Crow Holdings JV Secures $102M for San Diego Industrial Park

This is the first phase of a 1.8 million-square-foot development.

Elevation Land Co. and a real estate fund advised by Crow Holdings Capital have obtained $102.4 million in construction financing for the first phase of Otay Business Park, a four-building, 612,240-square-foot industrial development in the Otay Mesa submarket of San Diego.

New York Life Real Estate Investors provided the financing, which comes in the form of a three-year, floating-rate loan. A team from JLL Capital Markets, led by Senior Managing Director Aldon Cole and Analyst Ben Choromanski, arranged the deal.

At full buildout, Otay Business Park will occupy 119 acres, comprising nine buildings totaling 1.8 million square feet. Construction on the initial phase began this month and is expected to be completed by the middle of 2026, with stabilization expected by mid-2027. Cushman & Wakefield is handling leasing at the industrial park.

READ ALSO: Investment Activity Holds Firm

Phase one’s four warehouses can be divided into suites as small as 45,000 square feet to allow for multiple tenants with specific requirements. They will include 32-foot clear heights and a total of 608 parking stalls, plus 102 trailer stalls.

A strategic location

Otay Business Park will be positioned near the Siempre Viva Road extension, which provides direct access to California State Route 11. The property will also be within a mile of the upcoming Otay Mesa East Port of Entry, which is expected to open in late 2027.

The site is also 2 miles from California State Route 905 and 20 miles from Interstate 15. Downtown San Diego and San Diego International Airport are within 25 miles from the property. The surrounding area is also home to warehouses for Amazon and FedEx.

Brig Black, Elevation’s founder & principal, said in prepared remarks that the business park takes advantage of the growth in cross-border trade between the U.S. and Mexico. JLL’s Cole noted that the location can help tenants streamline supply chains and speed up cross-border transit times.

Positive outlook in San Diego

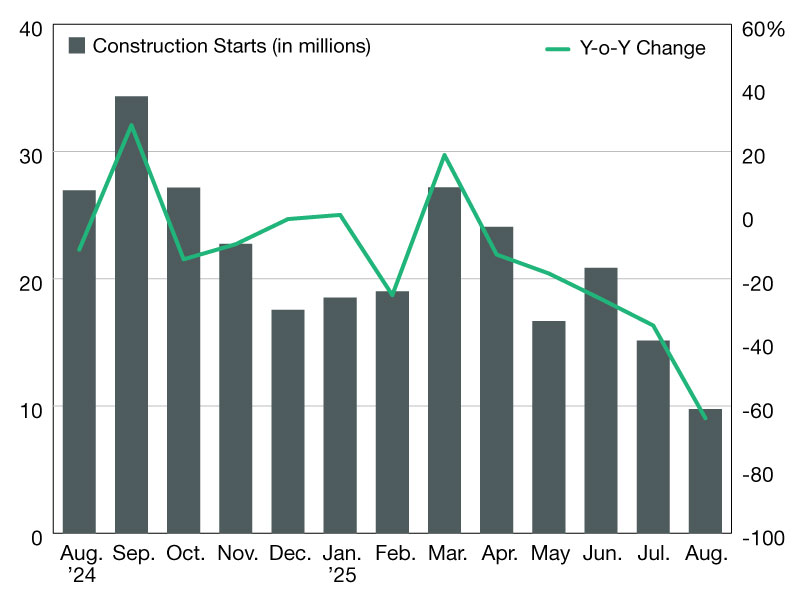

Some fundamentals in the San Diego industrial market softened in the second quarter of 2025, according to a report from Cushman & Wakefield. Net absorption, for example, was a negative 1.6 million square feet, marking the 10th consecutive quarter of declines.

The area’s vacancy rate also ticked up 70 basis points quarter-over-quarter and 230 points year-over-year to 7.7 percent, which is the highest the figure has been since 2013.

Despite these lukewarm stats, Cushman & Wakefield predicts a positive outlook for the metro. As of the second quarter of this year, the area had about 2 million square feet of industrial space under construction, 1.7 million of which is located in Otay Mesa.

Otay Mesa is expected to be a hotbed for development, as it currently accounts for 61 percent of the 6.7 million square feet planned for development across the entire metro.

You must be logged in to post a comment.