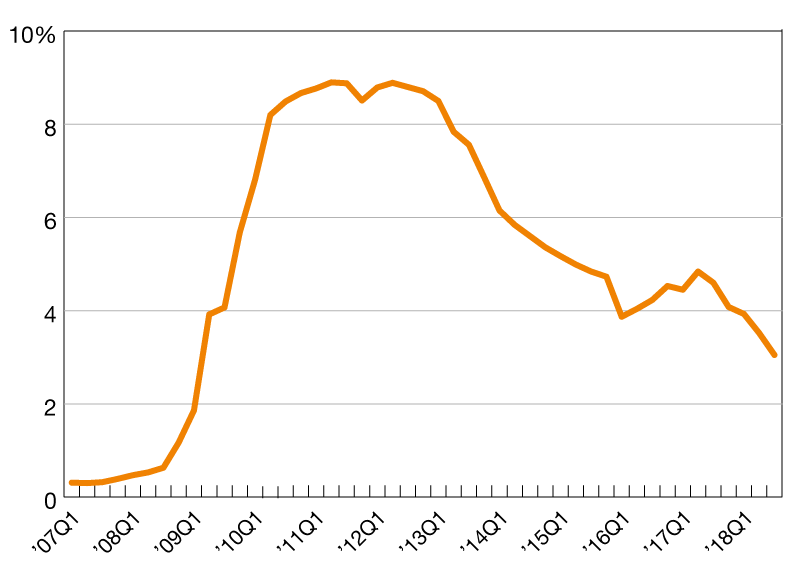

CMBS, 30+ days and REO

Delinquency rates for commercial and multifamily mortgage loans remained low in the third quarter of 2018, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Delinquency Report. The delinquency rate for loans held on bank balance sheets set a new series low, and delinquency rates for loans held by life companies or guaranteed by Fannie Mae and Freddie Mac are all below 10 basis points. Loans held in commercial mortgage-backed securities (CMBS) have a higher ‘headline’ delinquency rate because of the way the industry reports on those loans, but if one pulls out loans in foreclosure or real estate owned (REO)–which are generally excluded from the calculations for the other groups–the CMBS delinquency rate is just 45 basis points, the same level as December 2005.

MBA’s quarterly analysis looks at commercial/multifamily delinquency rates for five of the largest investor-groups: commercial banks and thrifts, CMBS, life insurance companies, Fannie Mae and Freddie Mac. Together, these groups hold more than 80 percent of commercial/multifamily mortgage debt outstanding. Based on the unpaid principal balance (UPB) of loans, delinquency rates for each group at the end of the third quarter (compared to the second quarter) were as follow:

- Banks and thrifts (90 or more days delinquent or in nonaccrual): 0.48 percent, a decrease of 0.02 percentage points from the second quarter of 2018

- Life company portfolios (60 or more days delinquent): 0.04 percent, an increase of 0.01 percentage points from the second quarter of 2018

- Fannie Mae (60 or more days delinquent): 0.07 percent, a decrease of 0.03 percentage points from the second quarter of 2018

- Freddie Mac (60 or more days delinquent): 0.01 percent, unchanged from the second quarter of 2018

- CMBS (30 or more days delinquent or in REO): 3.05 percent, a decrease of 0.47 percentage points from the second quarter of 2018

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

Reggie Booker is the Mortgage Bankers Association’s associate director of commercial real estate research.

You must be logged in to post a comment.