CRE Lending Sees Significant Drop: CBRE

Despite high-profile failures, banks continue to account for the largest share of non-agency loans.

Commercial real estate lending continued to slow in the first quarter, in the face of banking system stress and volatility in the financial markets, according to a new report from CBRE.

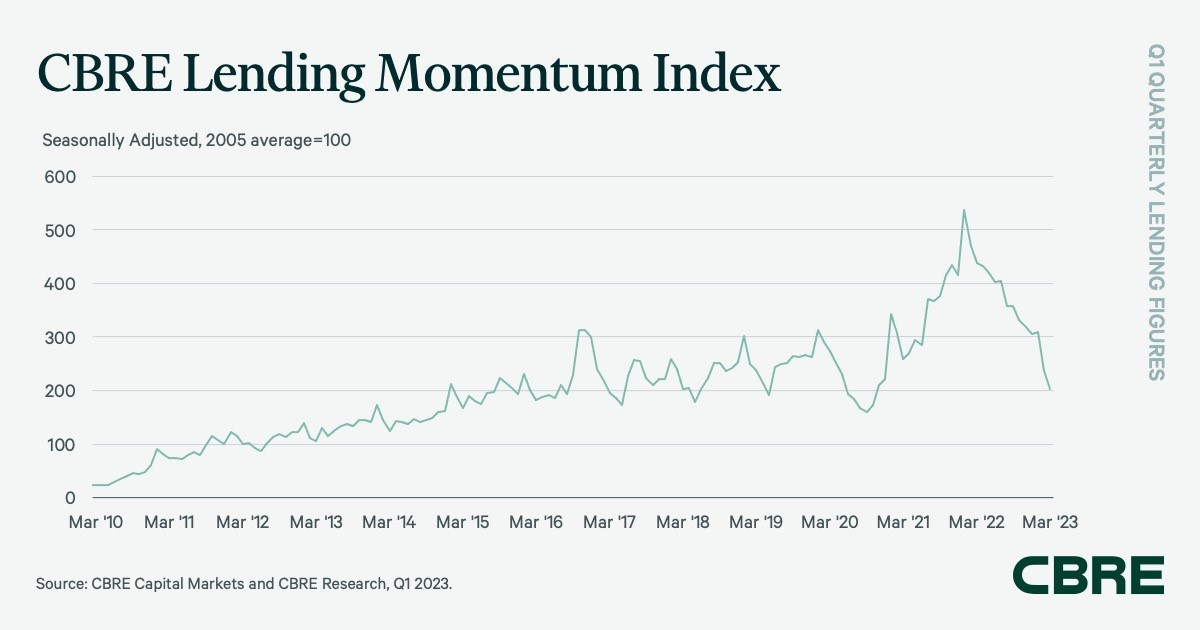

CBRE’s Lending Momentum Index, which tracks CBRE-originated commercial loan closings in the U.S., declined by 33 percent from the fourth quarter of 2022—and by 53.5 percent versus the strong loan volume of 12 months prior. The index closed the first quarter at 204.

The Federal Reserve’s commitment to reduce inflation with aggressive rate hikes continued to heighten market uncertainty through the first quarter, according to Rachel Vinson, president of Debt & Structured Finance, U.S. for Capital Markets at CBRE. She commented in prepared remarks that plenty of debt capital remains available, but increased borrowing costs coupled with credit tightening continues to put downward pressure on lending activity. Borrowers will continue to opt for shorter-term, fixed-rate debt with shortened call protection until volatility begins to normalize, Vinson concluded.

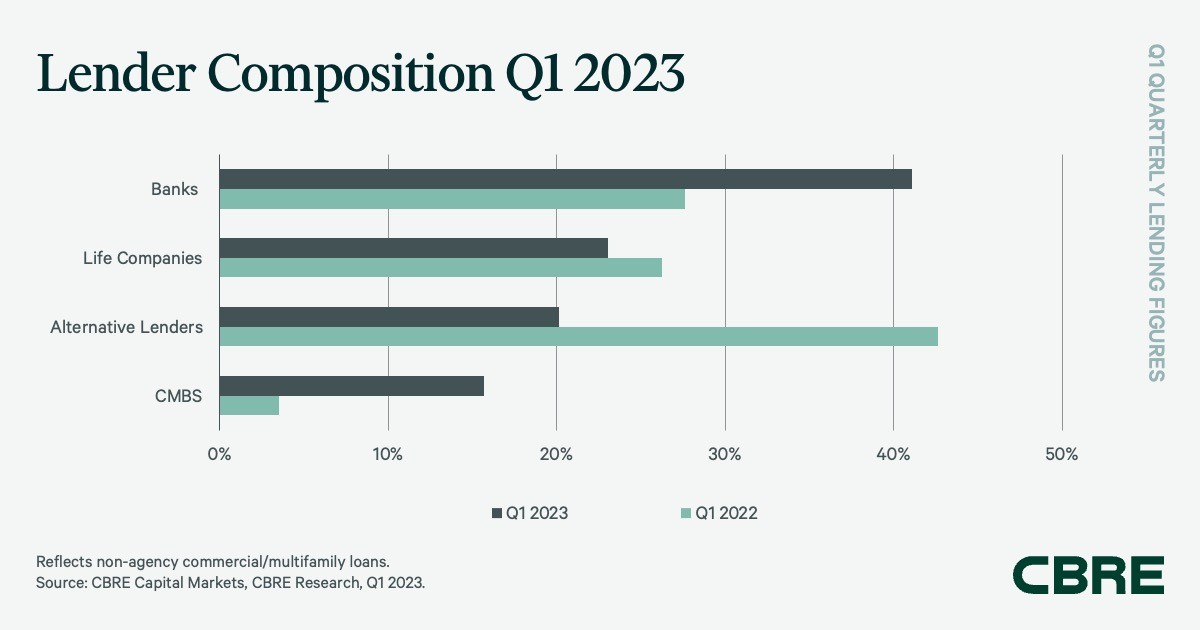

Recent much-publicized bank failures notwithstanding, banks were the dominant players, with 41.1 percent of CBRE’s non-agency loan closings for the fourth consecutive quarter, though this was down from 58 percent in the fourth quarter. CBRE noted that this result “was driven by a diverse set of smaller local and regional banks, as well as credit unions.”

About one-third of bank loans were for construction projects, mostly on the multifamily side, while the rest were split between acquisition loans and refinancings.

READ ALSO: Office Owners Face Financing Dilemma

Life companies were the next most active lenders in the first quarter, with 23 percent of closed non-agency loans, which was just above their fourth-quarter share. Loan closings in the first quarter included a high proportion of five-year deals, with an average 52 percent loan-to-value ratio, CBRE reported.

Debt funds, mortgage REITs and other alternative lenders accounted for 20.2 percent of loan closings in the first quarter, comparable to their fourth-quarter portion.

“Higher spreads and interest rate cap costs created a challenging environment for financing floating-rate bridge loans,” CBRE said.

Securitization, rates, terms

Collateralized loan obligation issuance in the first quarter consisted of two deals totaling just $1.1 billion, versus a total of $15.2 billion 12 months earlier.

CMBS conduit loans accounted for 15.7 percent of non-agency loan volume in the first quarter, which was up from 2 percent in the previous quarter. Industrywide CMBS origination volume was only $5.9 billion in the first quarter, a major fall from the $29.1 billion in the first quarter of 2022.

“Higher mortgage rates and loan constants were a key feature of loan underwriting criteria” in the first quarter, with average mortgage rates rising by 38 basis points quarter-over-quarter, CBRE reported.

However, loan constants rose by only 13 basis points, to 77.6 percent, driven by an increase in the share of loans that carried partial or full interest-only terms, the report noted.

Finally, underwritten debt yields and cap rates on closed loans climbed by 29 basis points from the previous quarter to an average of 5.61 percent, CBRE stated.

You must be logged in to post a comment.