December Marks 2018’s Weakest Growth in Cycle

Pricing across the property segments was mixed in the final month of the year, with office and apartment posting monthly gains, while retail, industrial and hotel pricing declined.

by Peter Muoio

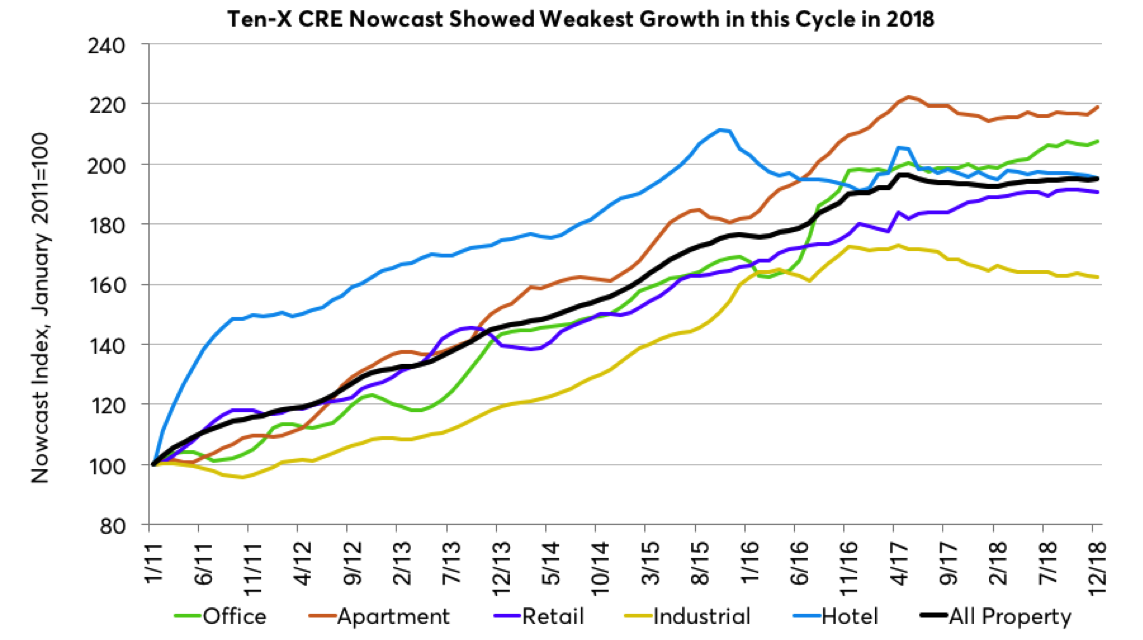

Despite a 0.2 percent uptick in December from November, U.S. commercial real estate pricing ended 2018 up just 1 percent from the previous year, the weakest gain for this cycle. This compares to 2017’s 1.4 percent increase, the 8 percent gain in 2016 and double digit jumps in the previous years of this cycle. Pricing across the property segments was mixed in the final month of the year, with office and apartment posting monthly gains, while retail, industrial and hotel pricing declined.

Office pricing was the biggest winner in 2018 according to the Ten-X Office Nowcast, rising 4.7 percent for the year, boosted by December’s 0.6 percent monthly gain. Southwest office pricing popped 20.8 percent in 2018, by far the biggest regional gain, but this simply clawed back most of the 22 percent drop in the previous year, as the region’s office pricing mimics the sharp up and down movements of oil pricing and their impact on the local economy. Office pricing was weakest in the Midwest, where pricing fell 5.6 percent in 2018.

Industrial pricing was the big loser for 2018, despite generally favorable dynamics for fundamentals. Industrial pricing was down 2 percent for the year following December’s 0.2 percent decline from the month before. Industrial property prices in the Midwest and Southeast bucked the downward trend, rising 5.9 percent and 0.9 percent respectively in 2018, while the other regions all posted declines. The Southwest, which has a particularly large pipeline of new supply was the weakest, declining 7.2 percent.

With a strong 1 percent monthly increase in December, apartment pricing increased 1.3 percent for 2018 after being down to flat for most of the year. The strongest pricing gain for apartment was in the Midwest in 2018, which saw a 6.3 percent increase. The West and the Northeast were the only regions to show declines for the year, with prices falling 1 percent in the West and 1.4 percent in the Northeast, although these two regions have the strongest supply pipelines.

Like the office segment, retail pricing posted a gain in 2018 despite noticeably challenging fundamentals. Pricing increased 1.5 percent in 2018, despite back to back 0.2 percent drops in November and December. Retail pricing was up in all but the Southeast region, with the Northeast posting a robust 10.7 percent gain to top the other regions. Retail pricing was strongest in the Northeast in 2018, up 10.7 percent and weakest in the Southwest, down 3.1 percent.

Hotel pricing declined 1 percent in 2018. The hotel nowcast declined in the last two months of 2018 and in six of the last eight months of the year. Hotel pricing was actually quite strong in the Midwest, increasing 10.6 percent in 2018, and was up modestly in the West, while the other regions all posted declines, with the Southwest down the most— 8.8 percent.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.