Delinquency Rates for Commercial Properties Increased in Fourth-Quarter 2023

Delinquency rates for mortgages backed by commercial properties increased during the fourth quarter of 2023, according to Mortgage Bankers Association.

Delinquency rates for mortgages backed by commercial properties increased during the fourth quarter of 2023, according to the Mortgage Bankers Association’s (MBA) latest commercial real estate finance (CREF) Loan Performance Survey, released earlier this month.

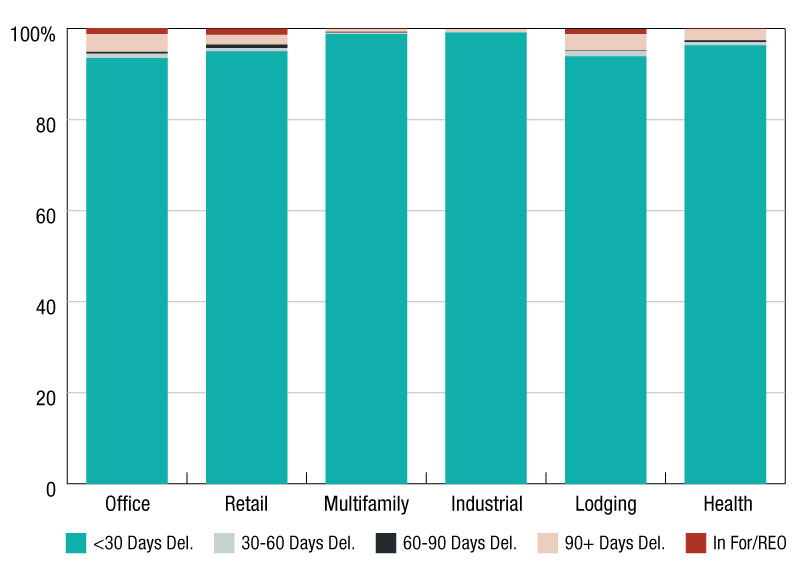

Continuing challenges in commercial real estate markets pushed the delinquency rate on CRE-backed loans higher in the final three months of 2023. Delinquency rates jumped to 6.5 percent of balances for loans backed by office properties and to 6.1 percent for lodging-backed loans. Delinquencies for loans backed by retail properties remain elevated from the onset of the pandemic but were unchanged during the quarter. Delinquency rates for multifamily and industrial property loans both increased marginally but remain much lower.

Long-term interest rates have come down from their highs of last year, which should provide some relief to some loans, but many properties and loans still face higher rates, uncertainty about property values and – for some properties – changes in fundamentals. Each loan and property faces a different set of circumstances, which will come into play as the market works through loans that mature this year.

The balance of commercial mortgages that are not current increased in December 2023 (compared to September 2023).

- 96.8 percent of outstanding loan balances were current or less than 30 days late at the end of the third quarter, down from 97.3 percent at the end of the third quarter of 2023.

- 2.3 percent were 90+ days delinquent or in REO, up from 2.2 percent the previous quarter.

- 0.3 percent were 60-90 days delinquent, up from 0.2 percent the previous quarter.

- 0.6 percent were 30-60 days delinquent, up from 0.3 percent.

- Loans backed by office properties drove the increase.

- 6.5 percent of the balance of office property loan balances were 30 days or more days delinquent, up from 5.1 percent at the end of last quarter.

- 6.1 percent of the balance of lodging loans were delinquent, up from 4.9 percent.

- 5.0 percent of retail balances were delinquent, flat from the previous quarter.

- 1.2 percent of multifamily balances were delinquent, up from 0.9 percent.

- 0.9 percent of the balance of industrial property loans were delinquent, up from 0.6 percent.

- Among capital sources, CMBS loan delinquency rates saw the highest levels.

- 5.1 percent of CMBS loan balances were 30 days or more delinquent, up from 4.4 percent last quarter.

- Non-current rates for other capital sources remained more moderate.

- 0.9 percent of FHA multifamily and health care loan balances were 30 days or more delinquent, up from 0.8 percent.

- 0.9 percent of life company loan balances were delinquent, up from 0.7 percent.

- 0.5 percent of GSE loan balances were delinquent, up from 0.4 percent.

You must be logged in to post a comment.