Cross-Border Investment in US Properties Drops 54%

U.S. investors remained active overseas amid a sharp decline in inbound capital flows.

Foreign investment in U.S. commercial real estate plunged by 54 percent in 2019, falling short of outbound investment for the first time in six years, according to a new report by CBRE.

The dramatic drop in overseas capital flows was largely caused by a pullback in entity-level sales last year, after a string of blockbuster M&A transactions buoyed investment volumes in 2018. Excluding such entity-level deals, inbound investment in 2019 declined by 12.1 percent year-on-year.

READ ALSO: Singaporean Investors Ink $1.4B Deal With Digital Realty

U.S. capital outflows eased back 1 percent from 2018 levels last year, but still exceeded inbound flows by $17.5 billion, the report shows, drawing on data from Real Capital Analytics. The last time the U.S. was a net exporter of capital in the commercial real estate market was 2014.

“Asian outbound investment in the U.S. dropped by 53 percent year-on-year in 2019 due to a lack of big-ticket portfolio transactions,” noted Henry Chin, CBRE’s Head of Research for APAC/EMEA to Commercial Property Executive.

China was notably quiet as Beijing continued to clamp down on speculative outbound investment. Real estate investors based in the world’s second-largest economy injected only $468 million into the U.S. last year—excluding entity-level deals—after averaging $5 billion annually since 2013.

But other East Asian giants stepped up, with investors from South Korea and Japan targeting office buildings and hotels amid the Chinese retreat. “Korean and Japanese investors turned active in the U.S., with investment turnover increasing by 33 percent and 18 percent year-on-year, respectively,” Chin said.

Canada looks south

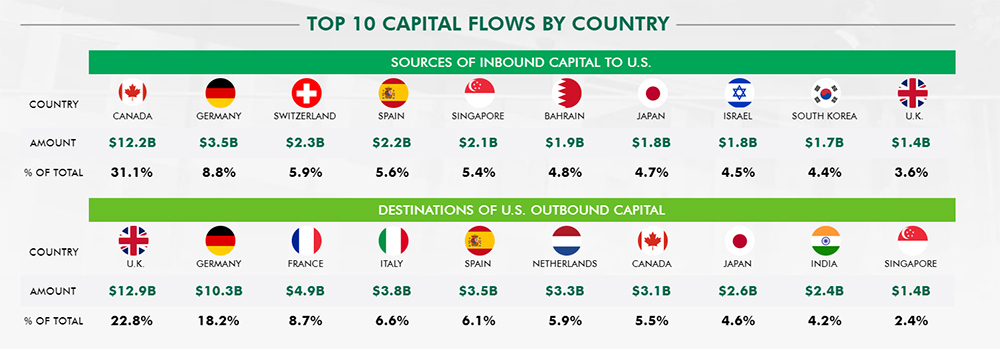

Canada was by far the largest source of inbound capital to the U.S. last year, pouring $12.2 billion into the market, followed by Germany, Switzerland, Spain and Singapore on the top-five list. Bahrain, Israel and the United Kingdom also ranked high as capital sources.

America’s northern neighbor accounted for more than half of the total inbound capital in both multifamily and retail, according to CBRE. Notable deals in the public record include Toronto-based Tricon Capital Group’s purchase of a 7,289-unit apartment portfolio across the Sunbelt region for $1.4 billion in April.

Japanese investors plowed $1.8 billion into the U.S. in 2019, focusing mainly on the office sector. A subsidiary of Japan’s Sumitomo Corp. made its debut in the Minneapolis office market by snapping up SPS Tower for $144 million from California State Teachers’ Retirement System. The deal for the downtown, LEED-certified building closed in February of last year.

While favoring office assets, Korean investors also displayed a growing appetite for hotels, with major hospitality operators expanding their global footprints on America’s east and west coasts. A unit of South Korea-based Aju Group acquired two Hyatt-branded hotels in Midtown Manhattan for a combined $138 million last year, for example, while Korea’s Lotte Hotel partnered with Hana Financial to buy the hotel portion of F5 Tower, a mixed-use skyscraper in downtown Seattle, for $175 million.

Americans abroad

Despite the crash in capital flows into the U.S., activity remained strong in the other direction, with U.S. investors piling $56.6 billion of capital into overseas real estate—a shade less than the previous year’s total of $57.4 billion.

Britain took in more than one-fifth of the total, with Germany following close behind. U.S. investors also looked favorably on commercial properties in France, Italy, Spain, the Netherlands and Canada. Among Asian nations, Japan, India and Singapore attracted the most interest.

U.S. investors focused primarily on office and logistics assets in Asia Pacific, Chin observed. Private equity real estate funds raised by companies such as Blackstone, AEW Capital Management and CBRE Global Investors dominated investment activity in the region.

You must be logged in to post a comment.